- Natural gas has lost roughly 65% of its value during the ongoing downtrend since this past August. Late Q1 to early Q2 could see the futures market bottom out.

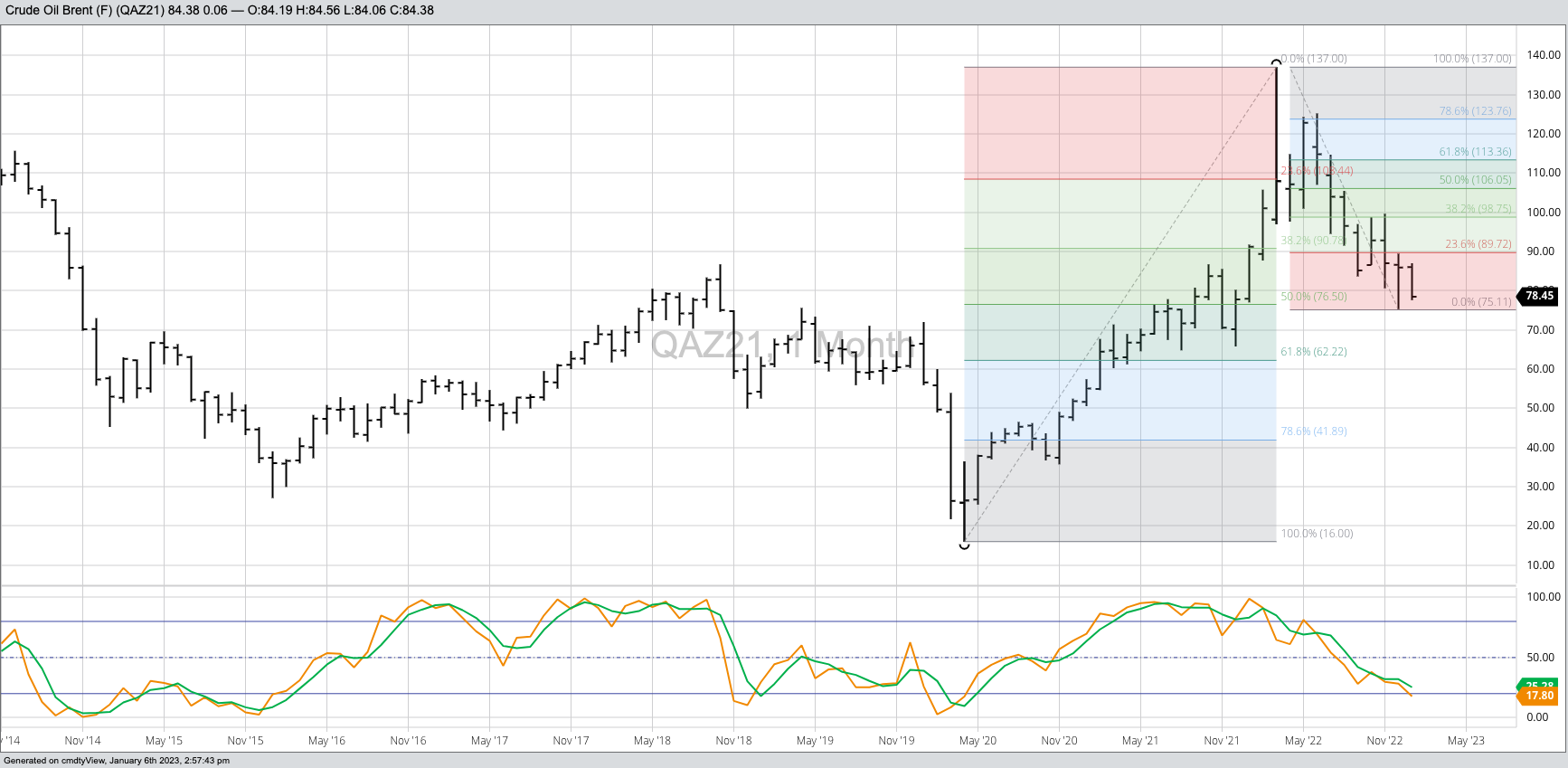

- Brent crude oil has fallen hard, losing roughly $62 per barrel since March 2022, but could also be looking for a bottom over the first-half of 2023.

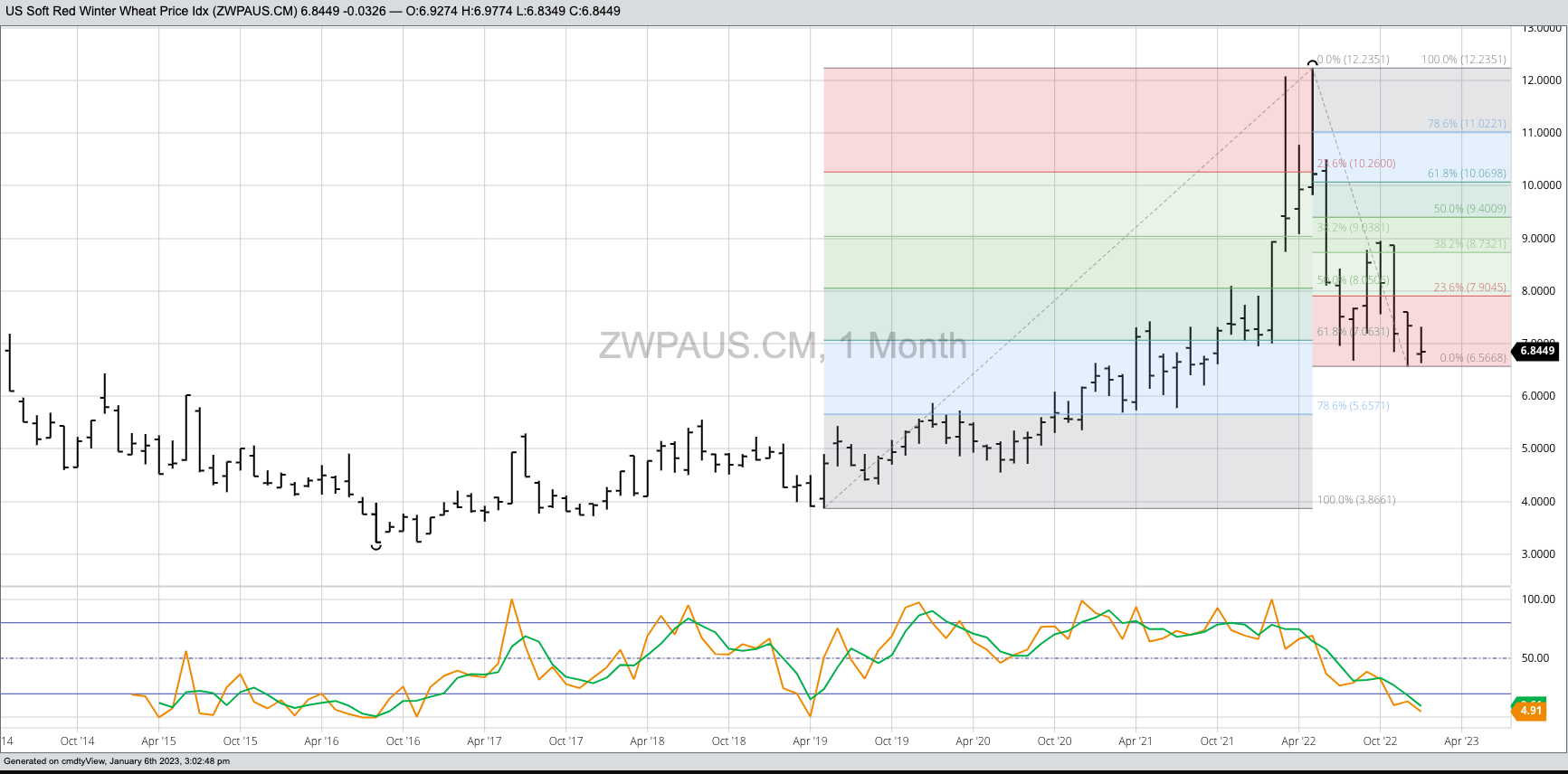

- The US SRW wheat market could be in the spotlight this year after its cash index posted a bullish technical reversal pattern during December.

Earlier this week, my friends at Barchart reposted a CNBC Mad Money piece that included a video of host Jim Cramer looking at charts for crude oil, natural gas, and wheat. The key takeaway from the conversation between Mr. Cramer and the analyst who brought the charts to light was that all three markets could reverse course and move higher again in 2023. The bottom line is these key commodities, representing global fuel and food markets, were indicating reports of inflation’s death was an exaggeration. To be clear, I think the worst has passed, but am also looking for prices to rise again this coming year.

Let’s start with natural gas (NGG23), the famed Widow Maker. The market’s monthly chart shows a clear and dramatic long-term downtrend with the spot-month futures contract falling from an August 2022 high of $10.028 to this month’s low (so far) of $3.52. That’s a 65% drop for those of you keeping score. We’ve also seen liquid gas prices fall around the world due in part to a milder winter in Europe. Back to the futures market: The next pocket of possible support is between $3.40 and $3.30, roughly a78.6% (Fibonacci) retracement of the previous long-term uptrend from $1.44 (June 2020) through this past August’s high. With monthly stochastics nearing the oversold 20% level, I would expect the Widow Maker to make a sudden turn late in Q1 or possible early Q2 2023.

The monthly chart for global Brent crude (QAH23) also shows a long-term downtrend with the spot-month futures contract holding near the target of $76.50. This price marks the 50% retracement level of the previous uptrend from $16.00 (April 2020) through the high of $137.00 (March 2022). However, again note monthly stochastics have not moved below 20% meaning there is time and space to move lower with the next target the 61.8% retracement level near $62.20. Fundamentally the market is not as bullish as it was a few months ago with the first two futures spreads showing a slight contango. This will likely change as demand picks up once the Northern Hemisphere, including Europe, gets through the winter season.

To me, the most intriguing market looking forward into 2023, at least for now, is US Soft Red Winter (SRW) wheat. The monthly chart for the Barchart National SRW Wheat Price Index (ZWPAUS.CM), a weighted national average cash price that I view as the intrinsic value of the market, shows a bullish spike reversal completed during December. This is the type of reversal pattern that usually signals the start of a long-term uptrend. I say usually, because wheat in all its many forms is well known for its technical head fakes. Here, though, we see monthly stochastics already below 20% and in position for a potential bullish crossover. Fundamentally SRW wheat has moved from bearish to knocking on the door of bullish with the carry in Chicago futures slashed as December unfolded. Why? Harvest is rolling in both Australia and Argentina with the former expecting a record crop while the latter looking down the barrel at another year of drought reduced production. Once we get those out of the way, attention will turn to the 2023 winter wheat crops in the US and Europe, the latter including Ukraine.

As Hamlet would say, “Ay, there’s the rub…” The common denominator of these three key markets is the R word economists should be focusing on – Russia. With Putin’s insane invasion of Ukraine nearing its one-year anniversary, the world is looking at another year of disruption in food and fuel supply and demand. It has been interesting to watch the world adjust this past year, particularly in the energy sector, where Europe and its Western Allies have found ways to work around the lack of supplies from Russia. It was a Herculean effort, and at this time seems to be headed in the right direction.

But food is different than fuel, and Ukraine has long been thought of as the Breadbasket of Europe. Traditionally, Ukraine accounted for roughly 10% of global wheat exports with the December USDA estimates bringing 2022-2023 exports in closer to 6%. But that was for the crop planted before Russia invaded, with a limited number of ships navigating a narrow safe passage through the Black Sea to the rest of the world. Reportedly, Ukraine’s 2023 winter wheat crop planted area is down approximately 40%, though I would guess more area than that went unplanted. A look at 2023-2024 marketing year Chicago futures spreads shows only a small carry, meaning commercial traders have long-term concerns over global supply and demand.

To wrap it all up with a nice, neat bow, economists are barking up the wrong tree as they all yap “Recession”. The focus should be on Russia, the latest developments, and how markets continue to evolve to take that country out of the equation.

More Grain News from Barchart

- Cocoa Prices Consolidate Recent Gains

- Sugar Prices Slide as Supply Outlook Improves

- Coffee Prices Fall Back as Invventories Hit 6-Month High

- Coffee Prices Slip on Abundant Supplies

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)