Blue chip stocks are generally considered to be large, established companies with a long history of stable performance, strong financials, and a solid reputation. During turbulent times in the market, blue chip stocks are often seen as a safe haven because of their stability and strong fundamentals.

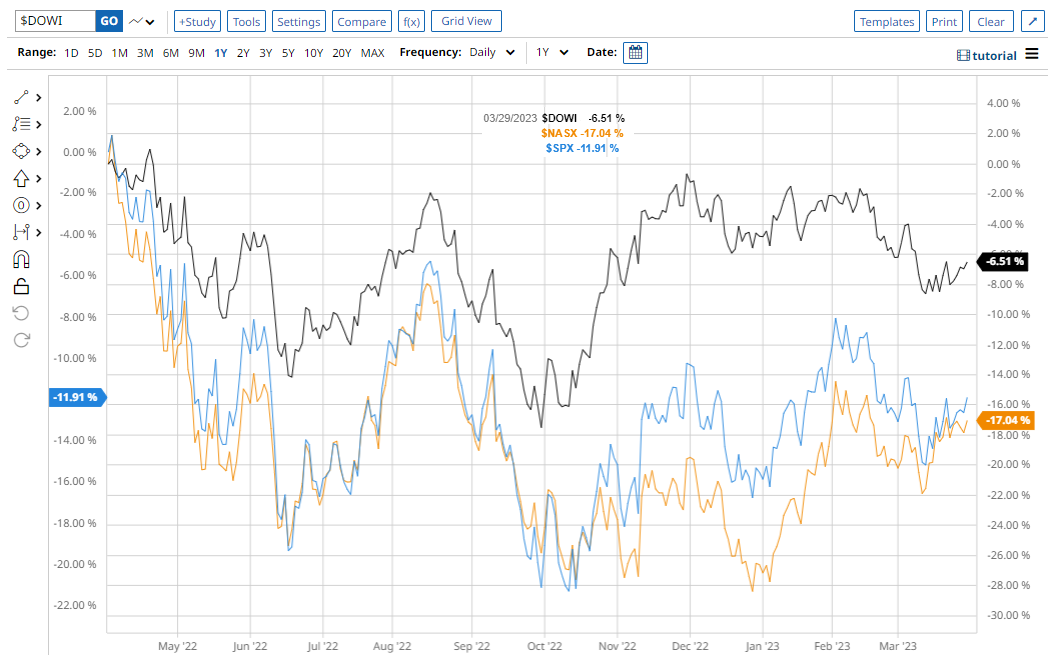

Investors typically look to the Dow Jones Industrial Average (DJIA) as a representation of blue chip stocks (older, more established companies). In contrast, the S&P 500 and Nasdaq include newer growth-focused companies.

The Dow Jones outperformed other major U.S. equity indexes in the past 12 months (see chart below) and may serve as a solid defense, with significant upside if economic conditions worsen.

While dividends are a common characteristic of many blue chip stocks, there are some companies that do not pay dividends or have a history of paying lower dividends.

For example, companies in the technology sector, which often have high growth potential and reinvest their profits into research and development, may prioritize reinvestment over paying dividends to shareholders. On the other hand, companies in the utilities or consumer staples sectors, such as Procter & Gamble, Coca-Cola, which have a more stable and predictable cash flow, pay dividends.

It is important to consider a company's dividend history and policy, as well as its overall financial performance, when evaluating whether to invest in a blue chip stock. It is also important to keep in mind that dividends are not guaranteed and can be subject to change based on the company's financial performance and management decisions.

Berkshire Hathaway, the $334 billion conglomerate led by Warren Buffett, is heavily invested in blue chip stocks like Chevron, Apple, Bank of America, and American Express, with a combined $3.4 trillion market cap.

Many see blue chip companies as a safe investment because they’ve survived a variety of market cycles. Still, there’s always a risk. Like during the 2008 crisis when the sudden bankruptcies of General Motors and Lehman Brothers showed even the big dogs might struggle during market turmoil. Hence, it helps to diversify a portfolio beyond blue chip stocks even in times like these.

More Stock Market News from Barchart

- Here’s Why Olaplex (OLPX) May Be an Intriguing Opportunity for Contrarians

- 3 Top Electric Vehicle Stocks to Buy, According to Wall Street Analysts

- Markets Today: Stock Indexes Climb as Tech Strength Buoys Sentiment

- How to Buy PG for a 7% Discount, or Achieve an 8% Annual Return

On the date of publication, Andy Mukolo did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)