- Shorting options is a legitimate strategy, both covered positions or naked, though as the Speedo Principle tells us the unlimited risk/limited reward aspect is not fore everyone.

- Before jumping into a short options position it is best to run the possible strategy through a set of filters: Seasonality, Price Distribution, and Volatility.

- The subject came up in soybean meal over the weekend where technical indicators were showing one thing while long-term fundamentals remain incredibly bullish.

Over the weekend I saw increased chatter over a couple different subjects: Selling options as an investment strategy and folks getting bearish soybean meal based on technical patterns. This immediately transported me took the years of 1994 and 2012, along the way passing a couple Columns I wrote for my website on November 19, 2018 (Beware of the Naked Man) and November 23, 2018 (The Speedo Principle).

Let me be clear up front: I have used short options a number of times in the past, both when I was trading and as a broker. There is also a chance I used the strategy as a grain merchandiser, though my memory is a bit foggy as the general manager and grain accountant were strongly against that kind of unlimited risk/limited reward position. That’s when I came up with the idea of the Speedo Principle to describe the situation: Like wearing a speedo at the beach, being short options isn’t right for everyone.

Back in the summer 2012, as a Senior Analyst and strategist, the soybean market was telling me selling November call options was a good position based on a set of factors I was watching. However, the flip side of the coin occurred back in the summer of 1994, as a broker, I didn’t read the live cattle market correctly and it turned out to be an expensive lesson. This gave rise to Newsom’s Market Rule #3: Use filters to manage risk, with those filters being seasonality, price distribution, and volatility.

Some of you will recall pieces on this website from last year when I discussed my thoughts on first shorting call options in corn, then selling puts in the same market. In the end both strategies did what I was needing them to do given my thoughts on the trends (long-term and intermediate-term) in corn.

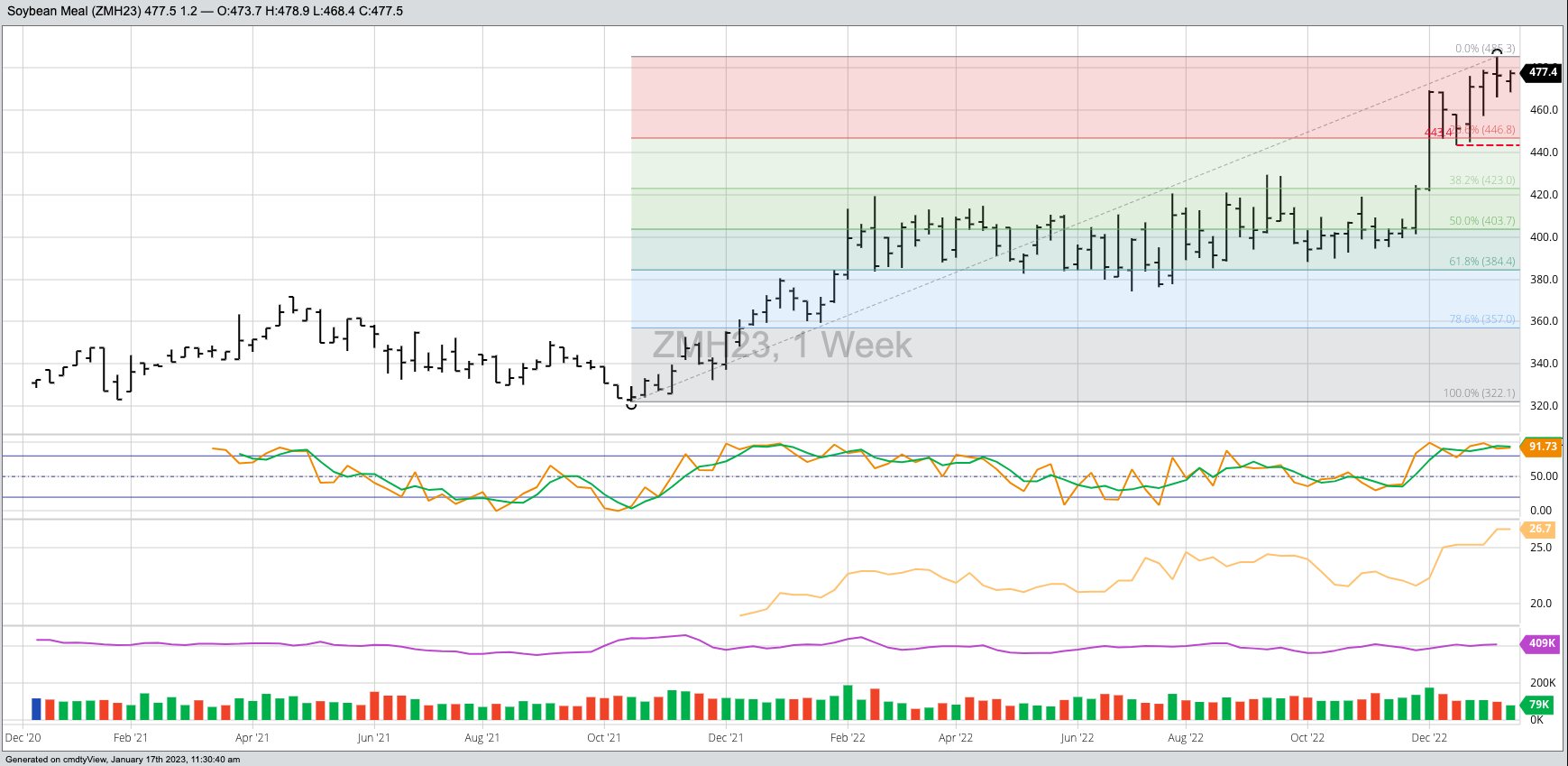

But what about soybean meal (ZMH23)? I had to go back a ways to find the last time I wrote about this market, all the way back to November 3, 2021 when the meal market was just getting started on its latest uptrend. Now, though, there is a great deal of interest in the idea March soybean meal has topped. I even talked about it on my website this morning based on the bearish spike reversal the contract posted on its weekly chart last week. If all we knew about soybeans was this technical pattern, we could be tempted to possibly sell March call options against the contract. But here’s where Rule #3 comes into play again:

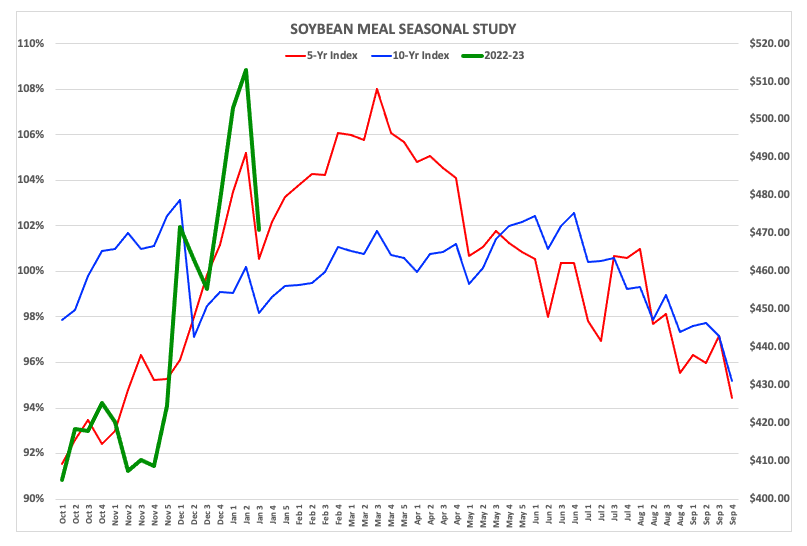

- Soybean meal’s 5-year seasonal index shows the market tends to post a high weekly close the third week of March, about the same time Argentina’s latest soybean crop has made its way to town and is being crushed for export.

- Yes, March soybean meal is in the upper reaches of its price distribution range with last Friday’s close of $473.60 easily one of the top-5 going back to at least 2013.

- Implied volatility was high at 24.4% but had already come down from its recent peak of 26.7%. When it comes to short options it is important to sell high volatility and buy low volatility.

- The conclusion is two of these three filters are flashing warning signs about selling March soybean meal call options, and we haven’t even touched on fundamentals yet.

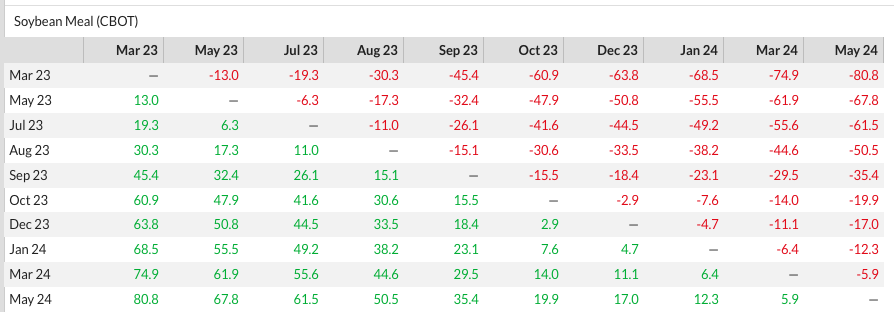

Ah yes, fundamentals. Good old supply and demand that is the central theme of Newsom’s Market Rule #2: Let the market dictate your action. A look at the Soybean Meal Spread Matrix on your Barchart cmdtyView system shows meal spreads are inverted out through at least the May 2024 contract. And as we can all recite by now, when talking about storable commodities, an inverse is always fundamentally bullish no matter how small. This factor alone would make me nervous about selling call options, at least until the market puts in its seasonal peak.

Last but certainly not least, my two Columns from November 2018 had to do with the bankruptcy of OptionSellers.com who foolheartedly built an entire business plan around selling natural gas options. There are so many things wrong with that idea, most notably choosing to marry oneself to the Widow Maker. The end was all but a foregone conclusion.

More Grain News from Barchart

- Coffee Slightly Lower as Dry Conditions Ease in Brazil

- Wheats Trading Mostly in Black

- Soy Recovering on the Board

- Midday Gains in Corn Futures

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)