Do not mistake me for either a Bitcoin (BTCUSD) bro or a Bitcoin detractor. To me, crypto has always just been another asset type. If Bitcoin exhibits low correlation to other investments I have, that helps me. Because it means I don’t have to play defense solely with traditional hedges, like inverse exchange-traded funds (ETFs), put options, and collars.

Even if an asset class or investing styles does not check that box, I can still make use of it as a trading tool. That has been the case with Bitcoin ETFs like iShares Bitcoin Trust ETF (IBIT), since it debuted in early 2024.

I’ve noted in my writing for some time that while I do have skepticism regarding Bitcoin and other cryptocurrencies as means of exchange on a wide scale, I do realize that blockchain is the real deal. And we’ve been able to invest in blockchain stocks through ETFs, like Amplify Transformational Data Sharing ETF (BLOK) and GX Blockchain ETF (BKCH), for about eight years now.

Is There Another Way To Try To Profit From Crypto? Absolutely.

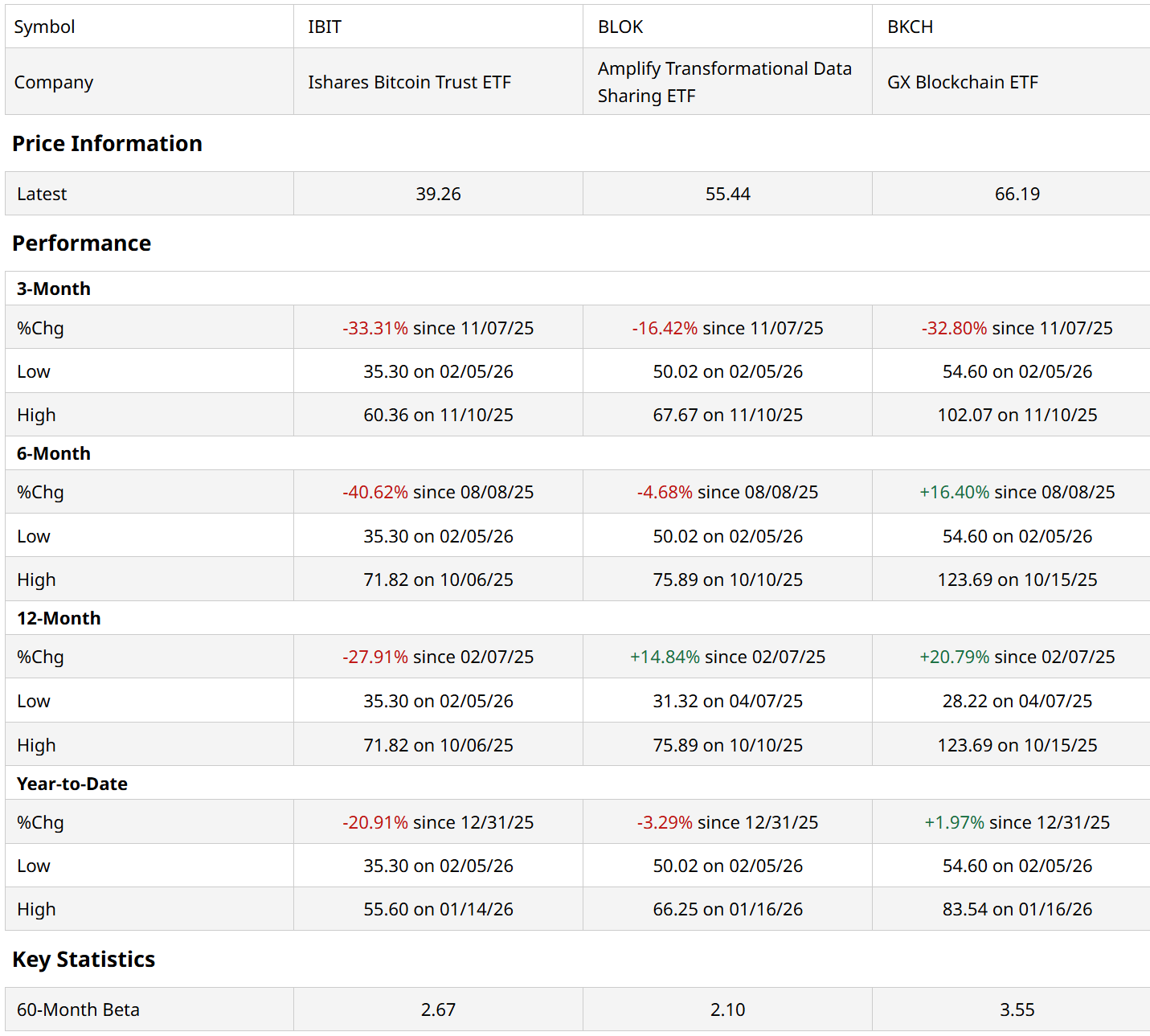

And that’s why this table speaks to me. I prepared it as a summary of a chart I ran that showed that BLOK has outperformed IBIT in every three-month rolling period since last June. That includes both a 40% rally and a 30% decline, all within the past seven months.

So this is not a case of blockchain stocks outperforming in one direction. It is beating Bitcoin in up and down markets. The past is not prologue, but I think that’s notable at a time when there’s obvious selling pressure in the coins, but the stocks are still living, breathing, tangible businesses.

The currencies themselves may have lost their spark, but the infrastructure behind them is showing resilience. For the do-it-yourself investor, this shift suggests that blockchain equity ETFs like BLOK and BKCH might be a more productive way to play the crypto trend than simply holding the digital tokens.

IBIT directly tracks the Bitcoin spot price. As of Monday, it is navigating a risk-off episode that has seen it fall out of bed and test major support levels below $70,000. It is also undergoing a process I call “counting backward.” The lower it goes, the further back we can look to say, “Bitcoin has made zero return since (a certain date).” Bitcoin crossed through $67,000 back in November of 2021. It traded lower than that at one point last week. Translation: Four years and three months of nothing!

While the institutionalization of Bitcoin via ETFs in 2024 and 2025 was supposed to stabilize the asset, it didn’t. When the global macro environment gets nervous, these ETFs face mechanical redemptions that can turn a simple dip into a liquidation event. It's the same old Wall Street story. That story gets too good to be true, and it turns out it is.

IBIT is a high-liquidity risk asset. It offers no yield, no earnings, and its value is derived entirely from the next person’s willingness to pay more for a digital coin. In the current environment of elevated interest rates and tighter financial conditions, Bitcoin is being treated as a liquidity-sensitive gamble rather than a mature safe haven. For many, the thrill of owning a digital currency that doesn't produce anything is starting to fade.

The Infrastructure Alternative: BLOK and BKCH

While the currencies struggle, blockchain ETFs are acting like the pick-and-shovel providers of this age. BLOK and BKCH don't just hold coins. They own the companies building part of the future of finance.

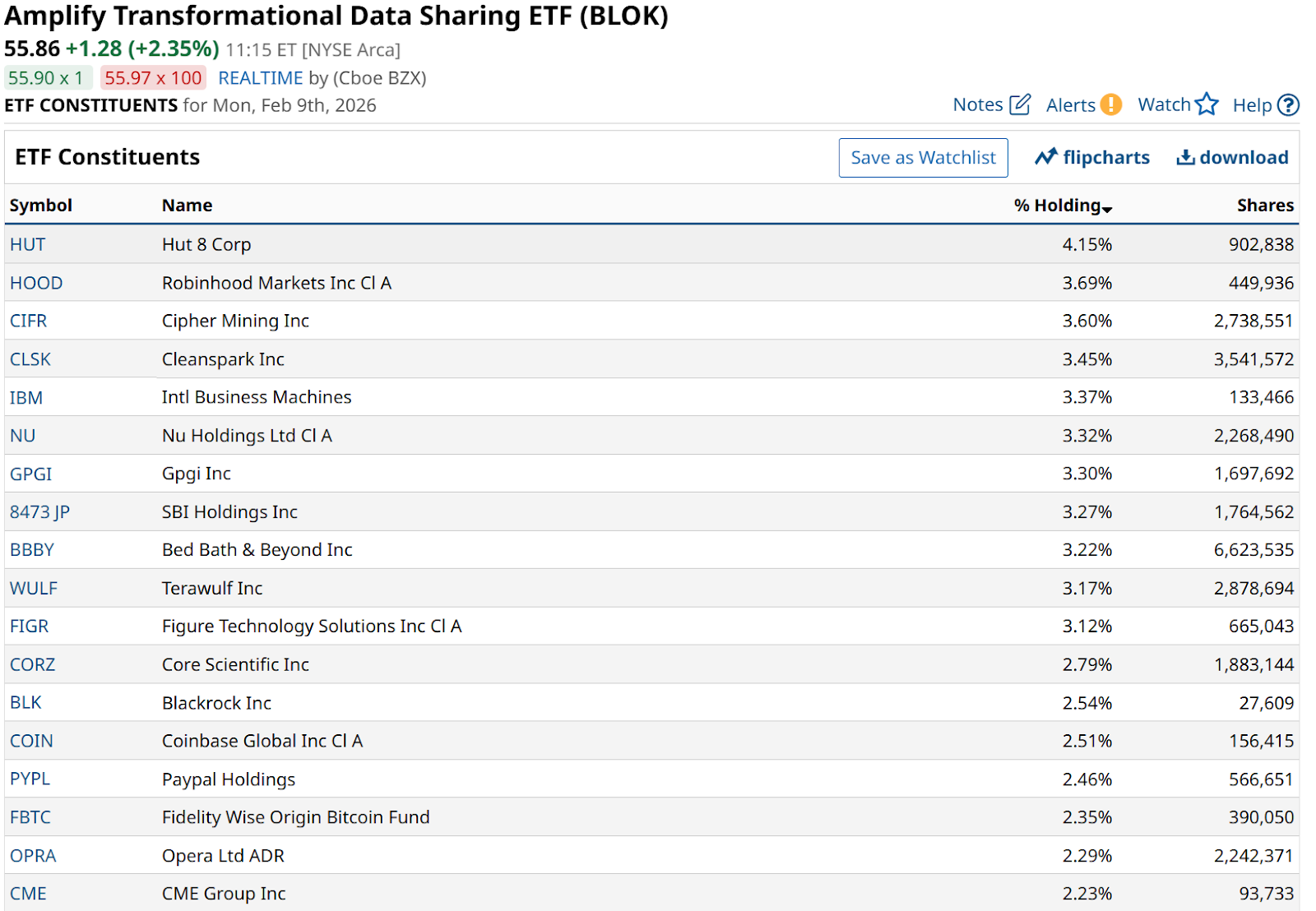

These funds represent a transition from speculation to utility. BLOK, for example, is an actively managed fund that holds a diversified mix of companies. Of its 56 holdings, the top 10 make up only 35% of assets. That’s some needed diversification in a volatile part of the market.

These are firms that generate actual revenue, have balance sheets, and pay employees. Their value is tied to the adoption of blockchain technology — such as transaction security and identity verification — rather than just the daily price swing of a single token.

The Bottom Line

The equity side of the crypto market is going to get more of my attention. BLOK and BKCH are not likely to buck an ongoing Bitcoin decline, but they can outperform it.

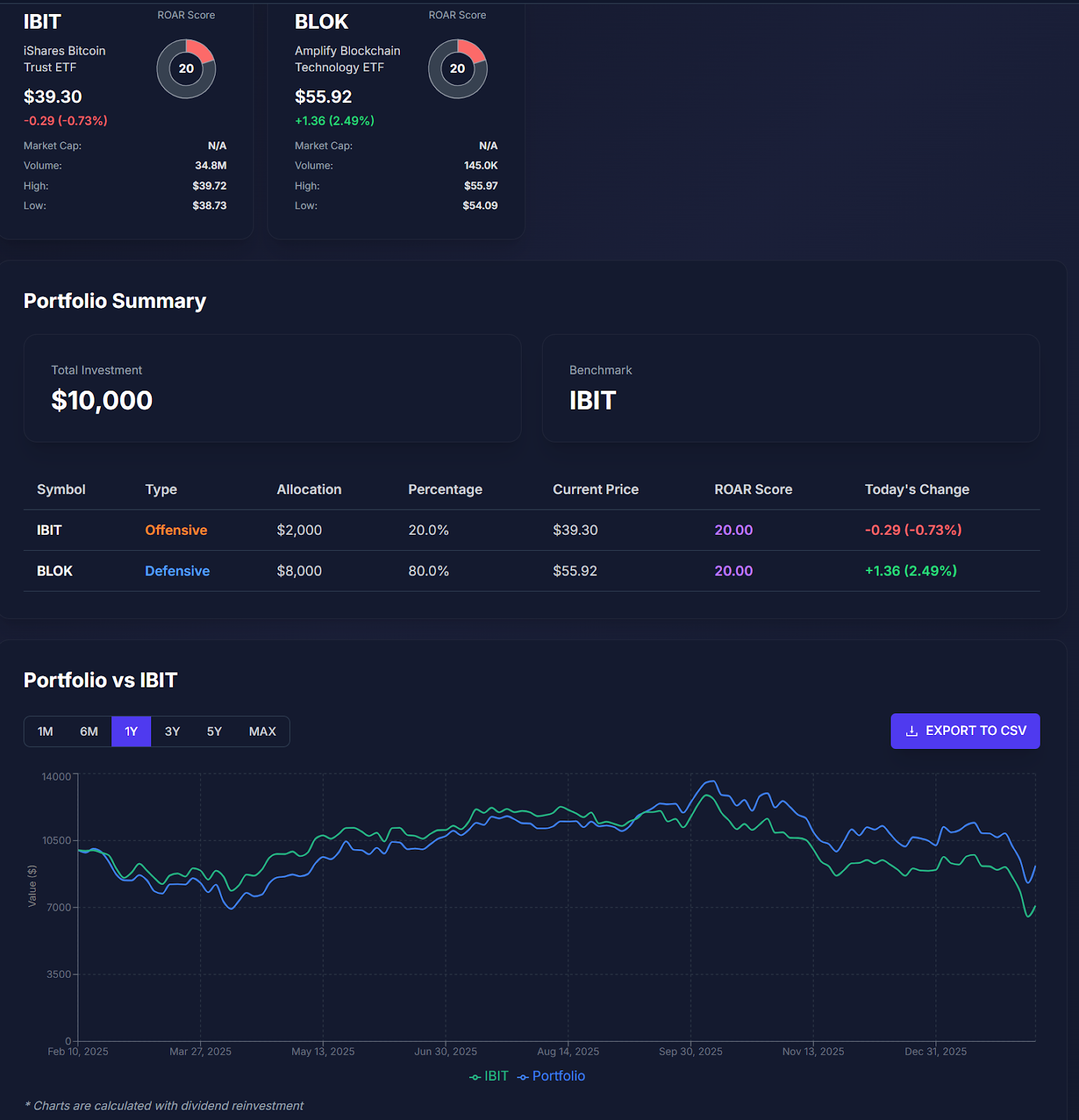

This is actually a great case study for the new ROAR score platform for research and portfolio creation. Below, I took a portfolio that uses just two ETFs, IBIT and BLOK, allocating among them, such that they are both owned at all times, but in a relative allocation governed by my ROAR Score.

Both ETFs have low current ROAR Scores (20), which implies above-average risk. However, if the assumption is that IBIT is the more volatile of the two, and BLOK can be the offset to some of its volatility, the past 12 months would have added significant value, and preserved a lot of capital despite the Bitcoin rout. I ran the portfolio with IBIT alone as the benchmark, to see just how much better one would have done using the ROAR approach to allocate among IBIT and BLOK over this time.

IBIT alone was off 29% in the past 12 months. But the two-ETF portfolio was down only 8%. On $10,000 invested, that’s helpful ($2,100 better off). On a $100,000 portfolio? $21,000 better off.

Risk management matters. And in a market this dicey, especially for crypto, the best reason to manage risk is simple: If you believe in the long-term prospects for crypto, the blockchain or both, staying in the game is the first goal.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. His weekly investor letter can be accessed at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. And, for a change of pace, his new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)