/Bank%20Of%20New%20York%20Mellon%20Corp%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Valued at $89 billion by market cap, Bank of New York Mellon Corporation (BK) is a major American financial services and investment company headquartered in New York City. Established in its current form in 2007 through the merger of The Bank of New York (founded 1784) and Mellon Financial Corporation (founded 1870), it traces its roots back to one of the oldest banking institutions in the United States.

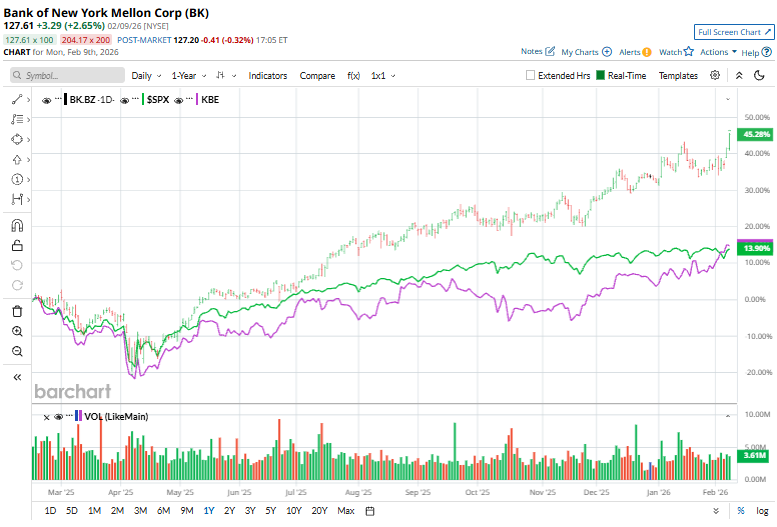

The banking giant has significantly outpaced the broader market over the past year. BNY stock has soared 48.1% over the past 52 weeks and 9.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 15.6% gains over the past year and 1.7% returns on a YTD basis.

Narrowing the focus, BNY has also outperformed the industry-focused SPDR S&P Bank ETF’s (KBE) 13.5% rise over the past year.

On Jan. 13, BNY shares rose 1.9% after the company released its fiscal 2025 fourth-quarter earnings. The firm reported total revenue of about $5.18 billion, up roughly 7% year over year, driven by higher net interest income and fee revenue that reflected continued client activity and asset growth. Adjusted earnings per share came in at approximately $2.08, surpassing consensus expectations. On a profitability and scale basis, BNY Mellon oversaw about $59.3 trillion in assets under custody and administration and $2.2 trillion in assets under management at quarter-end, reinforcing its position as the world’s largest custodian bank.

For the current year ending in December, analysts expect BNY to deliver an adjusted EPS of $8.32, up 10.9% year over year. The company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

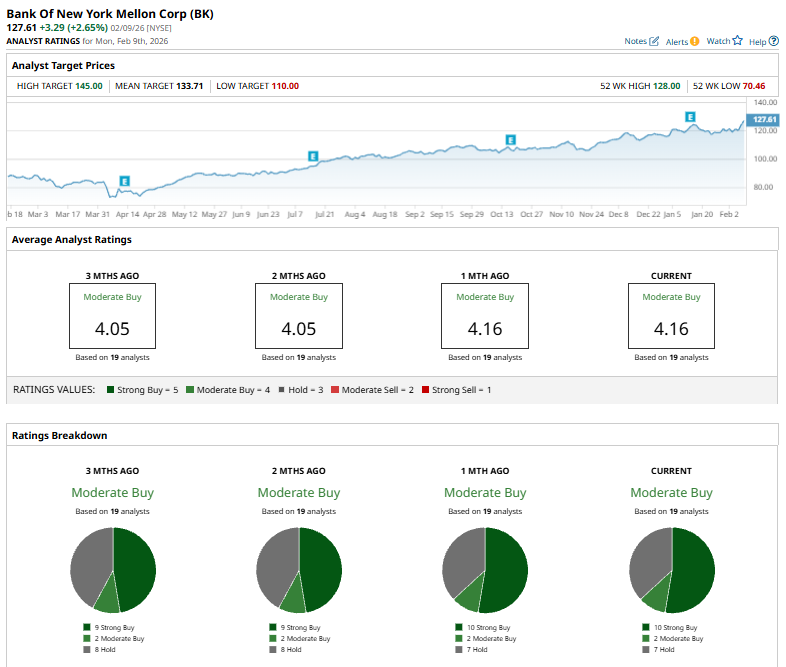

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on ten “Strong Buys,” two “Moderate Buys,” and seven “Holds.”

This configuration is slightly more optimistic than two months ago, when only nine analysts gave “Strong Buy” recommendations.

On Jan. 14, Emily Ericksen of Citigroup reaffirmed a “Neutral” rating on Bank of New York Mellon Corporation while raising her price target to $136 from $120, reflecting improved confidence in the company’s earnings outlook.

BNY’s mean price target of $133.71 represents a modest 4.8% premium to current price levels. The Street-high target of $145 implies an upswing potential of 13.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.