/Amazon%20Holiday%20delivery.jpg)

Amazon (AMZN) stock has fallen 50% in the last 6 months making it attractive to value investors. They are looking to short out-of-the-money (OTM) puts in AMZN stock as their premiums are high.

At $85.40 on Dec. 19, AMZN stock is now off over 8.2% in the last month and 50% in the last 6 months. Investors seem to be concerned that online shopping is falling this year. During the last quarter, the company reported higher sales but lower operating income.

More concerning though is the company's negative free cash flow (FCF). Last quarter its FCF fell to an outflow of $19.7 billion (i.e., negative FCF) in the last 12 months. This compares to n inflow of $2.7 billion in the prior period.

However, energy prices and shipping costs are likely to have ameliorated since the last time it reported its results. That should give investors some hope that its FCF can turn around.

But, so far, investors are not willing to believe this. As a result, its put option premiums have been rising. Contrarian investors want to take advantage of this by shorting OTM puts to create income.

Shorting OTM AMZN Puts For Income

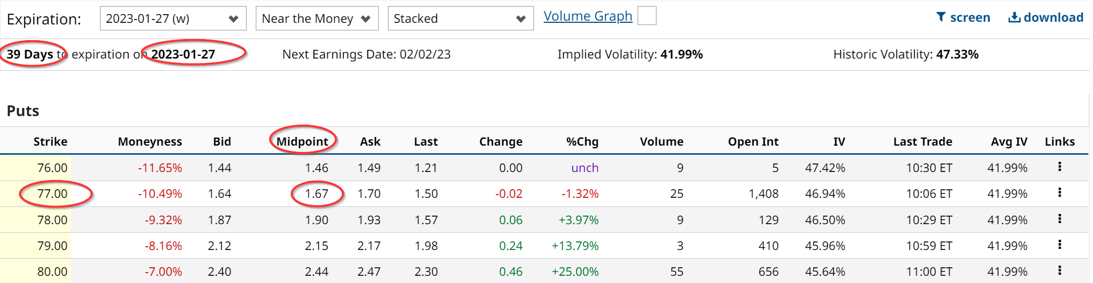

Right now the Jan. 27 put options for AMZN stock trade for $1.67 per put option contract at the $77.00 strike price. That assumes that the stock will fall 10.5% from $85.40 to $77.00 by Jan. 27. If it doesn't then the investor who shorts those puts gets to keep the $1.67 and not have to buy shares at $77.00 per share.

This also means that the short put investor immediately receives $167 after selling the $77.00 put contract and securing $7,700 in cash or margin with his or her brokerage firm. That works out to an immediate yield of 2.17% (i.e., $167/$7,700). That also represents an annualized return of 26% assuming the transaction can be repeated each month for a year.

The investor also may have to buy shares in AMZN at $77.00 per share if the stock falls to that level or lower by the close of Jan. 27. But that allows them to immediately sell covered calls at higher prices. In addition, unless AMZN stock falls below $75.33 or $10 below today's price, they will not actually lose any money. That is because after subtracting the $1.67 in premiums already received from shorting the puts from $77.00, the breakeven price is $75.33.

However, if AMZN stock rises, the investor does not gain any unrealized capital gain. Given that most investors seem to think that AMZN stock will keep falling, that may not be a big risk to most short-put investors.

The bottom line is shorting deep OTM short puts in AMZN stock is a way to make extra income for value investors.

More Stock Market News from Barchart

- New EU Crack Down on Meta Platforms

- Weakness in Chip Stocks Weighs on Tech Stocks

- Markets Today: Stocks Continue Their Downward Trend

- Option Volatility And Earnings Report For December 19 - 23

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)