Estée Lauder Companies (EL) is a global leader in prestige beauty, offering luxury skincare, makeup, fragrance, and haircare through 20-plus iconic brands like Estée Lauder, Clinique, La Mer, MAC, and more. The company markets its products via department stores, specialty retailers, travel retail, e-commerce, and salons, focusing on high-end products with science-backed innovation. Known for anti-aging serums, clean beauty lines, and personalized regimens, it blends heritage craftsmanship with cutting-edge research and development.

Founded in 1946 by Estée and Joseph Lauder, the company is headquartered in New York, New York and operates in more than 150 countries across North America, South America, the Middle East, Europe, and Asia-Pacific.

Estée Lauder Stock

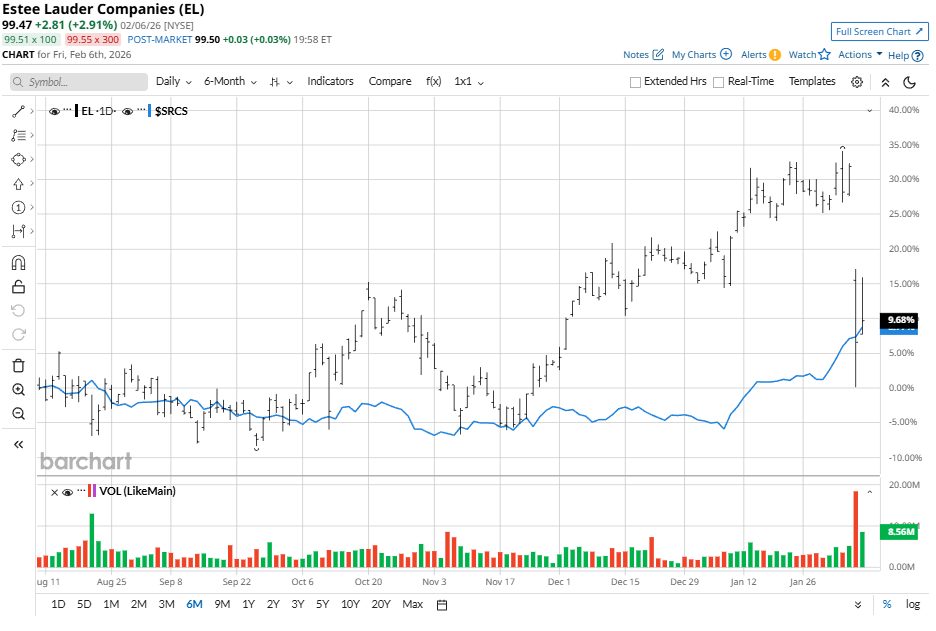

EL stock has been volatile lately, tumbling 12% over the past five days and 10% in the last month. Shares have rebounded by 14% over the past three months and 13% in six months, but the stock is still down by 2% year-to-date (YTD). Over the past 52 weeks, shares of EL stock are up by 49%, trading 15% lower than the high of $121.64.

Against the S&P 500 Consumer Staples Index ($SRCS), Estée Lauder has lagged short-term, where its negative returns have underperformed the index’s 1.3% five-day gain and 10% one-month rise. Over the past 52 weeks, however, Estée Lauder comfortably beats the index’s 9% returns, fueled by recovery from lows.

Estée Lauder's Q2 Results

Estée Lauder reported solid second-quarter fiscal 2026 results, posted on Feb. 05, where revenue rose approximately 6% year-over-year (YOY) to $4.23 billion, matching Wall Street forecasts exactly. Net income reached $162 million, or $0.44 per share, while adjusted EPS was $0.89, beating analyst estimates of $0.84 by 6%.

Gross margin improved slightly to 76.5% from 76.1%. Adjusted operating income rose to $608 million (14.4% margin, up 290 basis points), reflecting cost controls. First-half operating cash flow surged to $785 million from $387 million, boosted by lower capex. Organic sales grew 4%, a positive turnaround after declines.

Estée Lauder raised its full-year fiscal 2026 outlook following a strong first-half performance, although it remains cautious amid macroeconomic headwinds and business challenges. Net sales growth is now projected at 3% to 5% YOY, tightened from the prior 2% to 5% range. Adjusted organic net sales are expected to rise 1% to 3%, up from 0% to 3%. Adjusted EPS guidance improved to between $2.05 and $2.25, reflecting 36% to 49% growth.

Citi Upgrades Estée Lauder

Citi Research upgraded EL stock to a “Buy” rating from a “Neutral” rating, calling the post-second-quarter selloff of 24% an attractive entry point. Analyst Filippo Falorni highlighted the company's improving outlook from its "Beauty Reimagined" strategy and rebounding China business.

Q2 profits beat estimates, but revenue growth of 5% missed forecasts, while full-year guidance disappointed investors expecting a big raise. Falorni views Asia travel retail weakness as temporary. Estée Lauder reset post-pandemic (travel retail fell from 33% to 15% of sales) by launching on Amazon (AMZN) and TikTok Shop with faster innovation.

Should You Buy the Dip in EL Stock?

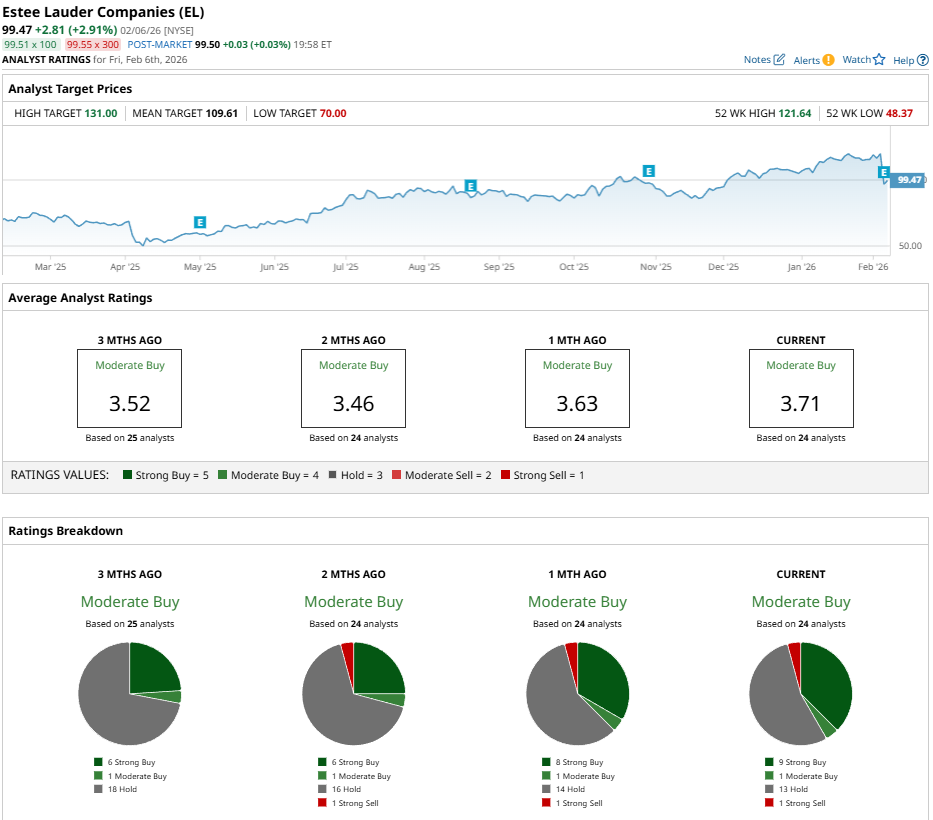

Overall, Wall Street is fairly bullish on EL stock. Amid the recent selloff, the stock has been valued to be at an attractive entry point, which can further be seen by the consensus “Moderate Buy” rating from analysts. The mean price target of $108 reflects potential upside of 4% from the current market rate.

EL stock has been valued by 24 analysts with coverage. Currently, the stock has nine “Strong Buy” ratings, one “Moderate Buy” rating, 13 “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)