Go big or go home. That adage has served investors pretty well so far in 2023.

The S&P 500, which includes the biggest stocks in the U.S., has soared close to 16% year to date. Meanwhile, two small-cap indexes -- the S&P SmallCap 600 and the Russell 2000 -- are up only 4% and 6%, respectively.

But don't be surprised if those dynamics change. Small-cap stocks could now be the smartest pick for investors in over 20 years.

Image source: Getty Images.

Large-cap vs. small-cap

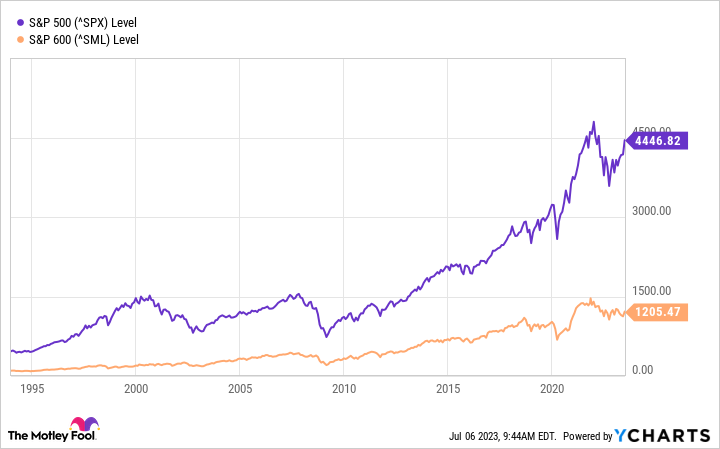

One chart goes a long way toward explaining why small-cap stocks could be poised to outperform going forward. Note the gap between the levels of the large-cap S&P 500 and the small-cap S&P 600 since the creation of the small-cap index in 1994.

The S&P 500 has always been higher than the S&P 600 because of the way the two indexes are structured. However, never has the large-cap index outperformed its small-cap counterpart to the degree it is now.

But this chart by itself isn't enough to justify the claim that small-cap stocks are now the smartest pick for investors in over 20 years. Perhaps large-cap stocks delivered such stronger earnings growth compared to small-cap stocks that the gap between the two is warranted. It's easy to blow that theory out of the water, though.

Yardeni Research regularly compares the forward price-to-earnings ratios for the S&P 500 and the S&P 600. The forward P/E for the large-cap index currently stands at 19.1, while the forward multiple for the small-cap index is 13.4. This reflects the biggest valuation gap between the two indexes since the dot-com bubble burst in 2001.

Lessons from history

In the past, wide valuation gaps between the S&P 500 and S&P 600 eventually narrowed considerably. That's exactly what happened following the dot-com bubble period. By late 2002, the forward earnings multiples of the S&P 500 and S&P 600 were nearly the same.

But the gap could be reduced by both indexes falling with the S&P 500 sinking more than the S&P 600. That was the case in the early 2000s. However, there's a pretty good argument to be made that large-cap stocks are overvalued right now while small-cap stocks aren't.

The S&P 500 traded at a higher forward earnings multiple in the latter part of 2020 through late 2021. Other than that period, though, the large-cap index hasn't been this expensive since its post-dot-com bubble decline.

Meanwhile, the S&P 600 is rebounding from one of its lowest valuations (based on forward earnings multiples) ever. The only times when small-cap stocks were cheaper were during the crash of 2008 and the COVID-19 sell-off in 2020.

Investors' alternatives

Investors hoping to profit from a potential resurgence of small-cap stocks could buy individual stocks. There are thousands of them from which to choose. However, small-cap stocks can be riskier than large-cap stocks.

Another good alternative is to invest in small-cap index funds. Two of the best picks, in my view, are the Schwab U.S. Small-Cap ETF (NYSEMKT:SCHA) and the Vanguard Small-Cap ETF (NYSEMKT:VB).

Both of these exchange-traded funds (ETFs) own large baskets of small-cap stocks. SCHA currently has 1,765 holdings, while VB has 1,456 positions. They both also have really low expense ratios, 0.04% for SCHA and 0.05% for VB.

Keep in mind, though, that the valuation gap between large-cap and small-cap stocks could remain wide longer than anyone expects. The S&P 500 should also still deliver solid returns over the long term.

Yes, I believe that small-cap stocks are the smartest picks for investors in over 20 years. However, that doesn't mean you should go small or go home.

10 stocks we like better than Schwab Strategic Trust-Schwab U.S. Small-Cap ETF

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Schwab Strategic Trust-Schwab U.S. Small-Cap ETF wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of July 3, 2023

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Small-Cap ETF. The Motley Fool has a disclosure policy.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)