Devon Energy (DVN) stock is well off its highs and down over 12% in the last month to $46.35 in early trading on March 20. This is making its high dividend yield and deep out-of-the-money short put option plays popular with investors.

The company paid an 89 cents dividend last quarter, but most of that (69 cents) was based on 50% of its excess free cash flow (FCF), as I explained in my last article on Feb. 17. So, even assuming in a worst-case situation that FCF is down 25% this quarter, investors can expect at least a 52 cent variable dividend, based on a 25% hit to FCF. This is on top of the 20-cent quarterly fixed dividend (i.e., $0.72 total).

That works out to $2.88 annually ($0.72 x 4), giving DVN stock a 6.21% dividend yield ($2.88/$46.35). But, again, that assumes a catastrophic 25% decrease in FCF in FCF this quarter. So far this quarter crude oil is down about 17%, but much of that has happened in the last several weeks. Nevertheless, it's good to be conservative, so assuming a 25% cut in FCF still gives DVN stock an attractive 6.21% yield.

Shorting Out-of-the-Money Puts

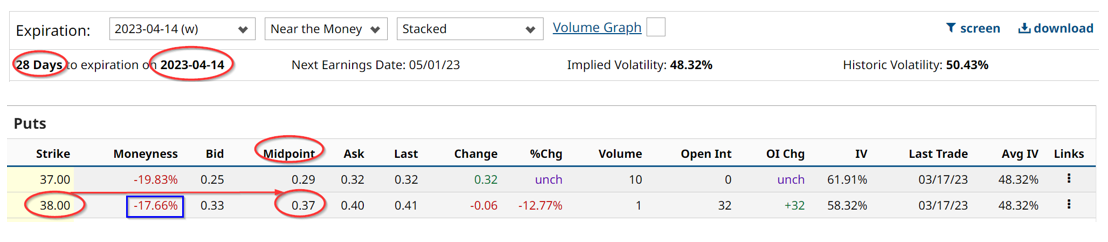

Moreover, now investors are flocking to shorting out-of-the-money puts in order to both pick up extra yield, as well as a potential cheap buy-in price. For example, the April 14 expiration put options, just 28 days from now, show that the $38 strike price is attractively priced. This strike price is 18% below today's price, but the premium that can be received is 37 cents.

That works out to an attractive put-to-strike price yield of about 1% (i.e., ($0.37/$38.00) x 100=0.97%).

This means that an investor who secures $3,800 in cash and/or margin with their brokerage firm, can then enter in an order to “Sell to Open” 1 put contract at $38.00. The account will immediately receive $37 per put contract shorted this way. So in the next 28 days, their return is at least 1.0%, and if it can be repeated over the next 12 months, the annualized yield is 11.68%.

Granted, the stock could rise from here, especially if the FCF decrease in Q1 is not as bad as investors fear. That means the short-put investor will not get to own the stock. Keep in mind, though, that often the investor will end up owning the shares from previous short-put plays. For example, based on our last article, investors might have shorted $50 strike price puts for expiration on March 17. Since the stock ended below $50, those investors now own shares at $50.

Now they can either sell those shares (at a loss), which is never worth doing in this kind of trade, or they can short out-of-the-money calls. For example, the $55.00 calls for April 14 trade for 22 cents at the midpoint. That works out to an income yield of about 47 basis points, or 5.63% annually. Given that they would have received 65 cents in the short put play last month, combined with the upcoming 72 cents dividend and the 22 call premium (i.e., $1.59 total), the investor's breakeven is now $48.41.

Then, by shorting the $38.00 puts, the investor can lower that breakeven to just $48.03. The bottom line here is the investor will be able to hold this stock for the long term, and by shorting more out-of-the-money puts, they can potentially lower their average buy-in cost.

More Stock Market News from Barchart

- Markets Today: Stocks See Boost From Credit Suisse Takeover But Banking Concerns Continue

- Option Volatility And Earnings Report For Mar 20 - 24

- Stocks Set To Open Lower As Investors Await Fed Meeting, Banking Sector Remains In Focus

- Bank Headlines, the Fed and Other Things to Watch this Week

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20HQ%20photo-by%20Sundry%20Photogrpahy%20via%20iStock.jpg)

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/Apple%20Inc%20Tim%20Cook-by%20John%20Gress%20Media%20Inc%20via%20Shutterstock.jpg)