Domino's Pizza (DPZ) stock looks like a bargain, given its solid Q3 earnings reports for the quarter ending Sept. 11 showing 2% comp sales and upgraded guidance for the year to December 11. With its 1.2% dividend yield, low P/E multiple of just 25x, and solid growth, option income plays with DPZ stock look very attractive now.

So far this year DPZ has fallen over one-third to $366.73 as of Thursday, Nov. 17. But in the last month, the stock has actually risen over 12.9%, partly on hopes that its solid fiscal Q3 results will carry over to fiscal Q4.

Good Earnings and Dividends

Domino's latest quarterly earnings report shows that the company made a 2% gain in same-store sales. In addition, the company posted a 4.7% gain in year-over-year (YoY) sales worldwide during its latest quarter. The company said it delivered one of three pizzas during the pandemic.

However, the diluted EPS (earnings per share) for the third quarter of 2022 was $2.79, a decrease of 13.9% from the diluted EPS of $3.24 in the third quarter of 2021. Nevertheless, the company was still able to pay a $1.10 dividend per share for the quarter, making it the 4th quarterly payment in the last year. This implies that the company will likely raise the dividend going forward. In the past 8 years, it consistently raised its dividend annually.

Right now, with its $4.40 annual dividend, the yield is 1.12%. If the dividend rises 10% to $4.80 next quarter, the yield rises to 1.31%. This is well above its average yield of 0.87% in the past 4 years.

As a result, if the dividend rises to $4.80 next quarter, the stock price target rises to $551.72 per share using a 0.87% dividend yield. That is seen by dividing $4.80 by 0.0087. This represents a potential upside of 50.4% from here (i.e., $551.72/$366.72-1).

Moreover, analysts forecast EPS will rise 17% next year to $14.26 per share, up from $12.16 this year. This puts the stock on a forward P/E multiple of just 25x. That also makes the stock look cheap.

Options Income Plays Look Attractive

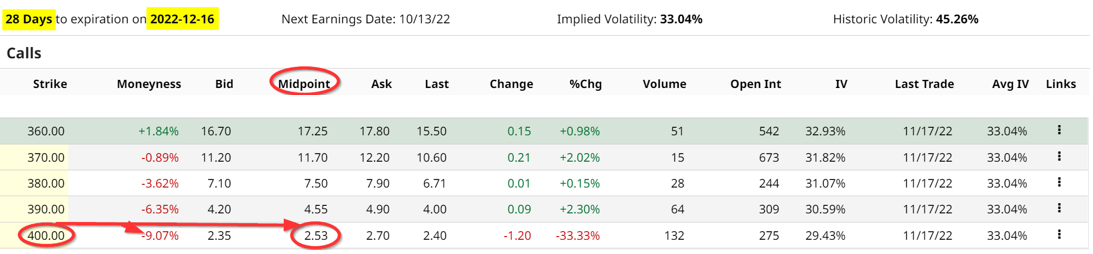

Call options for the period ending Dec. 16, which is 26 days from now, offer attractive covered call opportunities. For example, the $400 strike price, which is 9.07% over today's price, are priced at $2.53 per call option.

That implies that the covered call investor can make 0.69% in less than 1 month (i.e., $2.53/$366.72) for an annualized yield return of 8.28%. Moreover, if DPZ stock rises to $400 or higher by or before Dec. 16, the covered call investor gets to keep the 9.07% capital gain.

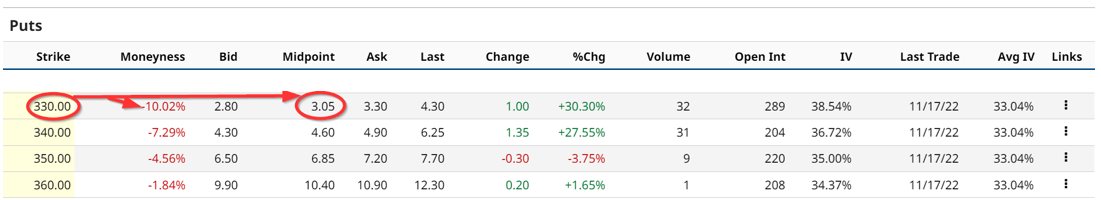

In addition, an investor can sell cash-secured puts that are out-of-the-money (OTM), such as at $330 per share. This is 10% below today's price.

The premium received by shorting cash-secured puts at the $330 strike price is even higher at $3.05 per share or 0.92% on the $330 strike price. This means that the investor puts up $33,000 with the brokerage firm to cover the potential purchase of 100 shares from shorting 1 put contract at $330. In return, the investor receives $305 for the short put contract. So $305/$33,000 investment works out to 0.92% for the cash-secured put investor.

This works out to an annualized ROI of over 11.0%, which is better than the 8.28% annual ROI with the covered call returns. However, the cash-secured short put investor cannot make a capital gain as the covered call investor can. That is why sometimes investors do both a covered call and cash-secured put for the stock expiration period, in order to maximize potential income opportunities.

The bottom line here is that DPZ has an attractive long-term investment outlook and short-term options and income opportunities.

By the way, Domino's is now offering a 50% discount on all their pizzas through Sunday, Nov. 20. We have shown the company can certainly afford it. It's also another opportunity to enjoy Domino's Pizza.

More Stock Market News from Barchart

- Stocks Close Moderately Lower as Hawkish Fed Comments Boost Bond Yields

- Did Restaurant Brands International Just Bag the Elephant?

- Nasdaq 100 Stuck in a Bear Market

- US Stocks- A Rollercoaster of Uncertainty