Domino's Pizza (DPZ) stock is still a bargain after Thanksgiving with cash-secured short put options and short covered call options income plays. Those shorted around Thanksgiving have done well, as I discussed in my article on Nov. 18: “Domino's Pizza Stock Looks Like a Bargain During Thanksgiving.”

In that article, I suggested that the $400 strike price calls could be shorted on a covered call basis for a premium of $2.65 per call contract. At the time, DPZ stock was at $366.73 per share. Today, Dec. 12, DPZ stock is very close to that price at $363.35. The call option strike price at $400 was 9.07% over the price at the time.

Today, the $400 strike price for one month out on Jan. 13 trades for $2.25 per call option, slightly lower than the prior call option premium. But it still means that the investor can now roll over his short call option from last month (now in a significant profit as it has no intrinsic value) to the next 30-day period.

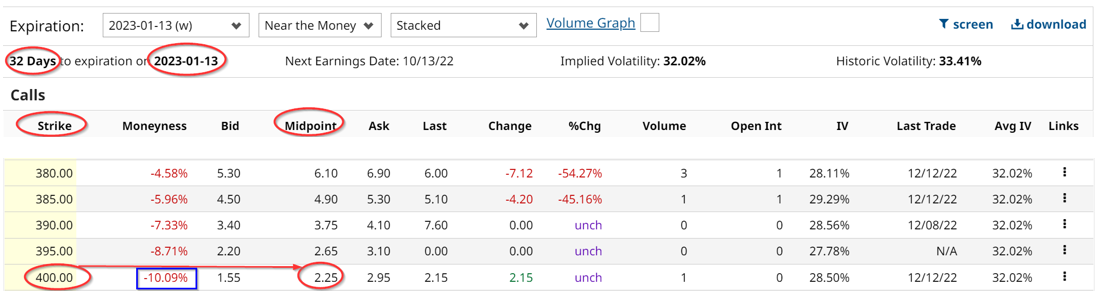

Here is how the DPZ call option chain for Jan. 13 looks.

It shows that an investor with 100 shares of DPZ worth $36,335 (100 x $363.35 price today) can sell covered call options at $400 per share and receive $225. That represents an immediate yield of 0.619% or 7.43% on an annualized basis. Moreover, the strike price is 10% over today's price, so the possibility of unrealized gains is also possible.

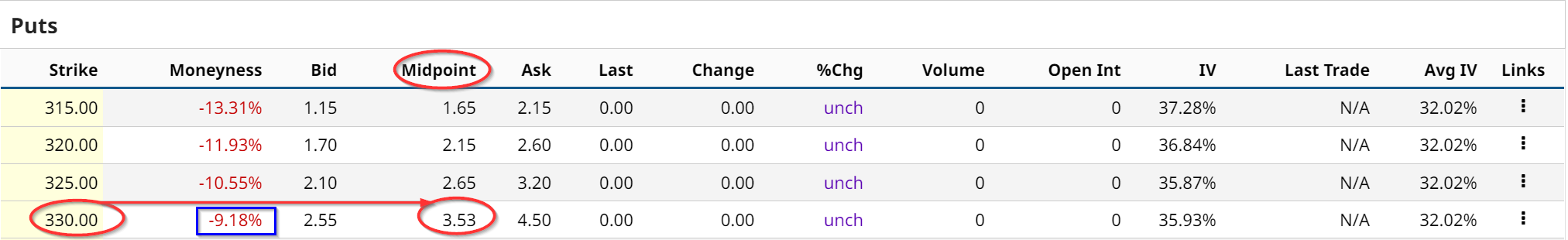

In addition, the stock has attractive short put option income plays. For example, in the last article on Domino's Pizza, I suggested shorting the $330 strike price for a premium of $3.05. Since the stock is nowhere near $330 now and the shorted puts from last month will expire this Friday worthless, giving the investor a very good profit. He can now turn around and short the Jan. 13 puts at $330 for Jan. 13 at a premium of $3.53 per put contract.

That means that the investor who puts up $33,000 in cash and/or margin with his brokerage firm, can then “Sell to Open” a put contract at $330 per share and immediately receive $353 in his account. That represents an immediate yield of 1.069%. This also works out to an annualized ROI of 12.83% if this short put exercise can be repeated each month.

Keep in mind that an investor will have to close out their existing short calls and puts before rolling over and doing these new out-of-the-money short-option plays. Often it is better to do this right before the present positions expire worthless. This allows the investor to make short calls and puts for the next month and prevents the possibility of problems should the stock unexpectedly move at the end of the expiration period.

However, the cash-secured short-put investor cannot make a capital gain. So, sometimes investors do both a covered call and a cash-secured put at the same time. This requires more capital but it also maximizes potential income opportunities.

The bottom line here is that DPZ has an attractive long-term investment outlook and short-term options and income opportunities.

More Stock Market News from Barchart

- Stocks Rally Ahead of Tuesday’s CPI Report

- Unusual Stock Options Volume Is Just What China’s Economy Needed

- Longer-Term Technical Indicators Remain Bearish on the Nasdaq

- Stocks Receive a Boost from M&A Activity

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)