- The March Chicago wheat contract has posted a decent rally the last couple weeks, hinting at noncommercial short-covering activity.

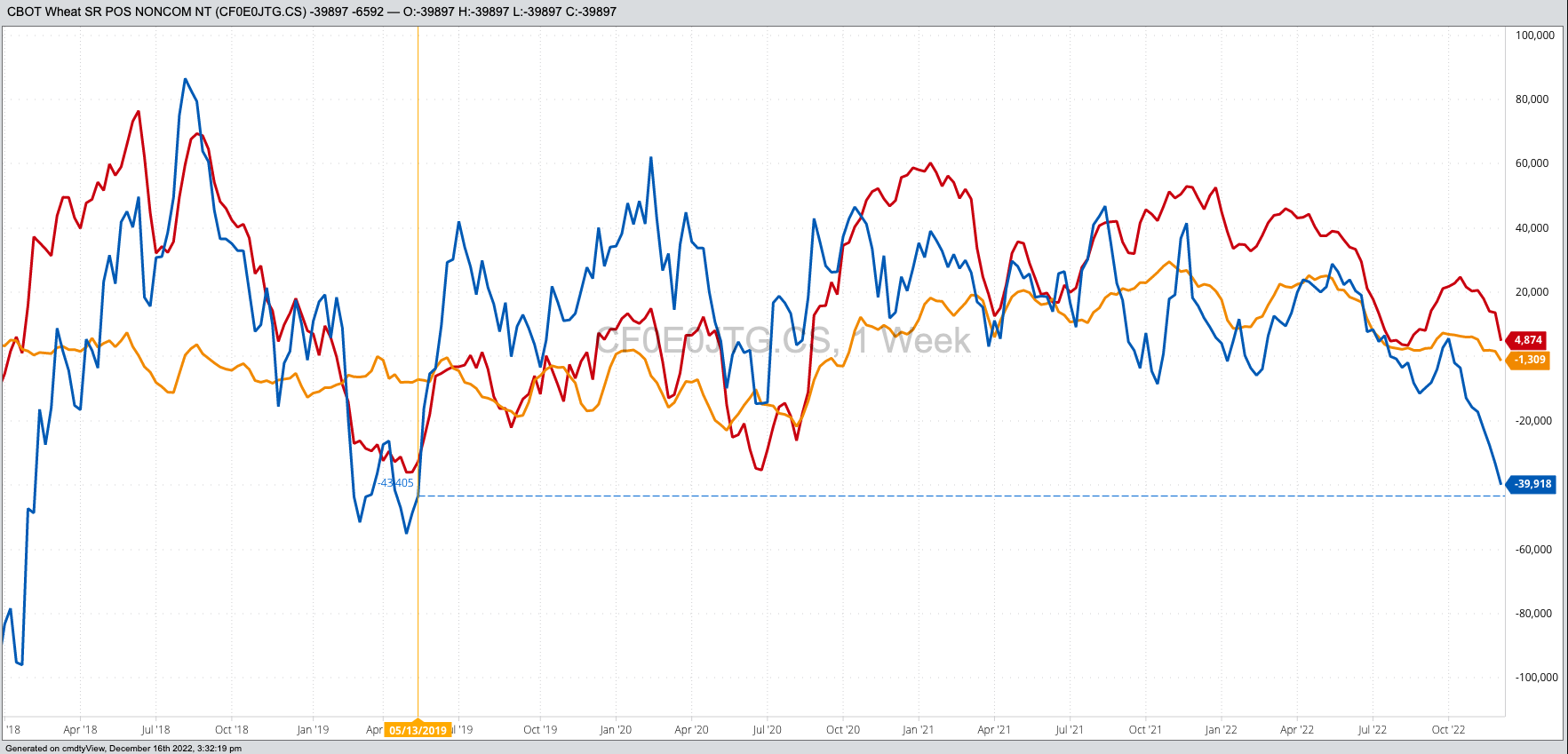

- However, the latest CFTC Commitments of Traders report (legacy, futures only) showed this not to be the case as noncommercial traders increased their net-short futures holdings.

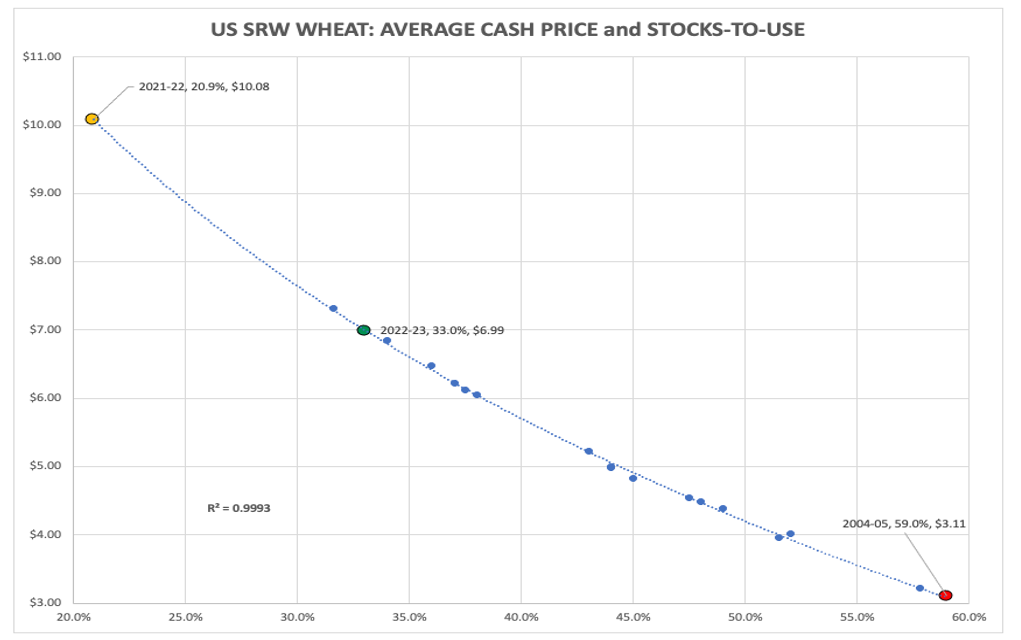

- To make things more complicated, SRW market fundamentals are a mixed bag with bottom line available stocks-to-use growing more bearish.

Feel free to pour yourself a nice wheated bourbon or a refreshing wheat beer as we take a look at the complicated Chicago (SRW) wheat market Friday afternoon. I say complicated because nothing about the Chicago market makes much sense these days, from a technical standpoint or fundamental view. Both were heavily debated this past week, not overly surprising given the time of year and little else to do in the wheat sector in general. Given this I’ll start with my conclusion, Newsom’s Rule #5 tells us “It’s the what, not the why”. But what is the ‘what’?

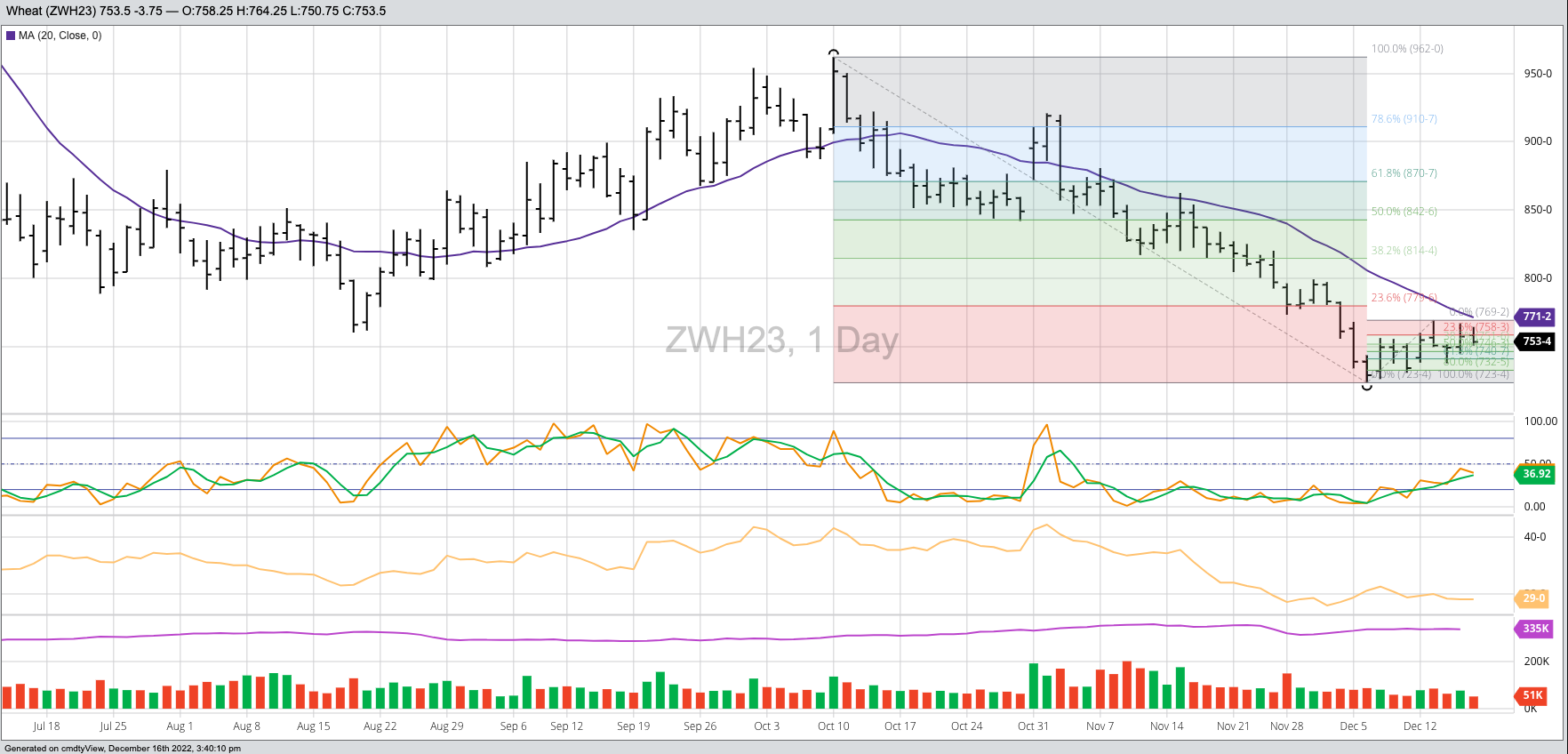

Let start with the technical picture for the March Chicago contract (ZWH23). When I talk about technical analysis I’m referring to trend, or price direction over time. Newsom’s Rule #1 tells us to not get crossways with the trend. Why? Because noncommercial traders tend to set price direction and few of us have enough cash to fight this group for a long period of time. If we look at March wheat’s daily chart, the contract posted a recent low on Tuesday, December 6 of $7.2350 before rallying to a high of $7.6925 on Tuesday, December 13. These days line up with CFTC’s Commitments of Traders reports (legacy, futures only), implying noncommercial traders were covering some of their net-short futures position. However, the most recent numbers show this group actually increased their net-short futures position by 21 contracts for the week (solid blue line), pushing it to 39,918 contracts.

Given markets only have two sides, and noncommercial traders weren’t buying, then it stands to reason the commercial side provide much of the support. However, if we compare closes by the March-May futures spread from Tuesday to Tuesday we see the carry was only trimmed by 0.5 cent, moving the needle of calculated full commercial carry (cfcc) from 61% on December 6 to 57% on December 13. The bottom line is fundamentals remained neutral.

What about the cash market? At the end of November, the cash index was calculated at $7.36, correlating to an available stocks-to-use of 31.3%, the most bearish reading of the major markets in the grain and oilseed sector. Midway through December, I’m projecting the index to come in at about $6.99 Friday evening. If so, it would correlate to available stocks-to-use of 33% meaning instead of tightening, SRW supply and demand continues to loosen. None of this sounds like strong commercial buying is taking place, though I will add that at Friday’s close the carry in the March-May futures spread had been cut 7.5% and covering 42% cfcc. This means the debate will continue for another week.

What comes next? For whatever reason, the short-term trend on March’s daily chart remains up. Someone pointed out the 20-day moving average is getting closer to the market, calculated this past Friday near $7.7125 as compared to the session high of $7.6425. The argument is a move above this technical indicator could trigger actual noncommercial buying. I’m not a huge fan of moving averages but will concede a number of trading algorithms have some form of them calculated into their equations. And as discussed, there is plenty of ammunition available if noncommercial traders do start to cover short positions. Given this, the upside target area between $8.1450 and $8.4275 seems possible, with probable a different question all together.

Lastly, there was also talk about possible winter kill. A few notes on one of my favorite subjects:

- It’s winter, and winter wheat is in dormancy. The math isn’t all that hard.

- If we do want to discuss winter kill, it’s a new-crop issue meaning it would be traded in new-crop July contracts rather than old-crop March.

- Most of the problem would be in the Kansas City (HRW) market rather than SRW.

The best part of this season is the adult beverage drinking game we can play with the subject. Take a shot of that wheated bourbon or chug another of those wheat beers each time someone mentions “winter kill”.

More Grain News from Barchart

- Cocoa Prices Slide on Signs of Ample Supplies

- Sugar Prices Underpinned by Production Concerns in India and Thailand

- Coffee Prices Fall Sharply on Abundant U.S. Coffee Supplies

- Friday Wheat Weakening

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)