Warner Bros Discovery (WBD) reported its Q4 earnings after the close on Feb. 23 showing disappointing earnings. However, its free cash flow was very strong during Q4. As a result, interest in short-put options as an income play is rising.

As you may recall WBD was the result of both a spin-off from AT&T (Warner Media division) and a simultaneous merger with Discovery, Inc., and started trading on April 11, 2022. This company now houses HBO, and CNN, plus documentary shows like Shark Week and the Food Network, and reality TV shows from Discovery.

Free Cash Flow Cuts Through the Bull

The problem is the spinoff saddled the company with a ton of debt. As of Dec. 31, 2022, it had $49.5 billion in gross debt. Last quarter alone the interest expense was $558 million, and the company said its average interest cost was 4.3%. But if rates stay high, this could eat into the company's cash generation.

That is why the company wants investors to focus on its EBITDA numbers (earnings before interest, taxes, depreciation, and amortization). The Q4 net income was negative $2.1 billion and the 2022 full-year net income was negative $7.1 billion. But this included a large number of non-cash expenses. As a result, its adjusted EBITDA (which eliminates non-cash expenses) was positive $7.7 billion before pro forma adjustments ($9.17 billion on a proforma basis).

Moreover, its free cash flow (FCF) does include cash interest payments and capex spending and also eliminates non-cash expenses. It came in at $3.3 billion for 2022, or 42.8% of pre-proforma adj. EBITDA number and 36% of the proforma number. The company says its goal next year is to raise its FCF to 50% of the proforma adj. EBITDA number. Eventually, management expects to hit a 60% “conversion” number.

This FCF is what Warner Bros Discovery uses to pay down its debt. It is slowly doing this, about $1 billion per quarter. So, although investors were pleased to see that subscribers increased by 1 million over Q3, the company still has a long way to go before its debt and interest expenses come way down. That keeps a lot of pressure on WBD stock.

Shorting Out-of-the-Money WBD Puts for Income

You can see that there is no room for the company to pay a dividend yet, at least until its FCF is stronger. Management is not even talking about this, as their focus is debt reduction. As a result, investors who want an income from WBD stock can look to short out-of-the-money puts.

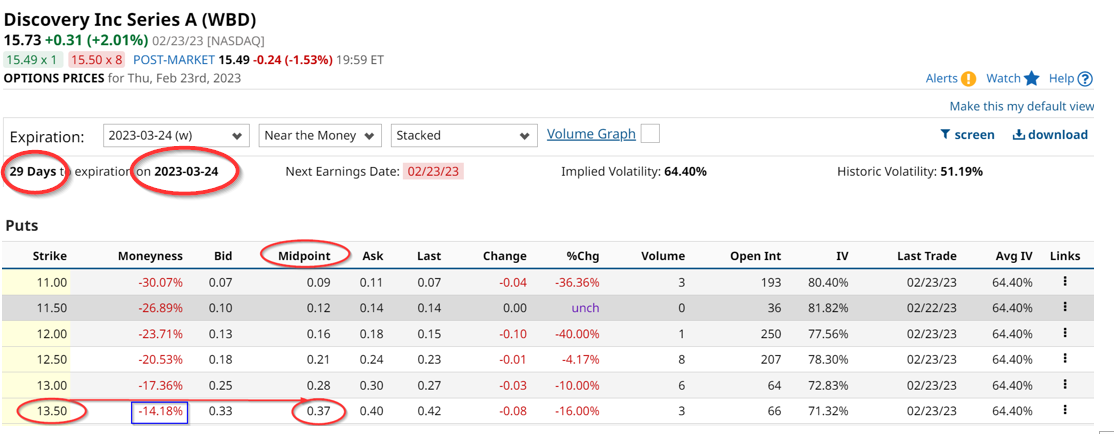

For example, the March 24, expiration period put option chain shows the $13.50 strike price, 14% below today's price of $15.73 (Feb. 23), trades for 37 cents per put option contract.

That means that the investor can make a 2.35% spot put yield (i.e., $0.37/15.73), and based on the put strike price the yield is higher at 2.74 (i.e., $0.37/13.50). This means that the investor who secures $1,350 with the brokerage firm in cash and/margin can enter in an order to “sell to open” 1 put at the $13.50 strike price and immediately receive $37.00. So $37 / $1,350 equals a return of 2.74%. If that can be repeated each month for 12 months the annualized return is a whopping 32.88%.

The risk is relatively low here since the stock would have to fall over 16.5% from $15.73 to $13.13 (i.e., $13.50-$0.37) before the investor would begin to lose money (at least on an unrealized basis, since the $13.50 strike price put would force the investor the buy the stock at $13.50).

In fact, if you want to be even more conservative, the investor could sell the $12.00 puts instead, which are over 23.7% below today's price. The return would still be over 1.0% on a spot basis (i.e., $0.16/$15.73), and 1.333% on yield to strike price basis (i.e., $0.16/$12.00).

In other words, WBD stock provides very good out-of-the-money options to create income for the enterprising investor.

More Stock Market News from Barchart

- Stocks End Higher on Nvidia and Lower Bond Yields

- Is Dr. Copper Advising Other Markets to get Vaccinated?

- Warner Bros Discovery Rebounds on the Company’s Cost-Cutting Plans

- This Company Is Flashing A 100% Buy And Is Highly Recommended By Analysts

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)