/code%20on%20computer%20screen%20java%20html.jpg)

International Business Machines Corp. (IBM) reported another excellent quarter on Jan. 25 in free cash flow (FCF)and projected even higher FCF next year. This underlies IBM's high dividend yield and large buybacks, attracting value buyers. As a result, short-call and short-put income plays are also good opportunities for those investors.

IBM reported that revenue was up 6% year-over-year (Y/Y) on a constant currency basis (i.e., without fluctuations in the currency exchange rate). In addition, it reported that its FCF was $5.2 billion, up $1.9 billion from the prior year. Its full-year 2022 FCF was $9.3 billion, up $2.8 billion from the preceding year or +43%.

Moreover, IBM expects FCF to reach $10.5 billion in 2023. This represents a potential gain of 12.9% in its FCF.

Dividend Yield Valuation

This is important since it will allow IBM to raise its dividend, which costs $1.5 billion per quarter, or $6.0 billion per year. It means that there is plenty of room to pay an even higher dividend next year.

For example, IBMy's upcoming quarterly dividend per share of $1.65 will be the fourth in a row. IBM has raised its dividend 23 years in a row and if it raises the dividend by 10% to $1.815 quarterly, the annual rate will be $7.26 annually, IBM stock could have a 5.365% dividend yield at today's price of $135.30 (i.e., $7.26/$135.30).

This is significantly higher than the stock's 5-year average yield of 4.82%, according to Morningstar. As a result, if IBM stock were to trade at this average yield, the stock would rise to over $150 (i.e., $7.26/0.482 = $150.62).

That implies there is a significant upside in IBM stock, over 11.3% assuming the stock rises to the average dividend yield over the past 5 years.

Shorting Calls and Puts For Income

Investors who want to generate additional income can short out-of-the-money (OTM) calls and puts. This especially applies to the put side as IBM's options premiums are heavily skewed to the put side with significantly higher prices than comparable calls.

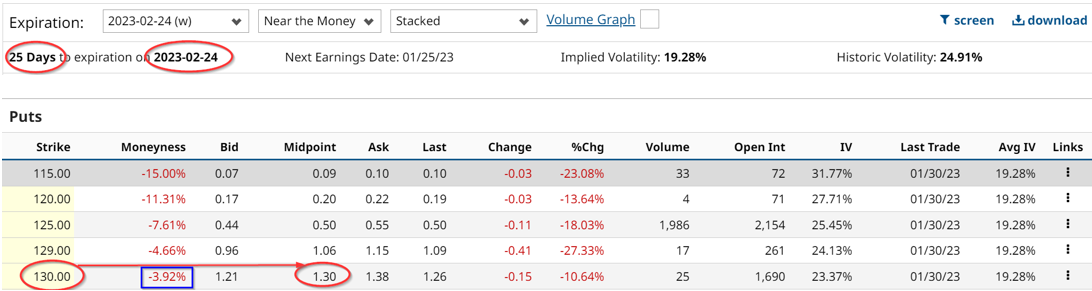

For example, the $130 strike price puts for the Feb. 24 expiration show that midpoint premiums are at $1.30 per put contract. This strike price is 3.92% away from the spot price as of the Jan. 30 close of $135.30 per share. The comparable call price that is about 4% away from the spot price is the $141 strike price. Its premium is just 44 cents. In other words, the put price is $1.30 and the call price is just 44 cents for the options that are about 4% out-of-the-money.

This also means that an investor who puts in an order to “sell to open” the $130 strike price will immediately receive $130 after placing $13,000 in cash and/or margin with the brokerage firm (i.e., $130 x 100 shares). That works out to a very profitable yield of 1.0% over the 25-day period to expiration. This is an attractive 12% annualized return if it can be repeated each month over the next 12 months.

As a result, value investors who buy IBM stock and short its puts have a good chance of making significant income over the next 12 months.

More Stock Market News from Barchart

- Stocks Slide on Weakness in Tech and Energy Stocks

- Why Unusual Options Volume for C3.ai (AI) Isn’t the Entire Story

- The WSJ Says Tesla Options Volume Surged Making Shorting Calls Attractive

- Dollar Weakness a Positive for Tech Earnings

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)