Unusual activity in ConocoPhillips' (COP) long-dated options shows institutional investors are taking advantage of a very profitable short-put income play in this profitable oil and gas stock. Moreover, the company's earnings which were released on Feb. 2, show that COP stock has a healthy dividend yield of at least 3.93%.

The company also said it bought back $2.7 billion worth of shares in Q4. That works out to an annualized rate of $10.8 billion, or 7.88% of its $137.1 billion market capitalization. So, in total, shareholders can expect a total return of 11.9% through the company's dividends and buybacks (i.e., 3.93% +7.88%).

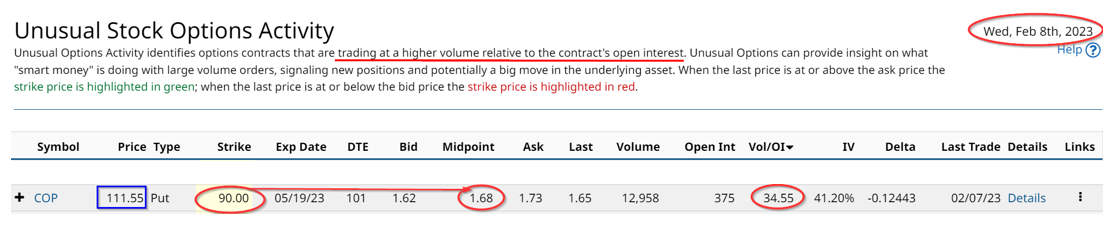

As a result, some institutional investors are looking to enhance their ample returns through shorting long-dated out-of-the-money puts. That is what is clear from the Barchart Unusual Stock Options Activity Report on Feb. 8.

The report shows that some large investors initiated a put trade at the $90 strike price for the period ending May 19, 2023. This strike price is almost 20% below today's spot price of $112.28 (Feb. 8, morning). Moreover, the expiration period is 101 days from now, likely after the Q1 earnings report has been released.

In other words, there is plenty of time for the stock to potentially fall 20%, so the premium for this unusual trade was relatively high at $1.68 per put option. That implies that the yield-to-put strike price is 1.867% (i.e., $1.68/$90.00). On an annualized basis this works out to a 6.74% return if the trade can be repeated 3.61x over the course of 12 months (i.e. 365/101 days to expiration = 3.61x).

Moreover, COP would have to fall to $88.32 per share (i.e., $90-$1.68), or 21.3% from $112.28 today. That is simply not very likely to occur, especially since the stock pays out such a huge dividend.

For example, at that price, the annualized dividend of $4.44 (i.e., 60 cents + 51 variable quarterly dividends x 4) would provide a huge 5.0% dividend yield. This is seen by dividing $4.44 by $88.32. That high yield would likely provide investors who would be forced to buy the stock at $90.00 plenty of income. They would be happy to buy the stock at that dividend yield.

What This Means for COP Stock Investors

Investors in this unusual trade was over 34x the outstanding amount of put contracts at the time. This show they are very keen to short these long-dated out-of-the-money COP puts. For example, the volume was 12,958 puts traded at this strike price. At the time there were only 375 put contracts outstanding at $90 for May 19, 2023, expiration.

We have shown in previous articles on unusual options activity that investors that short long-dated puts often make good money. This is likely to be another such case.

As a result, existing investors in COP stock are likely to take a close look at copying this institutional investor short of these out-of-the-money long-dated puts.

This is done by securing $9,000 in cash and/or margin with the investor's brokerage account. Then the investor puts in a trade to “sell to open” a put contract for the May 19, 2023, expiration period at the $90.00 strike price. Depending on the premium price at the time that could bring in $168 to the brokerage account at the $1.68 midprice. This works out to an immediate return of 1.867% to the account.

Over time as the expiration period approaches, and especially during the last 30 days, the price of the puts will decline unless COP stock falls close to the $90.00 strike price. As a result, the investor can enter a “Buy to close” order at any point to lock in any profits. If the stock tumbles over 20% to $90.00 or below, the put will rise giving a short-term unrealized loss.

But the investor can simply wait until May 19 to see if the contract actually closes with the investor having to purchase the stock at $90.00. That will give them the ability to make a dividend yield that is very attractive as I pointed out above. In addition, the investor could turn around and sell out-of-the-money short-dated calls. That will help pay for any 8nrealized loss from the purchase at $90.00.

More Stock Market News from Barchart

- Markets Today: Stocks Fall on Mixed Corporate Earnings Results

- 2 Bull Call Spread Trade Ideas For AAPL This Wednesday

- Futures are Signaling a Weak Open for Wall Street, Disney Earnings On Tap

- Stocks Rally as Fed Chair Powell Is Less Hawkish Than Feared

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)