/Phone%20and%20computer%20internet%20network.jpg)

Corning Inc. (GLW), is a glass company that produces stable revenue and cash flow by making LCDs and LEDs used in TVs and computers. Its stock is now trading well below its historical dividend yield and P/E multiples. That makes it attractive to value investors. In addition, shorting the put options for GLW stock is a good income play.

GLW stock is off just below 15% year-to-date (YTD) but has been inching up lately to $31.80 as of midday Dec. 27. The company has paid a 27 cents quarterly dividend for the past 4 quarters and is likely to increase the dividend when it reports its Q4 results next month. This is because it has raised its dividend consistently each year for the past 12 years, according to Seeking Alpha.

Dividend Yield Historical Metrics

So, at today's price, GLW stock has a 3.39% dividend yield, (i.e., $1.08 dividend/$31.80). Assuming it raised the quarterly dividend by 7.5% to 29 cents, the annual dividend will be $1.16, and its yield rises to about 3.65%.

This is well below its historical 5-year average yield of 2.59%, according to Morningstar.com. Therefore, assuming the stock rises to this historical yield, the price target is $44.79 per share (i.e., $1.16/.0259 = $44.79). As a result, just to get to the average yield it has had in the past 5 years, GLW stock could rise over 40.8%.

P/E Historical Metrics

The same method applies to its historical price-to-earnings (P/E) metrics. Right now, 6 analysts surveyed by Barchart forecast that earnings per share (EPS) will rise by over 8% from $2.06 this year to $2.23 in 2023. That put GLW stock on a forward P/E multiple of just 14.28 times earnings (i.e., $31.80/$2.23).

But this is also well below the historical 5-year average P/E multiple. Morningstar says that the average has been 17.08x. So, applying this to the 2023 EPS estimate we get a target price of $38.09 per share (i.e., $2.23 x 17.08).

This implies GLW stock could rise 19.8% from $31.80 to $38.09. In fact, the average of both the dividend yield and P/E target prices is $41.44 per share. That assumes the stock rises to its average of both the dividend yield and P/E historical metrics. This means value investors expect to make almost $10 investing in GLW stock today, or about 30%.

This also makes it attractive to investors who short its put and call options to generate extra income.

Shorting GLW Stock Puts and Calls for Income

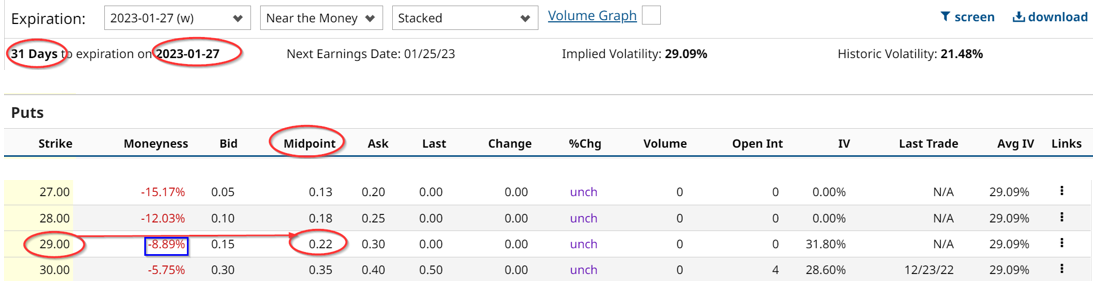

For example, the Jan 27 put option chain at Barchart shows that the $29.00 strike price puts sell for 22 cents. That results in an immediate return of 0.7586%. This also works out to an annualized yield of 9.1% if it can be repeated each month for a year.

This means that the investor puts up $2,900 in cash or margin and receives $22 when doing a “sell to open” for the $29.00 put. GLW stock will have to fall almost 9% before they will have to buy the stock at $29.00 per share by Jan. 27. Moreover, at that price the yield will be higher and the P/E lower, so it is an attractive entry point.

In addition, the Jan. 27 calls show that the $35.00 strike price calls trade for $0.13 per call option contract. That works out to an annualized yield of 4.90%. This is on top of the existing dividend yield of 3.39%, which is also likely to rise as we pointed out above.

The bottom line here is that Corning stock is attractive to value investors, both from a historical metric standpoint and also using options to create income.

More Stock Market News from Barchart

- Higher Bond Yields Weigh on Tech Stocks

- Southwest Airlines Flight Cancellations a Big Red Flag for LUV Stock

- S&P Futures: Income or Wealth Generating Asset?

- Markets Today: Stocks Mixed as China Reopens Borders and Ends Travel Restrictions

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)