Intel (INTC) stock has a sizeable unusual call options activity attracting value buyers. This is based on the Barchart Unusual Stock Options report for Dec. 20. Value investors believe Intel Corp will likely raise its dividend next month. In addition, the dividend yield for INTC stock is significantly above its 5-year average.

That implies that the stock will rise significantly from its current depressed price, thereby lowering its dividend yield. For example, on Dec. 20, INTC stock closed at $26.44, down over 50% year-to-date (YTD). Moreover, in the last month alone the stock is off 10.6%.

Dividend Yield Value Metrics

This puts it in value territory. For example, the annual $1.46 dividend gives the stock an annual dividend yield of 5.52%. That is significantly above its 5-year average yield of 2.68%, according to Morningstar.com. Even Seeking Alpha says the average dividend yield in the last 4 years has been 2.79%.

Therefore, if we divide the $1.46 dividend by 2.79%, the target price for INTC stock is $52.33 per share, or 98% over today's price. That implies that the stock should double from here if it were to trade at its average yield over the last 4 years.

Moreover, Intel has paid 36.5 cents per quarter for the last four quarters. It is likely to raise the dividend again in January, as it has done every year in the past 8 years, according to Seeking Alpha. If we assume the dividend rises to 38 cents quarterly or $1.52 annually, the dividend yield will rise to 5.75% from today's 5.52%.

So, even if the stock were to rise to a 4.50% yield, the stock price is worth $33.78. This is 27.7% over today's price and implies the stock is likely to rise. No wonder, then, INTC stock has a large volume of call options recently.

Unusual Call Options Volume in INTC Stock

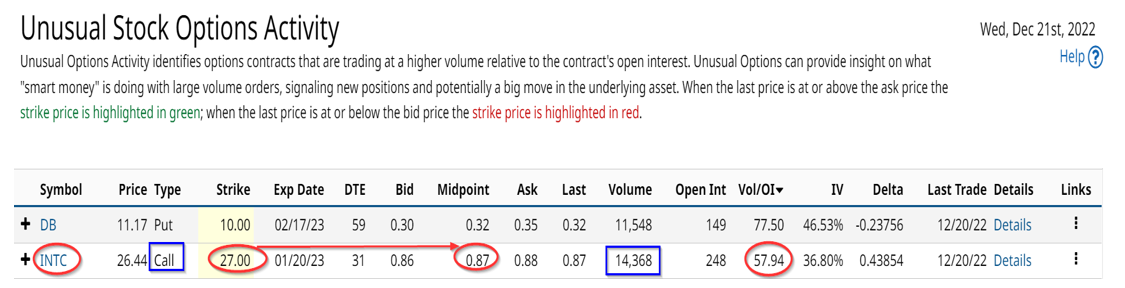

The Barchart Unusual Stock Options Report for Dec. 20 shows that there were 14,368 call options purchased at the $27 strike price for the Jan. 20, 2023, expiration period. The report also shows that the institutional investors paid 87 cents at the midpoint for these calls.

In other words, their breakeven price is $27.87 per share, which is only 5.4% over today's price of $26.44 per share. Given that the company is likely to raise its dividend by Jan. 20, 2023, the stock could easily rise significantly over $27.87 by then.

And don't forget that we showed that INTC stock is near its lows in terms of selling at a price well over its average dividend yield. This is likely what the investor who paid $1.25 million for these calls at the $27.00 strike price (i.e., $0.87 x 14,368 x 100 = $1.25 million).

This amount of call options is 58 times the existing open interest in the $27.00 strike price call options. That shows that there is a huge conviction in this investment. Given that the calls are very close to the present price, they stand to make a significant amount of money.

For example, if the stock rises to $33.78, our target price above, assuming the yield improves to 4.5% and the dividend rises to $1.52 annually, the calls will be worth $6.78 on the close on Jan. 20 (i.e., $33.78-27.00 = $6.78). Given that the investor paid 87 cents for the call options, their return will be a profit of 679% in just one month.

In fact, even if the stock rises to just $30.00 per share by Jan. 20, the investor's return will be 245% (i.e., ($30-$27)/$0.87 -1 = 2.45). That is why call options in INTC stock are attracting value investors. However, there is a risk that INTC stock does not rise above $27.87 per share by Jan. 20, which is the breakeven price. Investors in INTC calls have to take this risk into consideration.

More Stock Market News from Barchart

- Iron Condor Screener Results For December 21st

- Stocks Settle Mixed as Energy Stocks Gain while Tech Stocks Slip

- Spotify's Options Have High Premiums Perfect for a Jade Lizard Options Strategy

- Unusual Options Activity May Suggest Big 5 Sporting Goods (BGFV) Lacks ‘Firepower’

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)