Palladium is platinum’s sister metal and a platinum group metals member. While rhodium, osmium, ruthenium, and iridium are platinum group metals, only platinum and palladium trade on the futures market on the Chicago Mercantile Exchange’s (CME) NYMEX division. The NYMEX is traditionally an energy exchange, hosting crude oil, oil product, natural gas, and other energy futures contracts. Platinum and palladium trade on NYMEX because they are critical metals in oil refining. Their high density and heat resistance make them ideal catalysts in catalytic petroleum and petrochemical crackers or refineries.

Platinum has spent years underperforming palladium and other precious metals. In a recent Barchart article, I highlighted how platinum has disappointed investors who purchased the metal seeking capital appreciation. Meanwhile, palladium has been another story, as the price exploded to a record high in March 2022. Since then, palladium has been correcting, but it still trades at a premium to platinum. The Physical Palladium ETF product (PALL) moves higher and lower with palladium’s price.

A record high and correction

Nearby palladium futures took off on the upside in 2017 when they surpassed the previous February 2001 $1035 per ounce high.

The chart highlights the NYMEX palladium future’s pattern of higher lows and higher highs dating back over a decade. Palladium futures rose to $3,380.50 per ounce on the continuous futures contract in March 2022, where they ran out of upside steam.

A bearish trend over the past year

Palladium’s bull market ended in March 2022, and the metal has made lower highs and lower lows over the past year.

The chart illustrates palladium’s decline over the past year, which took the price to a $1,354 per ounce low in February 2023. At near the $1375 level on March 7, palladium futures were just above the recent low, less than half the price at the March 2022 high. Moreover, palladium futures broke below the mid-December 2021 $1549.49 low and the March 2020 pandemic-inspired $1,449.40 low, the metal’s technical support levels.

Palladium is rare and has growing industrial uses

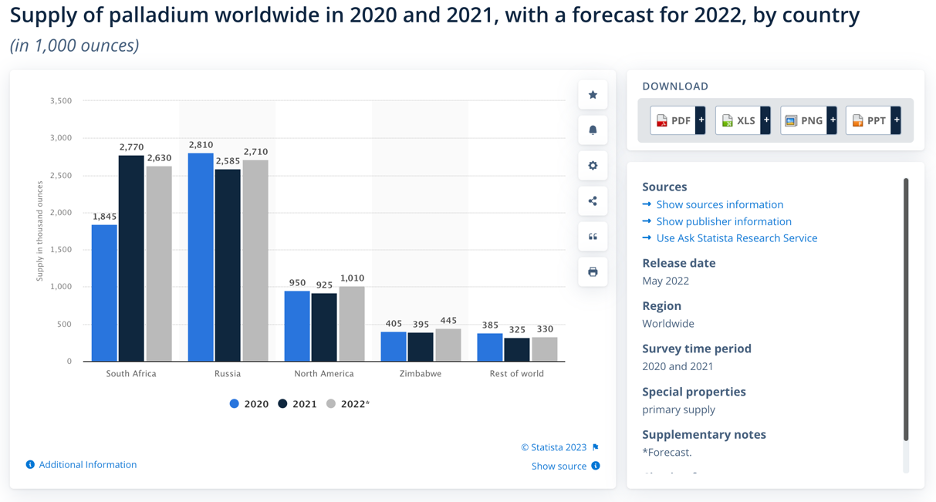

Like platinum and the other platinum group metals, most annual palladium supplies come from South Africa and Russia.

Source: Statista

While South Africa produces more platinum than Russia, the two countries produce around the same level of palladium.

Platinum is a precious industrial metal with significant investor demand; palladium demand is highly industrial. Palladium has been the metal of choice for catalytic converters in gasoline-powered engines. Jewelry, dentistry products, watches, blood sugar test strips, aircraft spark plugs, surgical instruments, and electrical contracts require palladium. Palladium is a musical metal as it is the metal that concert flute makers employ.

While platinum and palladium futures are less liquid than gold and silver futures, palladium suffers from lower liquidity than platinum as palladium’s open interest and volume are less than platinum.

As of March 6, platinum open interest on the NYMEX futures market stood at 3,448,550 ounces, while palladiums was nearly one-third that level at 1,2011,000 ounces.

Palladium trades at a premium to platinum, but that has not always been the case

On March 7, nearby June palladium futures commanded an over $440 per ounce premium to platinum futures.

The long-term chart ({PAM23}-{PLJ23}) illustrates nearby platinum traded at a premium to nearby palladium futures from the late 1960s through November 1999. From December 1999 through August 2001, palladium’s price exceeded platinum, but it moved back to a discount in September 2001 and remained there until August 2017. Since then, palladium has been the more expensive metal, rising to an over $1750 premium in April 2021 when palladium was making new record highs.

PALL is the palladium ETF product

The palladium bull market ended with a sharp correction that took the price from over $3,380 last March to the $1,375 per ounce level in March 2023.

Since Russia is a leading producer and palladium is a critical metal that cleans toxins from the environment, the war in Ukraine and poor relations between the US/Europe and Russia could cause supply shortages that lift the metal’s price after a year-long correction.

The most direct route for a risk position in palladium is the physical metal. Bars and coins provide pure exposure. The NYMEX palladium futures have a physical delivery mechanism, making them converge with physical prices at expiration. Meanwhile, the Aberdeen Physical Palladium ETF product (PALL) provides exposure for market participants without the need to hold the metal or venture into the leveraged and margined futures arena.

At $129.09 on March 7, PALL had $236.139 million in assets under management. PALL trades an average of 53,028 shares daily and charges a 0.60% management fee. The ongoing war in Ukraine, palladium’s industrial uses, and the highest inflation in decades could cause palladium to find a bottom and turn higher in the coming weeks and months. The trend is always your best friend, and while it remains bearish on March 7, palladium has significantly declined and offers far more value in March 2023 than it did in March 2022.

More Metals News from Barchart

- Stocks Fall on Hawkish Powell

- Dollar Slips on Strength in the Euro

- Stocks Rise on Strength in Apple and Lower Bond Yields

- Dollar Follows T-Note Yields Lower

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

/Lululemon%20Athletica%20inc_%20leggings%20by-%20Sorbis%20via%20Shutterstock.jpg)

/Palo%20Alto%20Networks%20Inc%20HQ%20sign-by%20Tada%20Images%20via%20Shutterstock.jpg)