/Amazon%20Box%20Delivery.jpg)

Amazon (AMZN) puts one month out have high premium prices, attracting investors who short them as an income play. This is due to fears about Amazon earnings that will come out later this month.

I discussed this play as being attractive to institutional investors last month when unusual activity in AMZN stock puts highlighted this as an income play. Those $74.00 strike price puts for expiration on Dec. 23, 2022, ended up not being exercised. That made this short put an attractive high-premium play in AMZN stock.

Investors seem to have a lot of fear that AMZN stock could fall once it discloses earnings around the 27th of this month. As a result, put prices well below today's price of $89.12 (Jan. 10 midday) have high premiums.

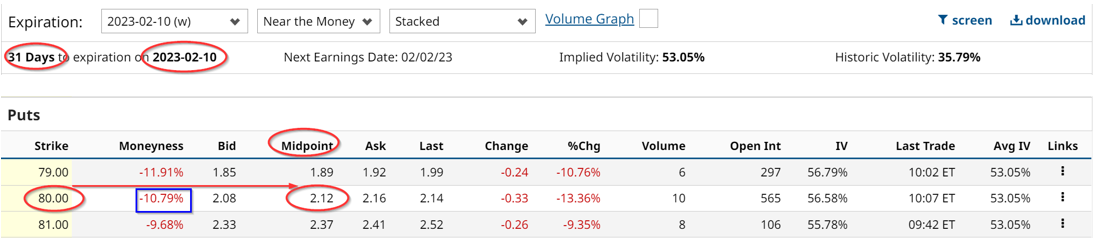

For example, for the Feb. 10, 2023 expiration period, the $80 AMZN puts have a mid-price premium of $2.12 per put option. That means that the investor can earn an immediate yield of 2.65% for a 31-day short put play.

The Barchart option chain above shows that the strike price is at least 10% below today's price. That means that if an investor puts up $8,000 in cash or margin with the brokerage firm, he can “sell to open” a put contract at $80.00 and immediately receive $212.00 in his account. This works out to 2.65% (i.e., $212/$8,000) and in reference to today's price it is a yield of 2.37%. Moreover, if this can be repeated each month for a year the annualized return is 28.5%.

Moreover, the investor has plenty of room for the stock to fall and yet still make a profit. For example, the investor's breakeven price is $77.88 per share (i.e., $80-$2.12). That is 12.6% below today's price of $89.12.

And even if the stock falls to $80.00 the investor gets a deeply discounted entry price into AMZN stock. For example, the investor could then turn around and short out-of-the-money (OTM) calls. This is known as a wheel strategy in the options trading arena.

For example, right now the OTM calls for Feb 10 at the $98 strike price have a $2.22 premium price. The investor could short covered calls today by buying the stock at $89.12 and then “sell to open” calls at $89.00 for $2.22. That represents an immediate yield of 2.49% or 30% on an annualized basis.

This shows that investors are willing to pay high premiums for AMZN stock puts and calls. As a result, they provide good income opportunities to those that want to short deeply out-of-the-money puts and calls for one-month forward expiration. The reason is their concerns about the potential for large changes in Amazon's earnings when they report at the end of this month.

More Stock Market News from Barchart

- Lululemon: It’s Time to Do a Protective/Married Put

- Markets Today: Stocks Fall Back Ahead of Comments from Fed Chair Powell

- How To Find Options Trades This Earnings Season

- Pre-Market Brief: Stocks Mostly Lower As Hawkish Fed Remarks Weigh On Sentiment, Powell Speech In Focus

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)