- At the end of December, all three major US stock indexes were in position for a continued Benjamin Franklin Fish Analogy to play out.

- However, things changed during January as all three indexes reversed course and closed higher for the month.

- The bottom line remains the same: Long-term uptrends established last October are still in place and could limit investment interest in other market sectors (e.g. commodities).

Sometimes all you can do is smile at how things work out. Just as I was sitting down to write my monthly piece on US stock indexes, this one an update on the Benjamin Franklin Fish Analogy I talked about previously, my friends at the Newman Grove City Café posted their daily menu board on Twitter. Besides celebrating Harry Styles’ birthday, Wednesday’s menu included Fish-N-Chips. What a perfect lunch that would be for this first day of February.

Why? Because all three US stock indexes set aside the possibility of a Benjamin Franklin Fish Analogy with a higher close to the month of January. This fishy analytical oddity tells us that like guests and fish, markets start to stink after three months (days, weeks, whatever timeframe is being studied) of moving against the trend. As I’ve talked about on numerous occasions, all three major indexes (S&P 500, Dow Jones Industrial Average, Nasdaq) posted important technical reversal patterns at the end of October 2022 indicating previous long-term downtrends had come to an end and new long-term uptrends had begun.

A sidenote here: When discussing this on Twitter with my friends at Barchart, they were quick to make a key point, “There is still some disbelief about it (long-term uptrends) though. It’s the most hated stock market rally in history.” I had to laugh when I read this, as it is true for a number of different reasons. It also reminded me of an interview I did with Tyne Morgan a number of years ago when she asked about “the most hated rally in grains of all time”.

The S&P 500 (($INX) closed January at 4,076.60, up 237.10 (6.2%), reportedly its best January performance in four years. Had the Benjamin Franklin scenario played out, given the lower close posted at the end of December, the expectation was for January and February to follow suit setting the stage for a spring rally. Since the index closed higher last month, the question is now how soon it takes out its previous 4-month high of 4,100.96 from December 2022. The January high was 4,094.21. Eventually the index will set a new 4-month high, an important momentum indicator for the long-term uptrend.

The Dow Jones Industrial Average ($DOWI) closed last month at 34,086.04, up 938.79 (2.8%) from December’s settlement of 33,147.25. While the index could consolidate for a while, its previous 4-month high of 34,712.28 (also from December 2022) is easily within sight on the horizon. Bringing another technical factor into play: Monthly trade volume for the Dow increased during January’s rally as compared to December’s selloff, 341.2 million to 332.6 million. However, we have to attach an asterisk due to all the December holidays. It will be interesting to see what happens in February given it is a short month.

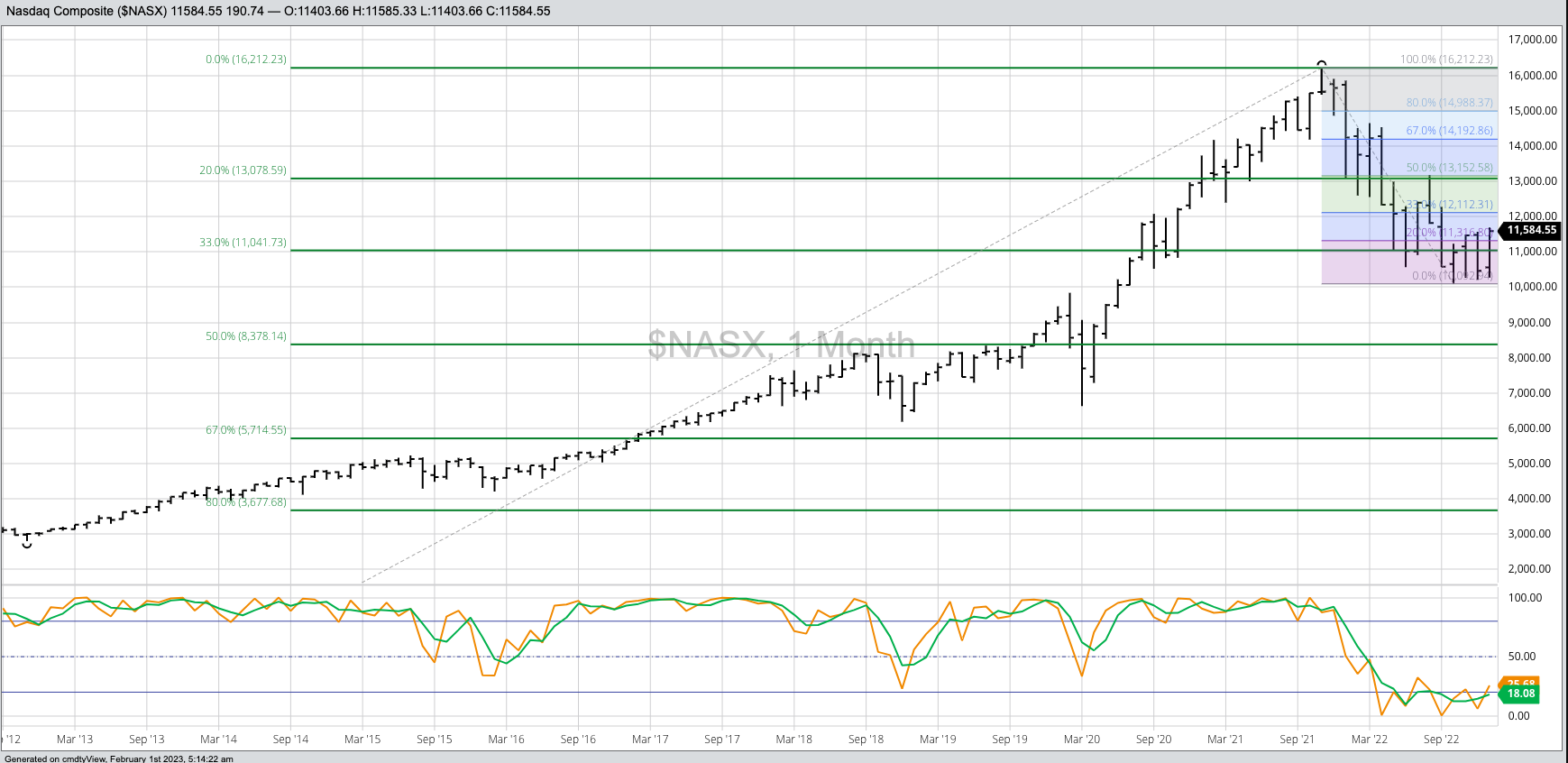

The Nasdaq ($NASX) led the way to open 2023, closing 1,118.07 (10.7%) higher for the month. If we go back to my discussions on the Nasdaq since the bearish turn at the end of January 2022 (the argument could be made it occurred at the end of November 2021 with the Nasdaq), this index has been the leader. Additionally, it was also the most likely to see its October reversal pattern fail if investors continued to put pressure on high-tech stocks. December saw it get close with a low of 10,207.47, as compared to the October mark of 10,092.94, and the index took another look in early January with a low of 10,265.04 before the mood of the market sector changed. Ultimately, the Nasdaq took out its December high on its way to a January mark of 11,691.89, now the 4-month high target for February.

Where do the three indexes go from here? We know the trajectory won’t be straight up, trends seldom are, but I’m still looking for all three to move higher over time. The key will be holding support on these same monthly charts, and ultimately setting a series of higher lows and higher highs – the very definition of an uptrend. The fact stock indexes in the US and around the world are in long-term uptrends, even if hated, could limit investment buying in other sectors. This includes commodities where a number of key markets continue to show bullish fundamentals through inverted futures spreads.

The stage is set for what should be an interesting 2023.

More Stock Market News from Barchart

- Stocks Moderately Lower on Mixed Economic News Ahead of FOMC

- Here’s Why Knight-Swift Transportation (KNX) May Be The Most Frustrating Trade

- Markets Today: Stocks Slightly Lower Ahead of FOMC

- How To Buy General Motors For A 10% Discount, Or Achieve A 16% Return

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)