/Technology%20-%20vishnu-mohanan-pfR18JNEMv8-unsplash.jpg)

In a Barchart article on November 27, 2022, I wrote:

The FXI offers value, but the potential for rewards is always a function of the risks. China’s value proposition comes with more than a few risks, but as the world’s second-leading economy, the U.S. market is critical for China’s future economic growth. Risk-reward favors Chinese stocks and the FXI ETF at the current level, and value seekers like Charlie Munger believe they are “worth the risk.”

The FXI offers value compared to the SPY and the S&P 500, but the risk is always a function of the potential for rewards.

The iShares China Large-Cap ETF (FXI) and Alibaba Group Holding ADR (BABA), the leading Chinese e-commerce company, have rallied since late November 2022. However, recent events could prove a stumbling block for the Chinese companies that trade on the U.S. and international stock exchanges.

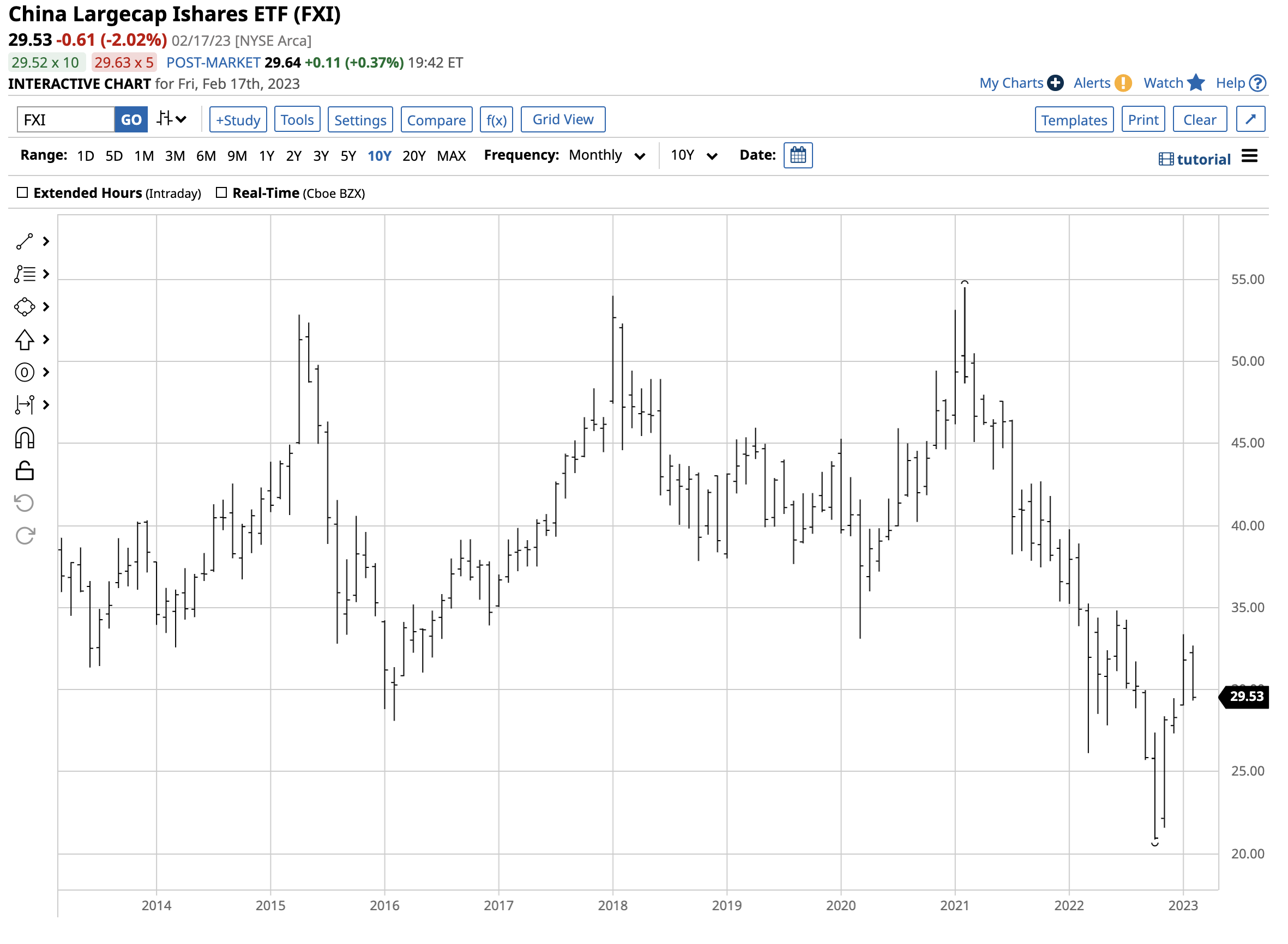

FXI has rallied since the October low

The most diversified U.S. stock market index, the S&P 500, fell 19.44% in 2022. At the 4,080 level on February 17, the index was 6.2% higher over the first month and one-half of 2023. The S&P 500 rallied 16.8% from the October 2022 3,491.58 low.

The iShares China Large-Cap ETF (FXI) was 22.6% lower in 2022, underperforming the S&P 500. At $29.53 on February 17, it was 4.3% higher in 2023. FXI reached a low of $20.87 in October 2022, the lowest level since October 2008. In mid-February, it had recovered 41.5%. FXI outperformed the S&P 500 since the October 2022 low and has done slightly worse so far in 2023.

Alibaba (BABA) is one of FXI’s top holdings. On February 17, 9.49% of FXI’s over $5.9 billion assets were invested in BABA shares.

BABA posted impressive gains since late November

BABA is a bellwether Chinese stock as the company is China’s answer to Amazon (AMZN).

The chart shows BABA shares suffered a 25.8% decline in 2022, underperforming the S&P 500 and FXI ETF. At $100.01 on February 17, BABA was 13.5% higher in 2023. After reaching a $58.01 per share low in October 2022, the shares exploded 72.4% higher. While BABA underperformed in 2022, the e-commerce company has outperformed FXI and the S&P 500 in 2023 and since the October low.

According to the latest 13-F filing, Charlie Munger, a value investor and Warren Buffett’s sidekick, held 300,000 BABA shares as of the end of 2022, his third largest holding with 15% of his Daily Journal Corp assets invested in the company.

Chinese-U.S. relations have deteriorated over the past weeks

FXI reached a high of $33.38 on January 27, and BABA rose to $121.30 per share on January 26 before the Chinese stocks reversed lower. Over the past weeks, tensions between Washington, DC, and Beijing have increased. The U.S. shot down a Chinese balloon after it traversed over Canada and U.S. territory. While China apologized, saying it was a privately-owned weather balloon that blew off course, the U.S. military claims it was on a government spy mission. Since the initial downing, the U.S. military has brought down other questionable floating objects from unknown origins.

The bottom line is the deterioration of U.S.-Chinese relations has weighed on investors’ appetites for Chinese stocks. In 2022, China’s “no-limits” alliance with Russia and Russia’s invasion of Ukraine likely caused Chinese stocks to underperform U.S. stocks. The potential for China to force reunification with Taiwan has been an issue hovering over the investment landscape since the February 2022 agreement with the Russians. Meanwhile, the balloon controversy has only intensified the tensions and stopped FXI’s and BABA’s rallies dead in their tracks.

Value metrics continue to favor Chinese stocks

Perhaps the value metrics were most compelling factor for FXI’s and BABA’s outperformance from the October 2022 lows. The price-to-earnings ratio of the SPY ETF product that tracks the S&P 500 stood at 17.36 on February 17, 2023. FXI’s P/E was at the 8.19 level, and BABA’s was at 15.74. While BABA is slightly lower than SPY, a better comparison is with AMZN, with a P/E of 135.94.

The bottom line is the objective metrics that level the playing field between companies make FXI and BABA compelling investments on a value basis. However, the playing field is anything but level.

The geopolitical landscape makes FXI and BABA risky investments

Markets reflect the economic and geopolitical landscapes. While objective metrics point to substantial value for FXI and BABA shares at the current price levels, the geopolitical tensions between the U.S. and China make them risky investments.

One of the factors investors faces when considering Chinese shares trading on U.S. and international exchanges is that the U.S. and Europe allow Chinese companies to raise capital in their equity markets. At the same time, China strictly limits reciprocal investments by foreign companies in its markets. In 2013, the Chinese purchased Smithfield Foods, a Virginia-based company that is the world’s leading pork producer. Smithfield had traded on the U.S. stock market, but the Chinese investors took the company private. Around the same time, a Chinese entity bought the U.K. London Metals Exchange, the leading global nonferrous metals trading platform. Foreign companies would never receive Beijing’s approval to invest in or own Chinese companies.

Meanwhile, deteriorating relations could lead to significant trade and investment restrictions over the coming months. Even though FXI and BABA offer value, the risk has been increasing from a geopolitical perspective.

In my late November Barchart article, I wrote, “Risk-reward favors Chinese stocks and the FXI ETF at the current level, and value seekers like Charlie Munger believe they are “worth the risk.” The balloon incident and the state of U.S.-Chinese relations have increased the risk. It will be interesting to see if Charlie Munger is still long BABA shares when the Q1 2023 13-F comes out in early Q2.

More Stock Market News from Barchart

- Archer-Daniels-Midland Stock Is Still Cheap for Short Put Income Players

- Stocks Settle Mixed as Bond Yields Decline

- Optimism in Alibaba to be Tested by Upcoming Earnings

- Central Bank Comments on Tighter Monetary Policy Weighs on Stocks

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)