/shutterstock_1978714172.jpg)

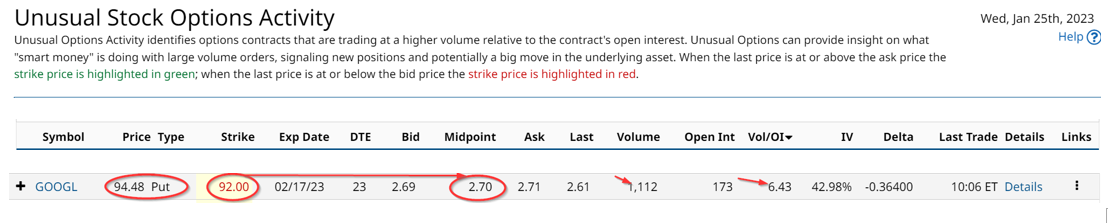

Alphabet (GOOGL) will announce its Q4 earnings on Thursday, Feb. 2 after the close. The battle over the direction of GOOGL stock is showing up in unusual put option activity recently. This can be seen in the Unusual Stock Options Activity Report from Barchart on Thursday, Jan. 25.

It shows that the Feb. 17 put options for the $92 strike price have experienced a large volume. This strike price has 1,112 put contracts traded today, which is 6.4x the 173 in open interest or existing contracts outstanding.

The investors who both bought and sold these puts at $92, which is very close to today's price of $93.85 have paid an average of $2.70 per put contract for the $92 strike price puts. That seems to imply that there is a large battle going on between those who are shorting the puts for an income play and those who buy the puts believing the stock will fall further by Feb. 17.

And, of course, a lot will depend on what happens with the Feb. 2 earnings release. I recently discussed how GOOG options are attractive to short-put investors in my article on Jan. 16, “In-the-money GOOG Options Still Look Attractive to Value Buyers.” At the time shorting out-of-the-money put options at the $85 strike price looked attractive in conjunction with a long in-the-money call purchase at $85 as well. So far, the stock is roughly flat from when that trade was discussed.

But investors may now be buying long puts at $92 in GOOGL stock as well, as this unusual activity shows. On the other hand, collecting $2.70 for the short put investor for just over three weeks to the expiration period seems like a reasonable way to collect short put income.

That means that the investor who puts in an order to “sell to open” $92.00 strike price puts for Feb. 17 will immediately collect $2.70, or 2.93% (i.e., $2.70/$92.00). Moreover, the annualized return if this is repeated over 12 months is 35.2%. Given how high this premium is the investor has a breakeven price at $89.30 (i.e., $92-$2.70), or almost 5% below today's price of $93.85.

This shows how investors are battling over the direction of GOOGL stock. As a result, the premium for near-term puts is relatively very high. Everything will depend on the outcome of the Feb. 2 results. Right now, the stock is treading water but it could take a further tumble if the company disappoints investors.

More Stock Market News from Barchart

- Stocks Slump as Microsoft’s Sales Warning Hammers Tech Stocks

- Markets Today: Stock Indexes Fall as Microsoft Warns of Weaker Revenue Growth

- Amazon Iron Condor Could Net 35% In 3 Weeks

- Pre-Market Brief: Stocks Mostly Lower As Mixed Earnings Weigh On Sentiment

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)