/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) is a specialized AI cloud provider delivering high-performance GPU infrastructure for training massive AI models. Unlike general clouds like AWS, it focuses solely on Nvidia (NVDA) GPUs with custom bare-metal servers, liquid cooling, Kubernetes orchestration, and AI-optimized storage/networking. Serving OpenAI, Meta (META), and AI labs, CoreWeave powers foundation models at unprecedented scale through 33+ data centers offering flexible public/dedicated deployments.

Founded in 2017, CoreWeave is headquartered in Weehawken, New Jersey.

About CoreWeave Stock

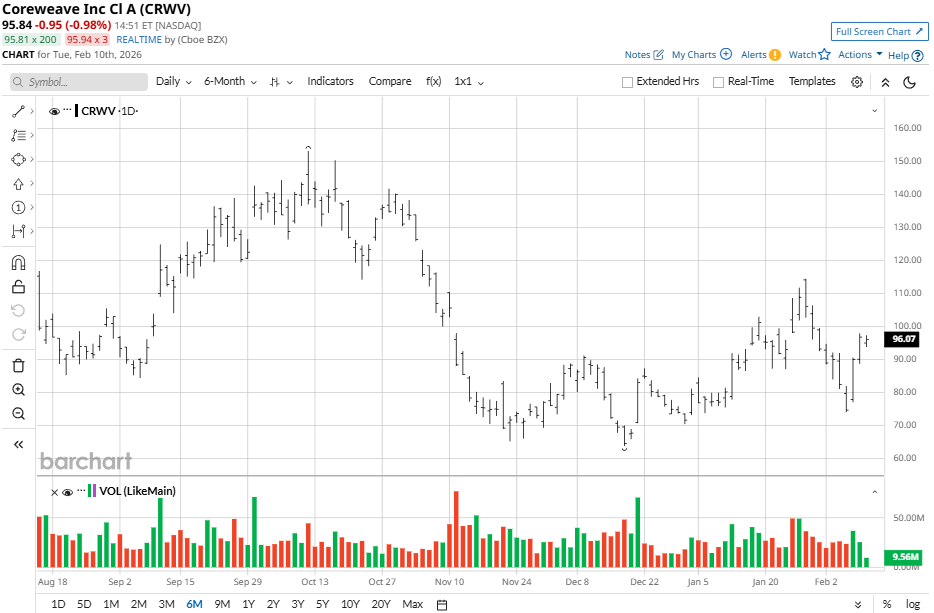

CoreWeave's stock has been volatile amid AI hype, gaining over 8% in the past week and 11% in the past month. Year-to-date (YTD), it's soared 25% from $73 lows while being 22% off its high of $114 set in late January. Despite this, CRWV stock lags in the medium term as it is flat in three months but down 36% in six months time.

Versus the Nasdaq Composite ($NASX), CoreWeave massively outperformed in YTD performance (32% vs. Nasdaq's flat report), riding AI infrastructure demand. Overall, its dips mirror Nasdaq pullbacks, but the monthly 18% gain edges the index amid sector rotation.

CoreWeave's Results Beat Estimates

CoreWeave announced third-quarter 2025 results on Oct. 30, 2025, showcasing explosive growth in its AI cloud infrastructure business. Revenue rocketed 200% year-over-year (YoY) to $1.36 billion from $453 million, handily beating Wall Street estimates of $1.28 billion by 6.25%, thanks to surging demand for Nvidia GPU clusters from AI hyperscalers. Adjusted EPS posted a loss of $0.08 per share, dramatically outperforming consensus forecasts of a $0.39 loss (79.5% beat), reflecting efficient scaling despite heavy investments.

Financially, GAAP net loss widened to $110.1 million ($0.22 per share) from $52 million prior, driven by $1.2 billion in capex for data center expansions. Revenue per GPU improved 15% YoY amid higher utilization rates (92%), with data center bookings up 250%. Operating cash flow turned positive at $45 million, signaling maturing operations.

Q4 guidance disappointed, projecting revenue below expectations and prompting a 51%+ stock plunge into oversold territory.

Upcoming Earnings Preview

CoreWeave is set to report its fourth-quarter results on Feb. 26. The AI company is estimated to post earnings of -$0.61 per share, a 100% decrease from the same quarter last year. Analysts also estimate Q1 2026 earnings at -$0.65 per share, with an 8.33% slip from the previous year.

For the full year 2025, analysts have bet on -$2.46 per share, while the fiscal year 2026 is estimated at -$0.08 with a growth of 96% YoY.

Should You Buy CRWV Stock?

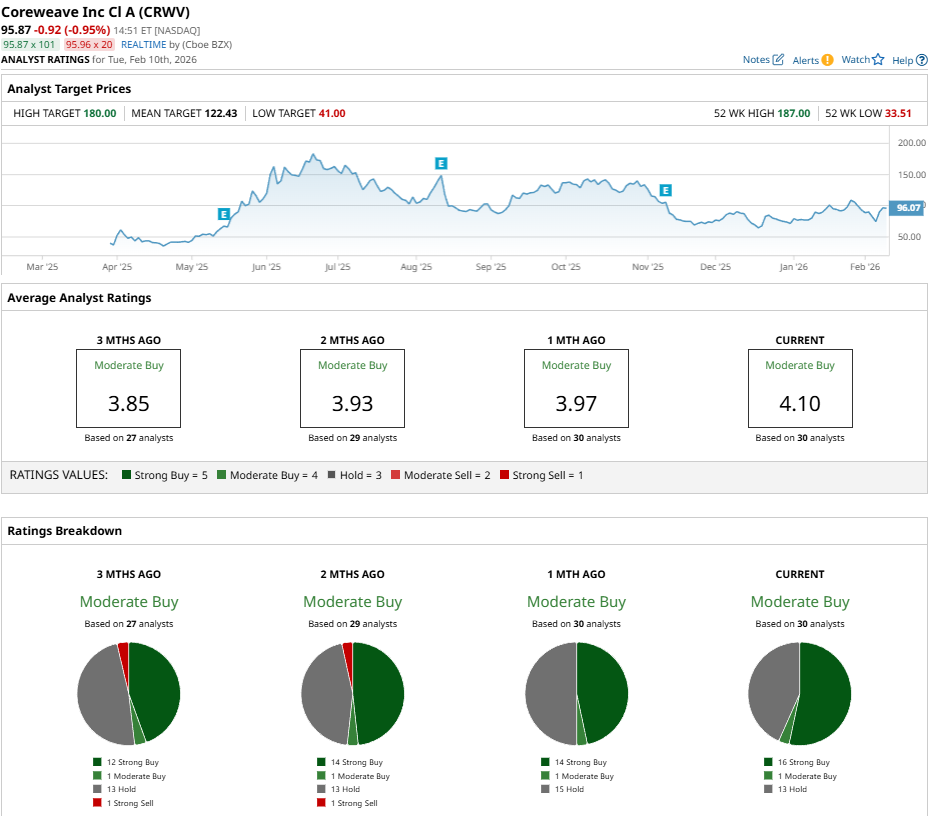

Amid the upcoming results, analysts have a consensus “Moderate Buy” rating on CRWV stock with a mean price target of $122.43, reflecting an upside potential of 28% from the market rate. The stock has been rated by 30 analysts, receiving 16 “Strong Buy” ratings, one “Moderate Buy” rating, and 13 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)