Short seller CapitalWatch did something you rarely see on Wall Street — it issued an apology. CapitalWatch retracted key portions of a January report that accused Hao Tang, a major AppLovin (APP) shareholder, of ties to criminal syndicates and money laundering operations. The move sent AppLovin shares soaring 14% as investors breathed a collective sigh of relief.

"Descriptions asserting direct connections between Mr. Tang and Chen Zhi, Prince Group, Jin Bei Group, Tang Jun, and Yang Zhihui were inaccurate and failed to meet our publication standards," CapitalWatch wrote in its apology posted on X.

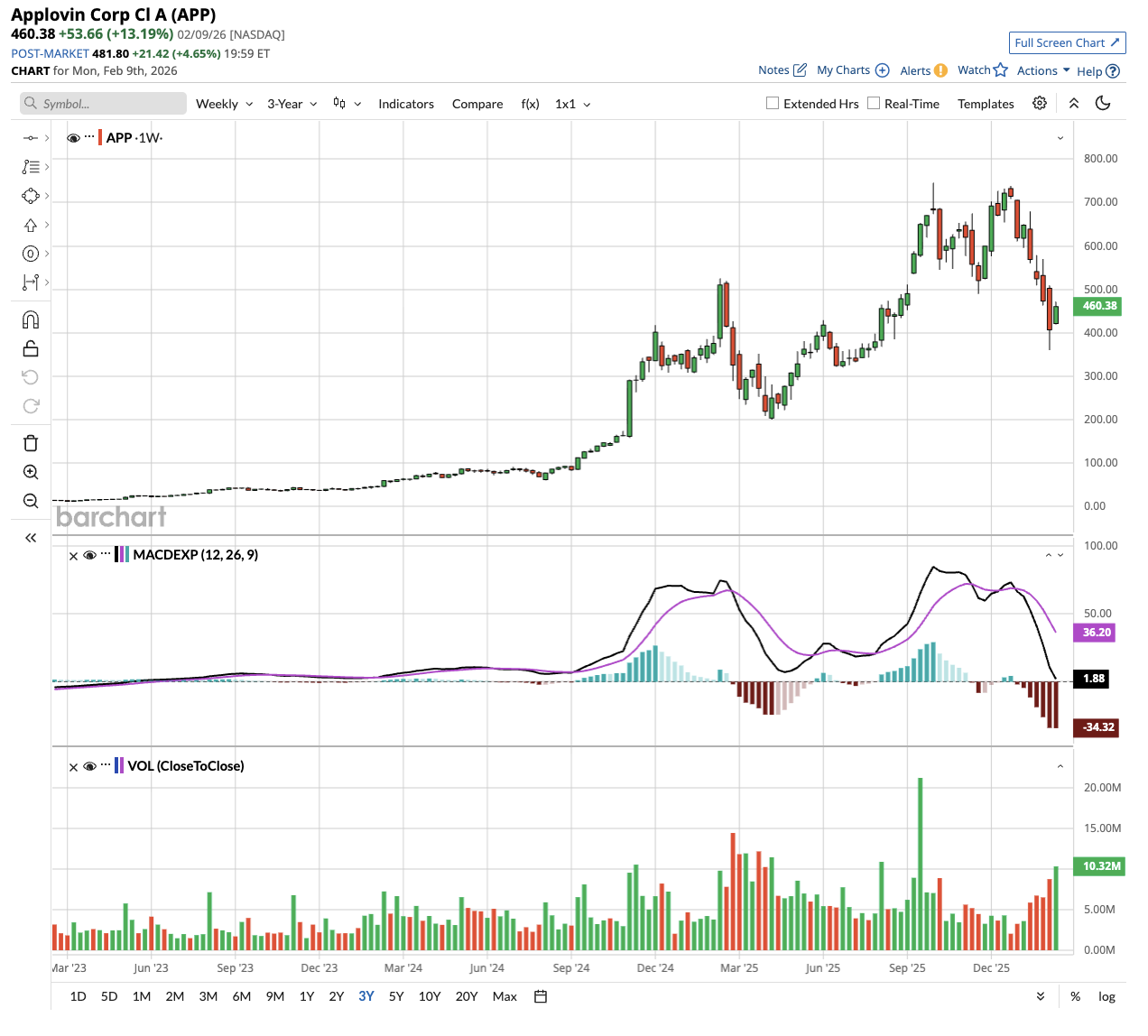

The retraction marks a dramatic turn for a company that's been under siege from short sellers for years. But with AppLovin's advertising platform firing on all cylinders and the stock up more than 860% over the past two years, investors are left wondering whether now is the time to jump in or stay cautious.

The Short Seller Makes a U-Turn

CapitalWatch's original report, published in January, made explosive allegations linking Tang to criminal enterprises across Southeast Asia. The claims were serious enough that AppLovin's legal team, led by high-profile attorney Alex Spiro, who also represents Elon Musk, fired off a cease and desist letter demanding an immediate retraction.

At first, CapitalWatch doubled down. The firm defended its work, claiming the report reflected "a rigorous six-month investigation supported by documentary materials and multiple sources."

Following an internal review, CapitalWatch admitted it "erroneously associated" a French court ruling with Tang and failed to verify key allegations through multiple sources. The firm pulled the relevant passages and issued a formal apology, though the original report remains posted on its website.

"CapitalWatch extends its sincere apologies to Mr. Tang for the distress caused and the potential impact on his personal reputation," the short seller stated. Despite the retraction, CapitalWatch maintained that its stance on AppLovin's financials remains unchanged and pledged to continue publishing reports about the company.

AppLovin Continues to Grow Rapidly

While short sellers have been busy writing reports, AppLovin has been busy building one of the most impressive advertising platforms in the market. During recent investor conferences, CEO Adam Foroughi and CFO Matt Stumpf outlined a compelling vision for the company's future, supported by concrete results that are difficult to dispute.

AppLovin's Axon advertising platform has become a powerhouse in mobile gaming. Revenue growth in the gaming vertical continues to run 20% to 30% annually, driven by ongoing model improvements and an expanding inventory supply through its MAX marketplace. "The AXON model continues to improve over time […] driven by the technology improvements, which are the ongoing reinforcement learning," Stumpf explained at the Nasdaq Investor Conference.

What's exciting is AppLovin's expansion beyond gaming into e-commerce advertising. The company took a measured approach, testing the product with a fixed cohort of advertisers before opening up to a wider audience.

AppLovin scaled 600-plus advertisers to a $1 billion annual run rate in just months, according to Foroughi. The company recently launched prospecting campaigns that allow advertisers to target only new customers rather than retarget existing ones.

The CEO noted that, since launching a referral-based self-serve platform in October, that business has grown roughly 50% week over week. While starting from a small base, that kind of trajectory is growth investors want to see.

AppLovin Widens Competitive Moat

AppLovin's platform now reaches 1.6 billion daily active users, giving it massive scale in the mobile advertising market. The company serves full-screen video ads that users watch for an average of 35 seconds in e-commerce campaigns, compared to just 7 seconds on social platforms. That extended engagement time creates a powerful advantage. More time to capture attention means better conversion rates, which drives better returns for advertisers.

AppLovin is also investing heavily in AI-powered creative tools to help advertisers build content optimized for its platform. While image generation tools are already in internal testing at about $1 per ad, video generation remains more expensive at $100 to $200 per ad due to the need to repeatedly prompt large language models to produce high-quality outputs.

"[We're] at the point where the video ad is good enough for our platform to be better than what [advertisers] have today," Foroughi noted.

On capital allocation, CFO Stumpf emphasized the company's lean operations. Total headcount is 900, with only 400 focused on the ad tech business. AppLovin recently increased its share buyback authorization by $3.2 billion and maintains EBITDA margins in the low 80% range.

A History of Short-Seller Attacks

This isn't AppLovin's first rodeo with short sellers. The company has previously faced critical reports from Muddy Waters, Fuzzy Panda, and Culper Research. CEO Foroughi has consistently denied the allegations.

APP stock's performance suggests investors have largely dismissed these concerns. Shares have climbed from around $65 at the April 2021 initial public offering (IPO) to above $450 today, delivering life-changing returns for early investors.

With CapitalWatch now walking back some of its most serious allegations, the question is whether this represents a turning point in how the market views AppLovin's story — or just another chapter in an ongoing battle with skeptics.

What Do Analysts Think of APP Stock?

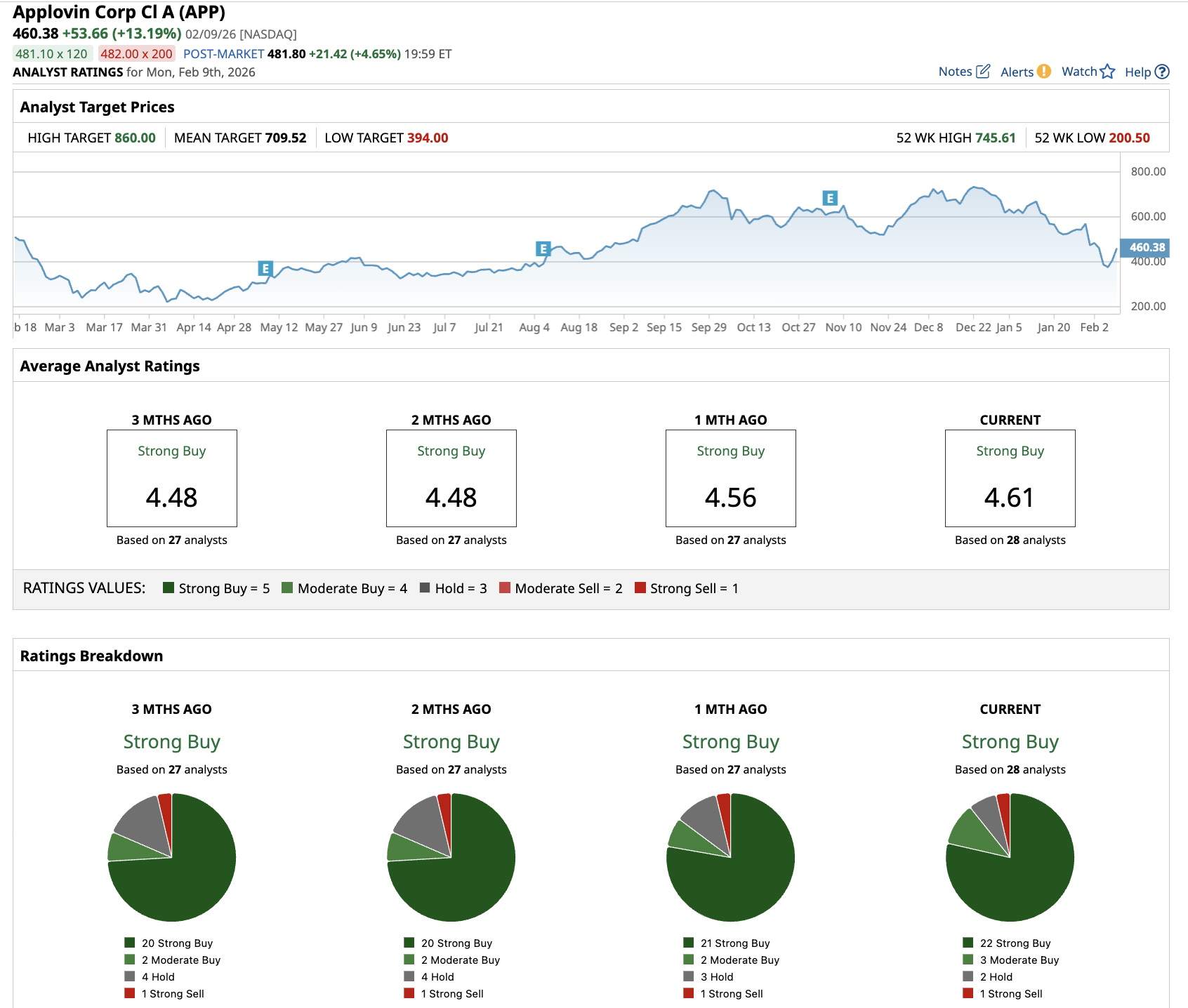

Overall, AppLovin has a “Strong Buy” consensus rating. Out of the 28 analysts covering APP stock, 22 recommend a “Strong Buy” rating, three recommend a “Moderate Buy,” two recommend a “Hold,” and one recommends a “Strong Sell” rating. The average AppLovin stock price target is $709.52, which represents 54% potential upside from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)