The Dow Jones Industrial Average ($DOWI) delivered a jaw-dropping performance on Friday, soaring past the historic 50,000 threshold for the very first time. The milestone came just one day after pronounced selling pressure rattled investors, underscoring a shift in sentiment.

With a robust 3.6% year-to-date (YTD), the Dow is outpacing its peers among major U.S. equity benchmarks, showcasing broad-based strength across heavyweight components. The rally leaves many asking what comes next. And while market history suggests caution after record-breaking runs, Wall Street analysts are pointing to three blue-chip names worth adding to portfolios right now.

Nvidia Leads the Charge With Transformative AI Momentum

Valued at a market cap of $4.6 trillion, analysts remain bullish on Nvidia (NVDA). During a recent presentation at Cisco's AI Summit, CEO Jensen Huang outlined a vision that extends beyond selling GPUs.

The chip giant is reinventing computing from the ground up, shifting from explicit programming to implicit, AI-driven approaches that enable computers to solve problems they've never encountered before.

"We're reinventing computing for the first time in 60 years," Huang said, explaining how the company's technology is enabling businesses to approach problems with near-infinite speed and zero limitations.

That transformation is showing up in the numbers. NVDA stock has delivered a staggering 1,230% gain over the past five years. A modest $1,000 investment made in 2021 would be worth roughly $13,200 today before taxes and fees.

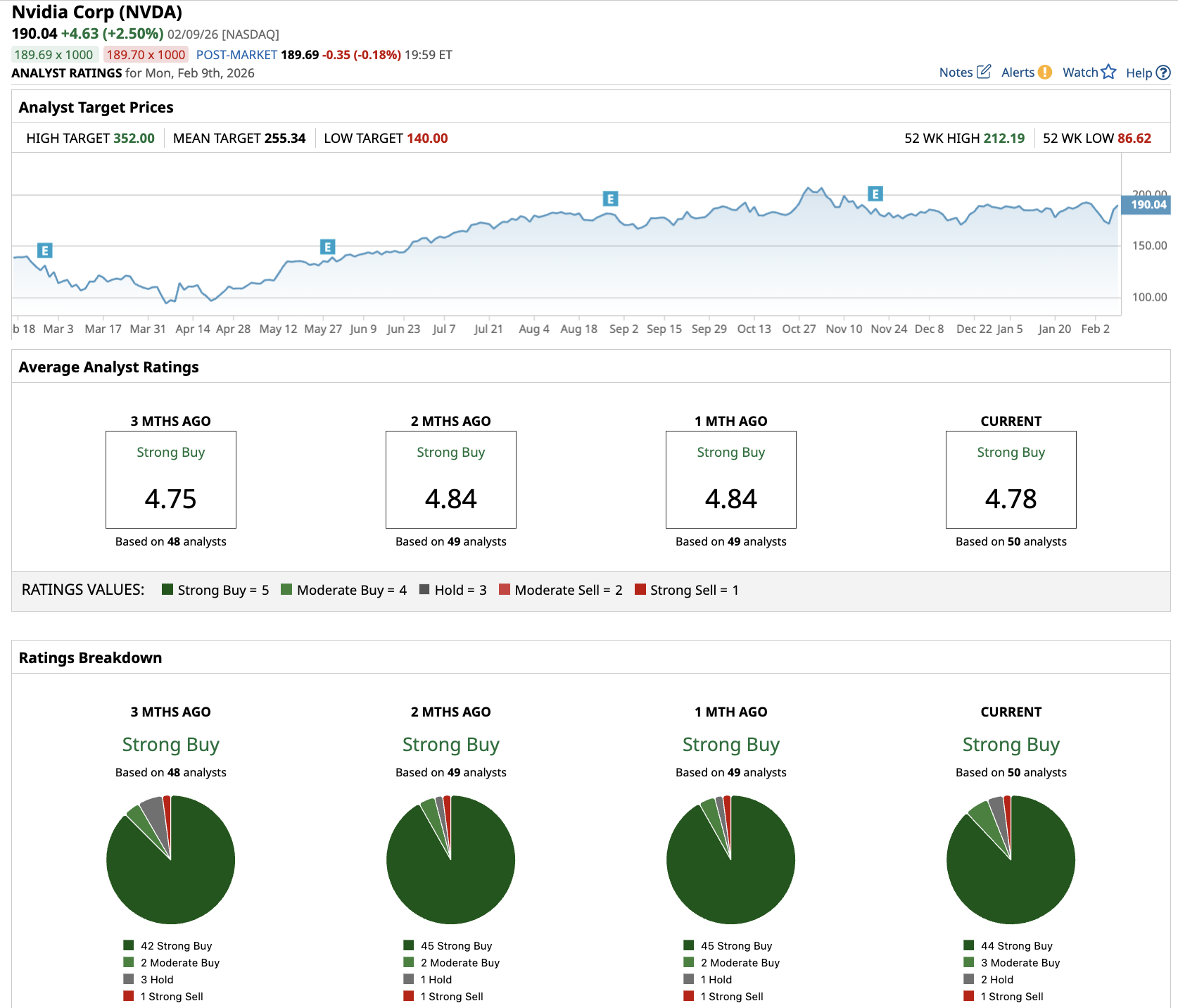

Nvidia’s growth story is far from over, given analysts' forecast revenue to increase from $130.5 billion in fiscal 2025 (ended in January) to $575 billion in fiscal 2030. Out of the 50 analysts covering NVDA stock, 44 recommend “Strong Buy,” three recommend “Moderate Buy,” two recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $255.34, above the current price of about $190.

Amazon’s AI Investments Fuel AWS Acceleration

Amazon (AMZN) is also building an entirely new computing paradigm. During the company's fourth-quarter earnings call, CEO Andy Jassy reported that AWS revenue grew 24% year-over-year (YoY), the fastest pace in 13 quarters. The cloud giant now has a $142 billion annualized revenue run rate, adding $2.6 billion in quarterly revenue and nearly $7 billion YoY.

Amazon’s Trainium and Graviton chip families have reached a combined annual revenue run rate of $10 billion, growing at triple-digit YoY rates. "Trainium2 is 30% to 40% more price performance than comparable GPUs," Jassy said, highlighting a critical advantage that's driving customer adoption.

Amazon is also making aggressive moves in AI model development. The company recently launched Nova Forge, which provides customers with early checkpoints for Amazon Nova models and enables them to mix their proprietary data with the model's data during the pretraining stage. "There is nothing else out there like this today and a potential game changer for companies," Jassy noted.

On the capital expenditure front, Amazon expects to invest roughly $200 billion across the company, predominantly in AWS, to meet surging demand. That's a massive commitment, but management is confident the investments will generate strong returns on invested capital.

The retail business is also firing on all cylinders. Amazon delivered nearly 70% more items same-day to Prime members in 2025 compared to the year before, while grocery sales topped $150 billion in gross sales.

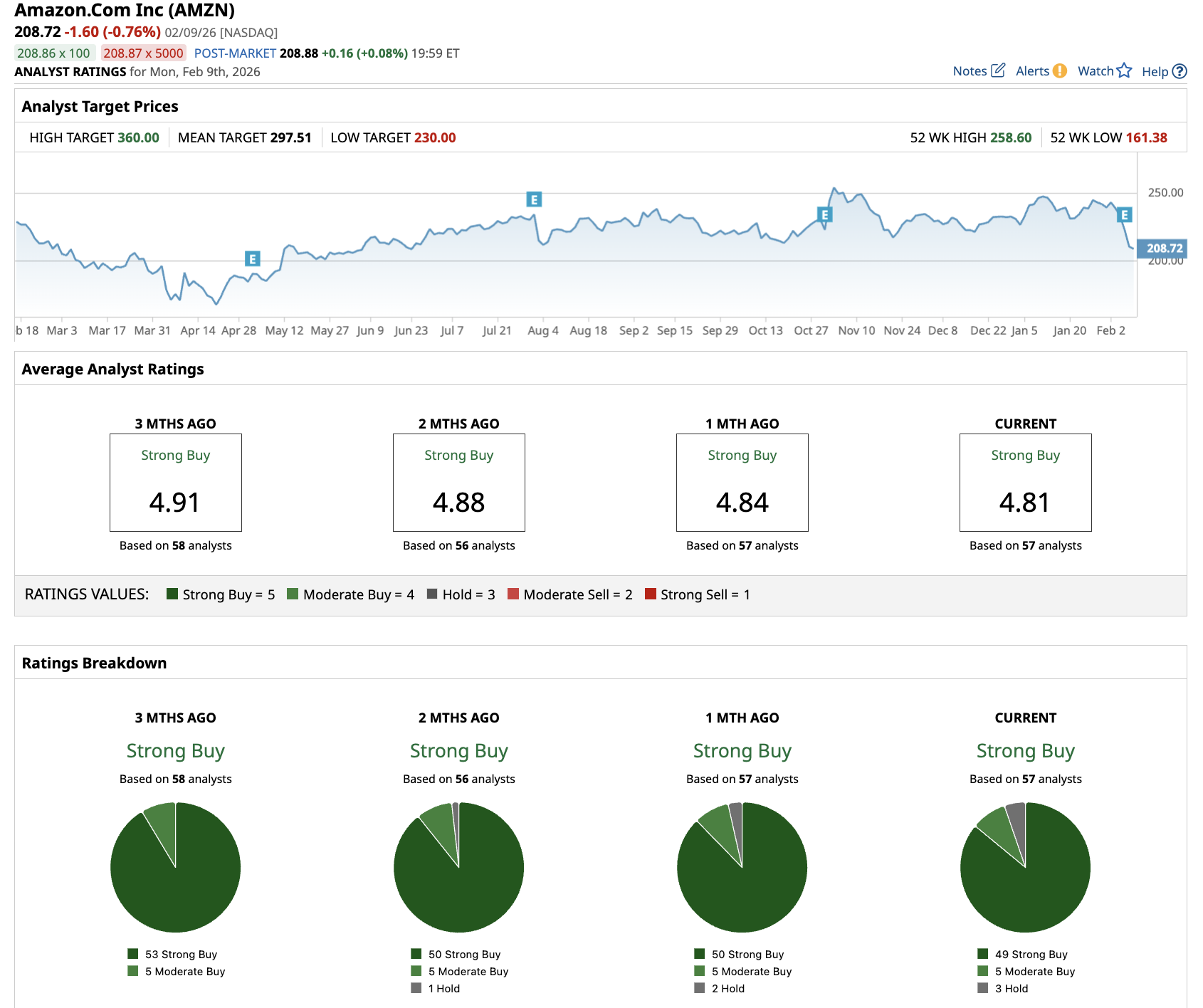

Out of the 57 analysts covering AMZN stock, 49 recommend “Strong Buy,” five recommend “Moderate Buy,” and three recommend “Hold.” The average AMZN stock price target is $297.51, above the current price of about $209.

Microsoft’s Full-Stack AI Approach Drives Cloud Dominance

Microsoft just posted its strongest quarter in recent memory, with the Microsoft Cloud surpassing $50 billion in revenue for the first time, up 26% YoY.

CEO Satya Nadella made clear during the company's earnings call that Microsoft is building for the long haul across all three layers of the AI stack—cloud infrastructure, agent platforms, and high-value agentic experiences.

"We are in the beginning phases of AI diffusion and its broad GDP impact," Nadella said, noting that the company's TAM will grow substantially as AI adoption accelerates.

Microsoft's custom silicon strategy is paying off in a big way. The company recently brought online its Maia 200 accelerator, which delivers over 10 petaFLOPS at FP4 precision, with a more than 30% lower total cost of ownership than the latest-generation hardware in its fleet.

Azure growth remained strong at 39% in constant currency, though management acknowledged that demand continues to exceed available supply. It added nearly 1 gigawatt of capacity in the fourth quarter alone and expects to double that figure again by the end of 2027.

On the productivity front, Microsoft 365 Copilot delivered record seat additions, up over 160% YoY. The company now has 15 million paid Microsoft 365 Copilot seats, with daily active users up 10x YoY.

CFO Amy Hood addressed investor concerns around capital expenditures head-on, noting that the company is optimizing for long-term value creation rather than maximizing any single business line.

"This is about investing in all the layers of the stack that benefit customers," Hood explained, emphasizing that Microsoft is building lifetime value across Azure, Microsoft 365 Copilot, GitHub Copilot, and other AI-powered services.

For fiscal year 2026, Microsoft expects operating margins to expand slightly despite the heavy AI infrastructure investments, a testament to the efficiency gains the company is achieving across its cloud platform.

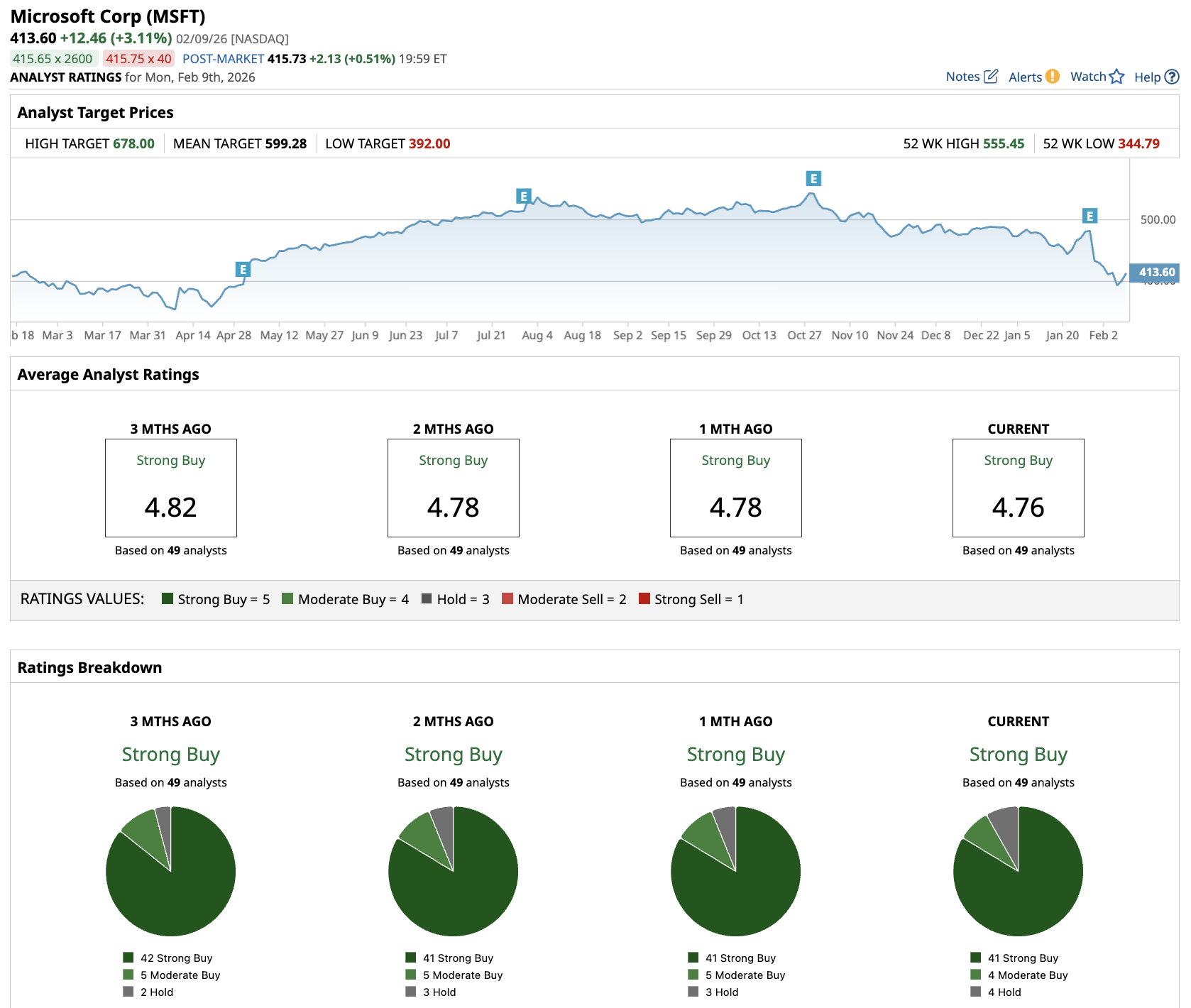

Out of the 49 analysts covering MSFT stock, 41 recommend “Strong Buy,” four recommend “Moderate Buy,” and four recommend “Hold.” The average MSFT stock price target is $599.28, above the current price of about $414.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)