Tenet Healthcare (THC) recently announced on Feb. 9 a very positive quarter and 2022 year-end results. This hospital chain is extremely profitable but the company still does not pay a dividend to its shareholders. As a result, one large institutional investor seems to be making up for this with a massive long-dated covered call trade that is significantly out-of-the-money.

The company generated $1.3 billion in free cash flow (FCF) excluding repayments of Medicare Advances and Deferred Payroll Tax Payments in 2022. Moreover, it projects it will do a similar amount in 2023. But the company's board does not want to pay a dividend, and in fact, it hasn't done so since 2000.

Instead, it buys back shares. Last quarter alone it bought back $250 million of its share as part of a $1 billion share repurchase program. That works out to a massive 14.94% buyback yield compared to its $6.69 billion market value. Obviously, the board feels this is a more tax-advantaged way of returning cash to its long-term shareholders.

For one, it increases Tenet's earnings per share. In addition, it increases each shareholder's stake in the company, as well as their stake in the company's earnings. As a result, investors expect the stock will reflect this over time. And lastly, dividends are taxable, whereas, at least this year, large buybacks are not taxable.

Creating Pseudo Dividend Through Covered Calls

Some large institutional investors want to have a pseudo dividend on their long-term investment in the company. They do this through selling covered calls in long-term dated expiration periods and at strike prices well over today's price. I have written about this type of pseudo income in a previous article on ConocoPhillips (COP) stock and a large short put trade.

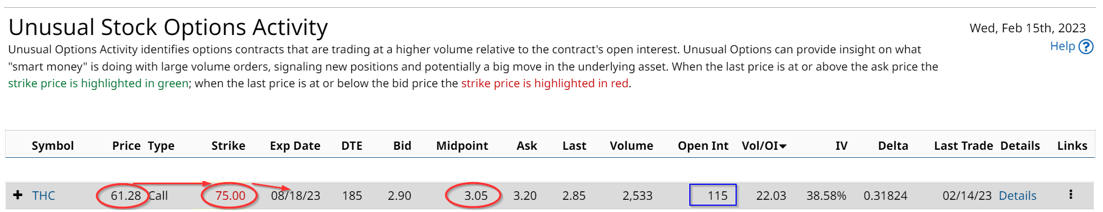

Barchart's Unusual Stock Options Activity report on Feb. 15, 2023, showed this trade. The investor sold 2,533 call options for the period ending Aug. 19, 2023, which is 185 days from today, or 6 months from now.

The interesting thing, which you can see in the report above is that the strike price is at $75.00, or 22.4% over today's price of $61.28. That means the investor will not even have to worry about having to sell their stock unless THC rises over 22% over today's price. And even then they will still receive the capital gain.

So how is this trade a pseudo-dividend? Look at the premium the investor received. It was $3.05 per call contract. If we divide that by the price today of $61.28, that is 4.977%. Moreover, if this trade can be repeated twice a year, it works out to an annualized yield of 9.95%.

That high yield assumes the stock is not called away from a huge rise in the THC stock price. But even so, it will still bring a total return of 27.37% to the investor (i.e., 22.39% from the capital gain and 4.977% from the covered call yield).

This is not a riskless trade. THC stock is very cheap at just 11.4x and given the huge buybacks, there is a good chance the stock could rise. In fact, so far this year it is up over 25%. Nevertheless, this investor is making a calculated bet that it will be worth the 6 months wait to see if the stock rises over $75 per share (or even before then). They are comfortable if that happens taking the 27% return as I showed above.

More Stock Market News from Barchart

- Markets Today: Stocks Fall as Strong U.S. Economic Reports Keep the Fed Hawkish

- Long Straddle Screener Results For February 15th

- Stocks Plunge Before The Open As Sticky U.S. Inflation Sparks Rate Worries, U.S. Retail Sales Data In Focus

- Stocks Settle Mixed as Bond Yields Climb on Continued High U.S. Inflation

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)