- Boxed beef and Beyond Meat have been moving in opposite directions, most notably the last quarter of 2022.

- Strong demand for beef continues to act as a bullish US economic indicator as consumers are willing to allocate some discretionary spending despite high prices.

- Beyond Meat's stock price has extended its long-term downtrend and is showing no sign of changing directions at this time.

I must have had Charles Dickens on my mind as I sat down to write this piece on meat markets. Given the incredible divergence between the paths of the US boxed beef market and the company Beyond Meat, I immediately thought of the opening to A Tale of Two Cities (It was the best of times, it was the worst of times…and much, much more)[i]. But how to explain the incredible increase in the price of boxed beef? The easiest way would be to call upon the spirits of holidays past, as was the case in “A Christmas Carol”, most notably John Harrington and Walt Hackney with a little help from Jack Daniels (ala Christmas Vacation). On the other hand, the best description I can come up with for Beyond Meat is “Great Expectations”, where all does not go as planned for the main character.

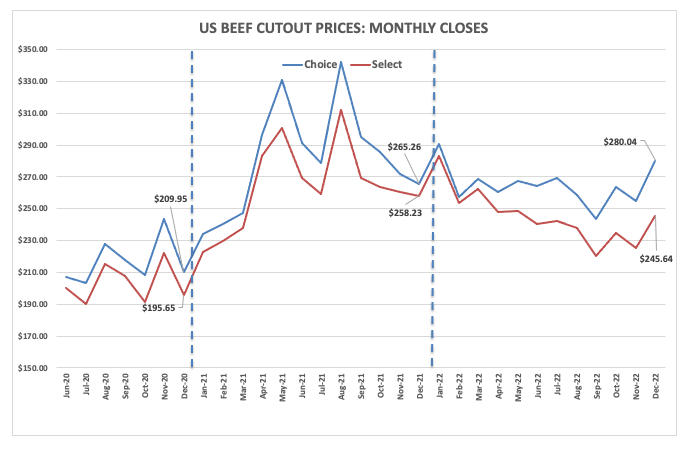

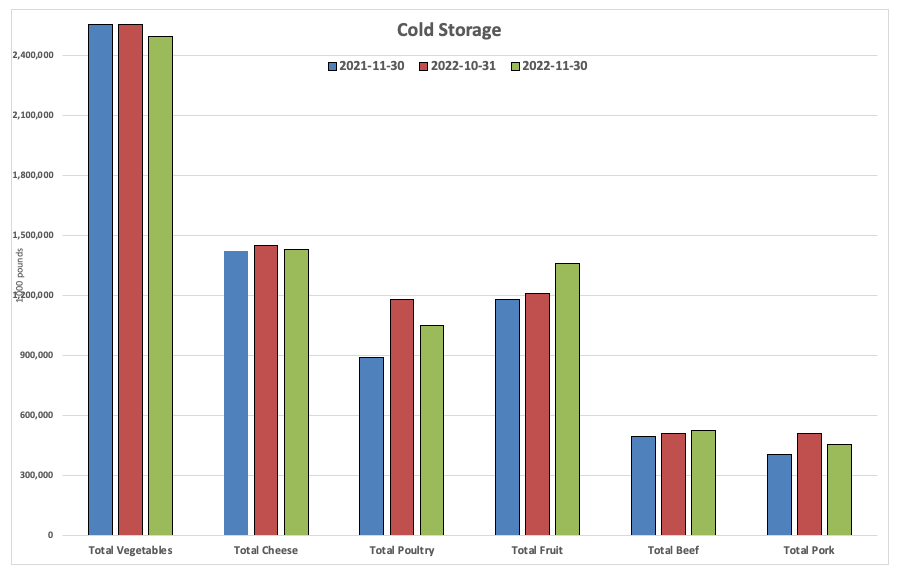

Tuesday afternoon, USDA released its boxed beef prices and let’s just say some of the numbers were astounding. Choice came in at $280.04, up $8.09 for the day and putting the market at its highest mark since February 3, 2022. But that’s just the beginning, for this was the third $8-plus daily gain registered during December, the accumulation being a monthly increase in market price of $25.16 (with three days remaining) and catapulting the yearly gain to $14.78. This also tells us what we can expect in the next Cold Storage report set for release on January 25, 2023. The most recent set of numbers for the end of November showed an increase in total beef stocks of 2% from the previous month and 6% from the previous year. This coincided with a downturn in boxed beef of $8.77 for choice and $9.45 for select. Given this month’s rally in price, I’m looking for beef stocks to decrease next time around.

In the past I’ve also talked about how we can use the boxed beef market as a US economic indicator. Despite some of the highest prices seen in over a year, consumers are still willing to allocate some of their discretionary spending to buying beef. This is not a sign of a bearish economy, one where everyone penny earned is allocated to covering the cost of necessities such as mortgage, rent, fuel, etc. What makes this even more interesting is the fact select has not kept up with choice, though still showing a gain of $20.63 for the month but a $12.59 loss for the year.

Beyond Meat (BYND) is a clear case of unfulfilled Great Expectations. It has been a while since I’ve talked about the collapse of this company’s stock in this space, with the most recent piece the second part of two posted on October 26, 2021. The stock has extended the long-term downtrend on its monthly close only chart to $11.46 this month, and as of this writing is showing the path of least resistance remains down. On my website this past July I asked the question of when investors might get interested in the company again. I had to chuckle as I researched this piece, for a number of different soothsayers have BYND on their list of of “Stocks to Watch in 2023”. We’ll see. For now the first thing that comes to mind is the famous line from Oliver Twist (yes, another Dickens tale) when Oliver, desperate with hunger and reckless with misery said, “Please, sir, I want some more.”

[i]The comparisons laid out by Dickens in the open amount to nearly 200 words and include the age, the epoch, the season, hope and despair, everything and nothing, Heaven and the other way, and nearly anything else you can imagine.

More Livestock News from Barchart

- Hogs to Follow Tuesday Gains

- Dec Cattle Sticks to Cash Trade

- Feb Hogs Rally on Hogs and Pigs Report

- Cattle Close Mostly Lower on Monday

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)