/ARK%20Invest%20logo%20by%20ChrisStock82%20via%20Shutterstock.jpg)

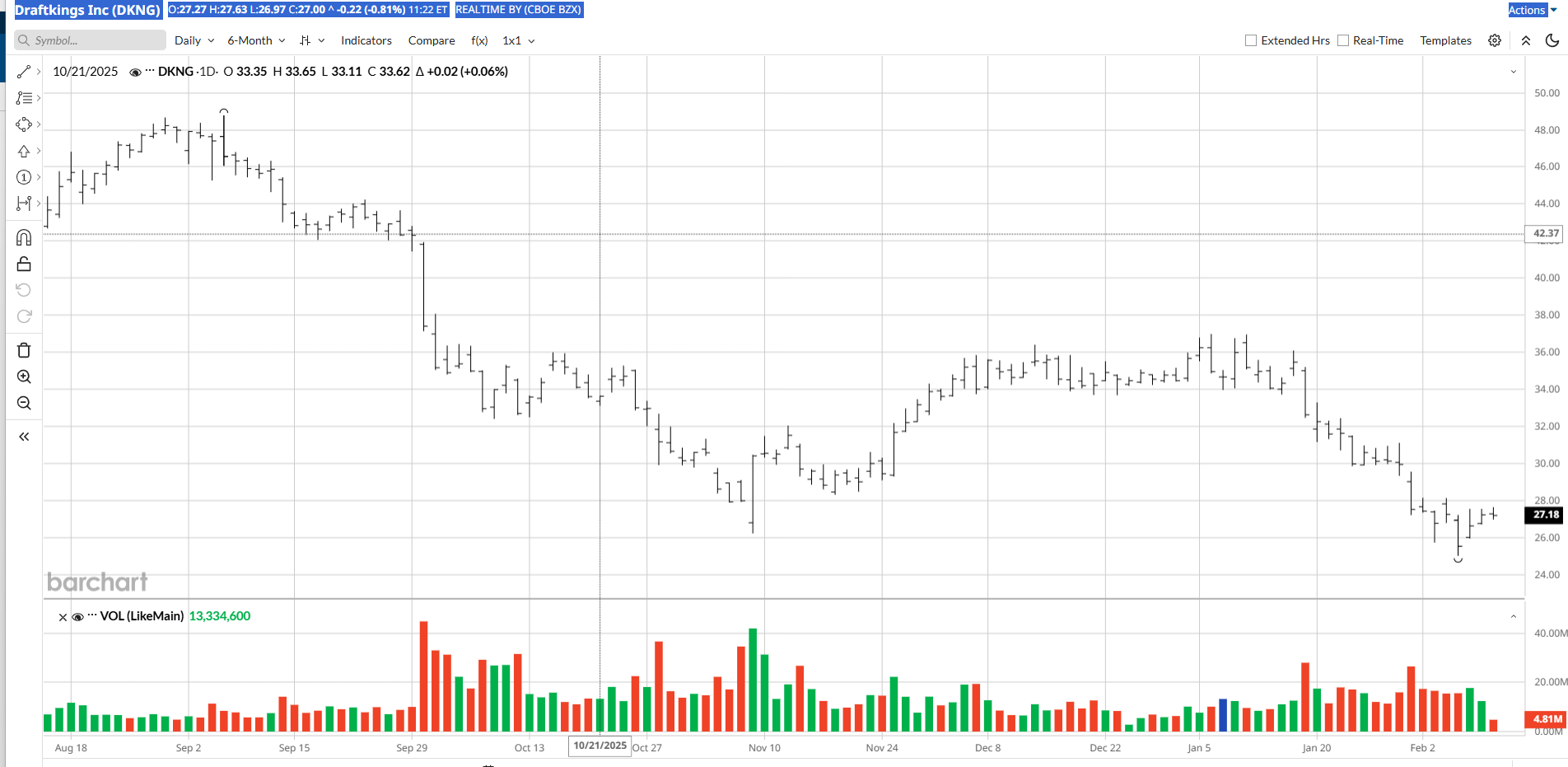

On Feb. 3, several days before the Super Bowl, Cathie Wood's exchange-traded funds (ETFs) unloaded 785,490 shares of DraftKings (DKNG) stock. In recent weeks, the online gambling stock has been struggling mightily amid fears of increased competition from prediction markets. While those worries appear to be overblown, there's a significantly better name in the online-betting sector than DKNG at this point.

About DraftKings

Based in Boston, DKNG offers retail sports betting in 28 states, while its prediction markets app is available in 38 states. The company also enables users to place online bets on casino games.

With a market capitalization of $13.5 billion, DKNG has a forward price-to-earnings (P/E) ratio of 22x. In the third quarter, DKNG's revenue climbed 4% versus the same period a year earlier to $1.14 billion. It generated a loss from operations of $272 million, better than the $298.6 million loss from operations that it delivered in Q3 of 2024. But it predicted that its 2025 EBITDA, excluding certain items, would come in at a robust range of between $450 million and $550 million.

As of market close on Feb. 9, DKNG had tumbled 21% in 2026. During the same period, the S&P 500 Index ($SPX) had advanced 1.75%.

Prediction Markets Versus Sportsbooks

Sports betting using prediction markets has become quite popular in the last year. About a year ago, Kalshi began enabling users to bet on sporting events for the first time. While previous administrations in Washington had prevented prediction markets from taking sports bets, President Donald Trump's administration declined to block the move, and sports betting on Kalshi has flourished since then.

Judging by the sharp declines of the shares of sportsbook owners like DraftKings and its online competitor, Flutter (FLUT), so far this year, many on the Street expect the sportsbooks' market share to tumble going forward. Also noteworthy is the fact that Street analysts' estimates for Flutter's Q4 adjusted earnings per share (EPS) have sunk 49% in the last three months.

But with total wagers on the Seahawks alone during this year's Super Bowl coming in at $1.5 billion, there seems to be plenty of money to go around for the major online sports-betting platforms.

Providing evidence for this assertion, senior analyst Ed Birkin predicted that the amount bet on this year's Super Bowl, excluding the prediction markets' share, would jump 9% year-over-year. Further, states may not continue to allow prediction markets to ignore their laws. Indeed, indicating that some states may take legal action against prediction markets that offer sports betting, Nevada recently filed a lawsuit against Coinbase (COIN) related to the firm's sports-betting offerings.

Additionally, the valuations of the sportsbook owners have gotten quite low. For example, Flutter now has a forward P/E ratio of just 19.3x, while MGM (MGM), which has a 50% stake in sportsbook BEtMGM, has an even lower forward P/E of 15.9x.

And DraftKings and Flutter have their own prediction market apps.

In light of these points, the entire sector currently looks attractive. But one name appears to be exceptionally well-positioned, particularly for long-term investors.

Why MGM Looks Like the Best Betting Stock to Bet On

Casino owner MGM has a huge customer base that it can constantly try to direct to BetMGM. These days, that strategy seems to be working as BetMGM's top line jumped 33% last year, with its sports-betting sales soaring 63%. Impressively, the joint venture generated $220 million of EBITDA in 2025. Meanwhile, MGM is much more diversified than DraftKings and Flutter, as, in addition, to its many brick-and-mortar casinos in the U.S., it owns two casinos in China.

For long-term investors, MGM's $8.9 billion resort in Japan, which is slated to open in 2030 and will apparently be the first casino in the country, is an important positive catalyst to consider. The resort could become a top destination not only for Japanese customers but also for well-heeled tourists from many other nations in the region, such as South Korea, the Philippines, and Singapore.

Finally, Barry Diller, who has built many top-notch businesses, in December 2025 acquired an additional $40 million worth of MGM stock, bringing his total stake in the firm to about 23%. The fact that a longtime winner like Diller obviously thinks so highly of MGM bodes very well for the gambling stock's outlook.

On the date of publication, Larry Ramer had a position in: MGM , COIN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)