Devon Energy Corp (DVN) reported lower-than-expected free cash flow (FCF) on Feb. 14 and a 34% cut in its variable quarterly dividend. That portion of the dividend is based on 50% of the quarter's FCF after paying out the fixed dividend. As a result, DVN stock dropped over 13% to $55.72 from $63.94 before the earnings release.

This is because its new quarterly dividend is now 89 cents, down 34% from the $1.35 paid last quarter. This includes a small hike, 2 cents per share, in the fixed portion of the 89-cent dividend (i.e., to 20 cents).

But the variable portion of the dividend is based on 50% of the adjusted FCF after deducting the fixed dividend costs. The variable portion of the dividend fell from $1.17 per share last quarter to 69 cents, down 41% from Q3.

That is why the stock fell so much. As it stands today, however, the dividend yield is very ample at 6.39% (i.e., $0.89 x 4 = $3.56/$55.72 stock price).

Outlook Should Sustain the Dividend

Going forward Devon Energy said it will be able to produce 643K barrels of oil equivalent (Boe) per day to 663K Boe during 2023. This is actually higher than the 636K Boe that Devon generated during Q4 on average (i.e., 10K - 30K Boe more, or 2.75% to 8.26% more, roughly 5% higher on average).

This gives investors a good deal of comfort assuming prices stay level or more higher in Q1, which they have so far. That means FCF will be at least 5% higher on average in Q1, and it makes the dividend clearly sustainable at this lower level.

Moreover, in the past two years, Devon Energy's dividend yield has risen from 4.47% in 2021 to 8.41% in 2022, according to Morningstar. That means that the average dividend yield in the past 2 years has been 6.46%. This is only slightly higher than today's yield of 6.39%, but the investor is still making more income than in 2021.

Shorting Puts for More Income

However, some investors may turn to options to create more income. Last month we wrote that some investors were shorting Devon Energy out-of-the-money (OTM) put options. This trade worked out well. The Feb 3 puts at the $54.00 strike price, which was 13.8% below the stock price, ended up expiring worthless. That is exactly what you want if you are shorting a security.

The investor in those short OTM puts made a clean 0.85% immediate yield at the 46 premium, or 10% annualized.

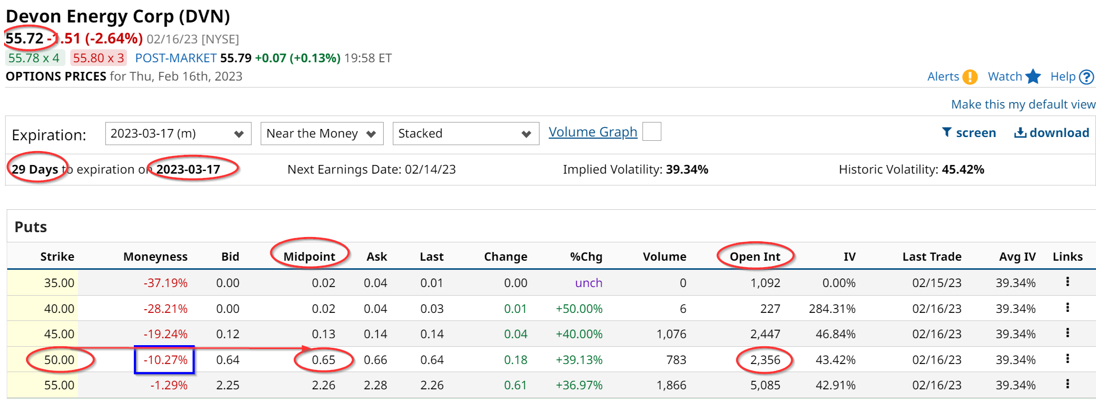

This same OTM trade is attracting more value players, as evidenced by the volume of OTM puts. For example, the March 17 expiration puts at the $50 strike price trade for a whopping 65 cents per put contract. That strike price is 10.3% below where the stock closed on Feb. 16 at $55.72.

The investor who secures $5,000 with a brokerage firm can then immediately put in an order to “sell to open” 1 put contract at $50.00 for March 17, and then receive $65.00 in the account. Similarly, securing $15,000 in cash and/or margin and then shorting 3 puts contracts brings in $195.00.

That works out to an immediate yield of 1.3% (i.e., $195/15,000). If repeated each month, the annualized return is 15.6%. The volume at these levels, 2,356 contracts in open interest shows that investors are piling into this trade.

The investor is taking a risk that DVN could fall to $50.00 by March 17 or earlier. But even if does, the investor will now own a stock that pays a dividend of $3.56 on a fairly sustainable basis, as we have shown above. That will give the investor a new dividend yield of 7.12%, which is higher than today's 6.39% yield. Moreover, at that point, the investor could also sell OTM calls to create additional income.

So investors who stay long in DVN stock can either create more income by shorting OTM puts or even covered calls. Meanwhile, the stock is attracting value buyers as well as short put players, based on its now reset dividend yield and high put premiums.

More Stock Market News from Barchart

- Stocks Slump as Fed Officials Mention Bigger Rate Hikes

- Profit Estimates for Tech Stocks Continue to Fall

- The CRUZ ETF- A Bearish Trend and Reversal

- Strength in U.S. Producer Prices and Hawkish Fed Speak Weighs on Stocks

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)