Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income.

A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock.

The goal is to either have the put expire worthless and keep the premium, or to be assigned and acquire the stock below the current price.

It’s important that anyone selling puts understands that they may be assigned 100 shares at the strike price.

Why Trade Cash Secured Puts?

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership.

If the investor was strongly bullish, they would prefer to look at strategies like a long call or a bull call spread.

Investors would sell a put on a stock they think will stay flat, rise slightly, or at worst not drop too much.

Cash secured put sellers set aside enough capital to purchase the shares and are happy to take ownership of the stock if called upon to do so by the put buyer.

Naked put sellers, on the other hand, have no intention of taking ownership of the stock and are purely looking to generate premium from option selling strategies.

The more bullish the cash secure put investor is, the closer they should sell the put to the current stock price.

This will generate the most amount of premium and also increase the chances of the put being assigned.

Selling deep-out-of-the-money puts generates the smallest amount of premium and is less likely to see the put assigned.

General Motors Cash Secure Put Example

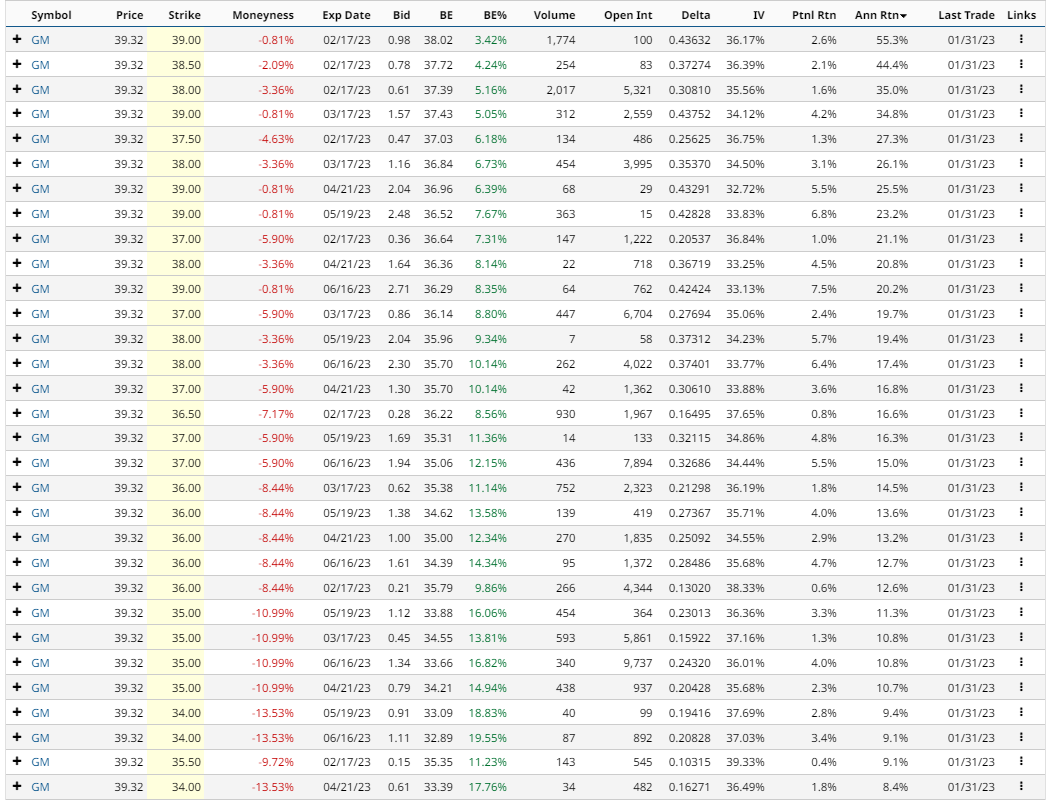

Yesterday, with General Motors (GM) trading around $39.25, traders could sell a May 19 put option with a strike price of $37.

For selling this put, the trader would receive $170 in option premium.

In return for receiving this premium, they would have an obligation to buy 100 shares of GM for $37. By May, if GM is trading for $35, or $30, or even $10, they still have to buy 100 shares at $37.

But, If GM is trading above $37, the put option expired worthless, and they keep the $170 option premium.

The net capital at risk is equal to the strike price of 37, less the 1.70 in option premium. So, if assigned, the net cost basis will be 35.30. That’s not bad for a stock currently trading at $39.25.

That’s a 10.06% discount from the price it was trading yesterday.

If GM stays above $37, the return on capital is:

$171 / $3,530 = 4.82% in 107 days, which works out to 16.28% annualized.

This trade either achieves a 16.28% annualized return, or results in buying a quality stock for a 10.06% discount.

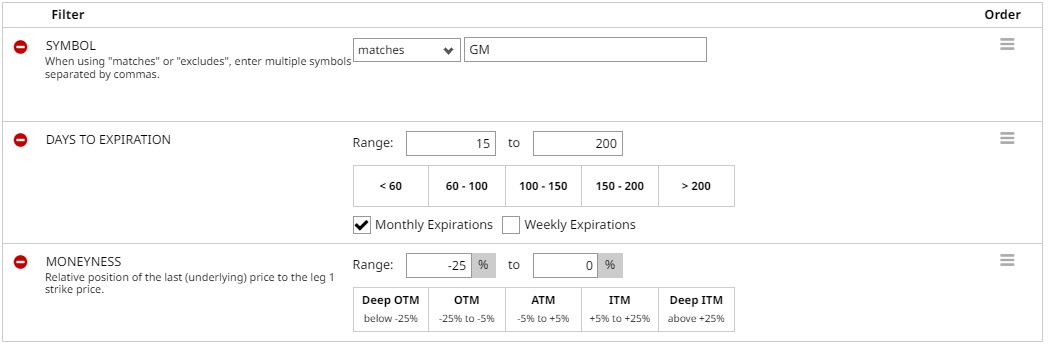

Below you can see the filters and results for this Naked Put Screener:

Company Details

General Motors is currently rated a Buy. The Barchart Technical Opinion rating is a 56% Buy with a Strongest short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

Of 16 analysts covering GM, 8 have a strong buy rating, 1 has a moderate buy rating, 6 have hold ratings and 1 has a strong sell rating.

General Motors the auto giant has had a long and checkered history. The company rose to dominate the U.S. industry; however, hit by the financial crisis, General Motors filed for bankruptcy and within few months, the firm emerged from bankruptcy. The company is stepping up to embrace an electric future and gain a strong foothold in the fast-growing market. The automaker plans to roll out fresh EV models. The firm's own modular battery platform, the Ultium Drive system, will aid in the transition to an all-electric portfolio.'The major EV offerings would include GMC Hummer e-pickup, Cadillac LYRIQ, Chevrolet Silverado EV, Chevrolet Equinox and Blazer EVs. The company will also offer an electric version of GMC's Sierra pickup truck.'General Motors, and its strategic partners, produces, sells and services cars, trucks and parts under four core brands - Chevrolet, Buick, GMC and Cadillac. General Motors assembles passenger cars, crossover vehicles, light trucks, sport utility vehicles, vans and other vehicles.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own.

If you end up being assigned, you can start selling covered calls against the stock position.

You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

Some traders like to add a deep out-of-the-money long put to reduce risk. For example, a May 19 put option with a strike price of 27 could be purchased for around $20. Buying this put, would cap losses below 27 and reduce total capital at risk from $3,530 to $850.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Settle Higher on Fed-Friendly U.S. Economic Reports

- Embattled Vroom (VRM) Tops the Screener for Unusual Options Volume

- Advanced Micro Devices is a Bright Spot for Chip Stocks

- Stocks Climb as U.S. Labor Costs Ease

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)