The planting intentions report was released on March 31st, and as many expected, corn will get more acreage this year than soybeans. While the significance of this report ranks in the top third of the yearly grain reports, many things can happen before the crops are planted.

Like speculating, timing is everything. Choosing the correct planting date can significantly impact the yield outcome. The earlier a crop is planted, the higher the yield can be, but that can come with some severe weather risks if planted too early. The last thing a producer wants to do is reseed if there is too much moisture in the soil or a late frost.

Soybean planting in the latter part of April could mitigate some of the abovementioned risks. At the same time, minding yield losses for planting past late May.

Crop rotation of corn to soybean naturally replaces many of the nutrients in the soil needed to yield a better crop. While optional, this replaces the need for producers to purchase as many fertilizers and other nutrients, which would cut their profit margins.

2022 Saw more soybean planting than corn

During this time, South America was experiencing a three-year drought brought on by La Nina. The US did not escape drought conditions in the corn belt, and the Russia-Ukraine escalation disrupted crop exports from the region, effectively reducing carry-over soybeans for 2023. Causing the USDA to find that year-over-year soybean grain stocks for March 2023 would be .smaller by 247 million bushels.

With smaller carry-over and fewer soybean acres planted, there may be a floor price to support higher soybean prices in 2023.

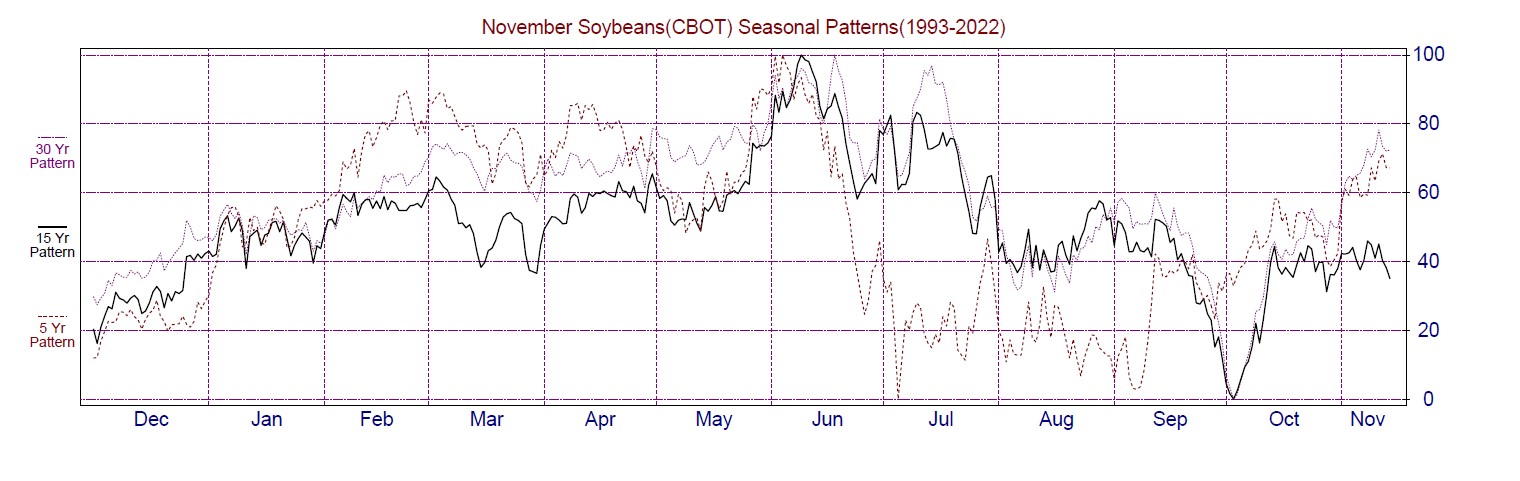

Seasonal Pattern

Source: Moore Research Center, Inc. (MRCI)

MRCI research illustrates that the 15-year new crop soybean pattern (black) tends to rally in April but has some sideways action until mid-May when the pattern reveals a significant rally into June. By June, producers will have planted their crops and anxiously await a price rally as the potential one in May, to sell futures contracts to hedge this year's crop. Currently, the soybean market is in backwardation, near months priced higher than back months, which could create some issues for hedgers wanting to sell the new crop month, November futures.

Commercial traders and speculators will continue monitoring weather, exports, and the Russia/Ukraine conflict for any signs of supply disruptions. With smaller acres and carry-over, the soybean market could get a significant price increase if the new crop supply shows signs of deteriorating.

As mentioned, seasonal patterns require more due diligence before trading a product. Part of that due diligence can come from monitoring the Commitment of Traders (COT) report and technical analysis.

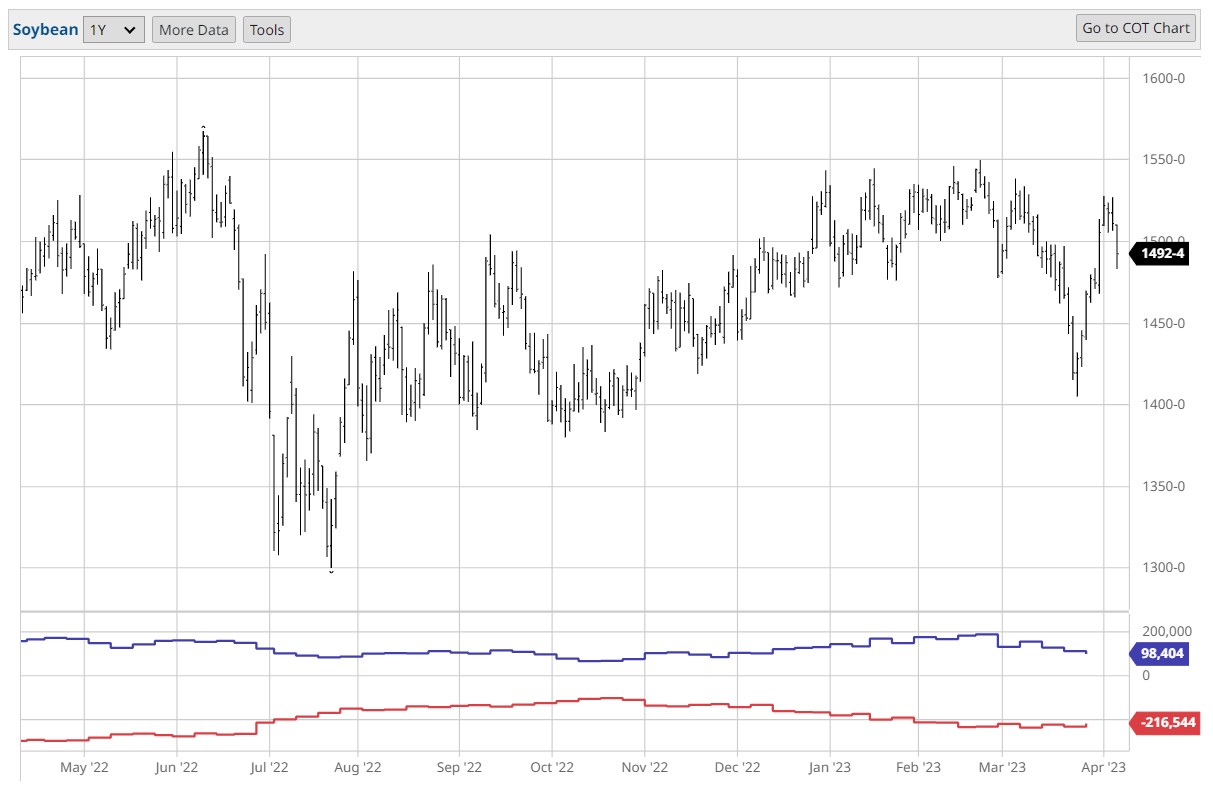

The Commitment of Traders (COT) report

The soybean COT report demonstrates the bullishness of managed money (blue) by remaining net long (more long positions than short) soybeans for the past year. The October rally shows managed money adding to their current long positions until they peaked in February. At that time, they had more long positions than in the past 52 weeks, usually a time to expect some long liquidation.

Source: Barchart COT Reports

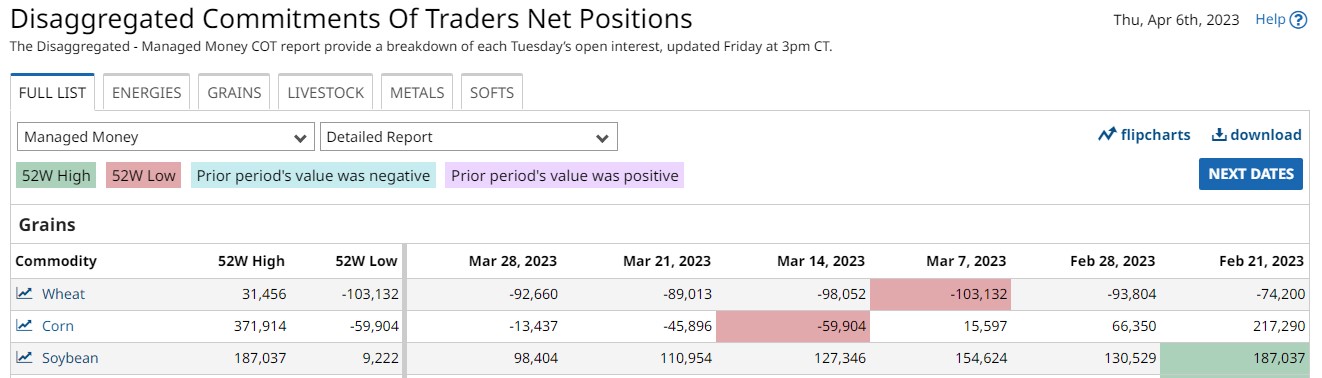

Reviewing additional COT information, when managed money had their most significant long position during February (green box), in 52 weeks, they held 187,037 more longs than shorts. After the price correction, managed money now has about 50% fewer longs, 98,404 leaving them with plenty of buying power to resume this uptrend. The result will be a price rally to allow producers to hedge at higher prices with short positions in June or July.

Summary

For more information on the COT report, please read my recent article, "A Commitment of Traders Report with more Transparency," on the uses and understanding of this analysis.

To participate in the soybean market, traders can use futures, options on futures, exchange-traded funds (ETF), and stocks of companies that process and produce soybeans.

The ETF (SOYB) is available for traders in the equity markets. Futures offer a standard-size contract (ZS) and a mini-contract (XK). The standard-size options would be a wiser choice for better liquidity than the mini contracts.

With reduced soybean acreage and carry-over, will the soybean market be closely watched for signs that the bulls can run prices higher, or will the bears lean into these already high soybean prices and push prices lower?

More Stock Market News from Barchart

- Stocks Recover Early Losses Ahead of Friday’s Payroll Report

- Unusual Options Activity in Citigroup Signals an Investor's Bearish Outlook

- Speculation Mounts About Apple Making an Acquisition

- Stocks Rally Despite Higher Initial Unemployment Claims

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.