/Solar%20Panels%20on%20Roof.jpg)

Put options on First Solar, Inc. (FSLR) now look attractive as JP Morgan downgraded FSLR stock on Nov. 28. The analyst said that the "easy money seems likely made" as a result of the stock rising over 27.5% in the last month. In fact, since bottoming at $118.97 on Oct. 17, FSLR stock closed at $165.85 on Nov. 28, or up 39.4% in the last 41 days.

This is also after the company reported negative earnings of negative 51 cents for Q3, a disappointing figure as it missed expectations by 27 cents, a wide margin, according to Seeking Alpha. The photovoltaic (PV) solar energy products manufacturer missed revenue expectations by a large margin. Analysts had been expecting $747.96 million in sales for the quarter, but they come in $119 million lower, or 15.9%, at $628.93 million.

The JP Morgan report, according to Seeking Alpha, downgraded FSLR stock on Nov. 28 to Neutral from Overweight. "With the stock up more than 120% over the past four months, we believe the 'easy money' has now been made," JPM analyst Mark Strouse said. However, he recommended that shareholders keep the stock if they already own it.

Buying Long Puts in FSLR Stock

That makes its next move downward highly likely and investors in the stock can hedge this by buying long puts in reasonably close out-of-the-money strike prices.

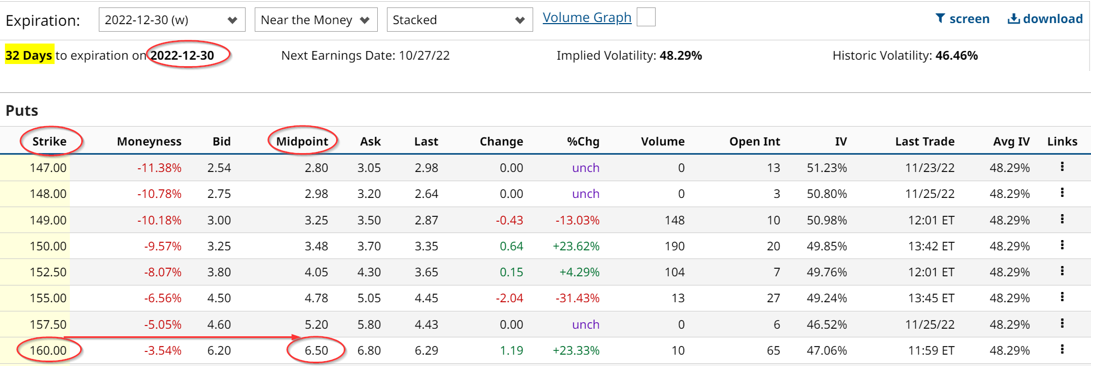

For example, look at the Barchart put option chain below for Dec. 30 expiration put options. It shows that the $160 strike price puts trade for $6.50 per put contract.

This means that the investor buying long puts would have a breakeven price of $153.50 per share (i.e., $160.00 strike price minus the $6.50 cost of the puts). That is only 7.03% below today's price of $165.11 and certainly well within a range of 10% to 20% that the stock could fall.

Keep in mind as well that investors typically sell off their losers near the end of the year. That is not the case here, as FSLR stock is up over 85% in the YTD period and almost 135% in the past 6 months. Therefore, investors in the stock might not want to sell, but they could very well want to hedge their holdings. Buying a put option like this, fairly close to the money will help do this.

Let's say for example, that the stock falls 20% to $132.09, or $33.02 below today's price. By Dec. 30, the $160 put options would be well in the money and have an intrinsic value of $27.91 per contract (i.e., $160-$132.09). That represents a gain of 329% over the $6.50 paid for the put options. And at some point, there would be additional extrinsic value and the puts could potentially rise to 30 or more (i.e. a gain of 361% over $6.50).

This means that the investor could buy put options representing one-third or more in value of his total long holdings in FSLR stock, assuming this 20% decline might be expected. The potential gains in the put options would hedge the potential declines.

If that cost (i.e., one-third of the long exposure) is too high the investor could also potentially sell covered calls well out-of-the-money to reduce that cost. For example, the $185 calls for Dec. 30 sell for $3.25 per call option. The investor could sell the same number of call options as he owns in long put options to reduce the cost of the long put hedge to just $3.25, or half of the $6.50 original put premium paid.

Keep in mind this only works if the investor believes the JPMorgan report that the stock has made most of its easy money. But, keep in mind, that reports like these tend to become self-fulfilling or act as a catalyst of sorts.

More Stock Market News from Barchart

- Unusual Options Volume May Bode Well for Wynn Resorts (WYNN)

- Etsy Is a High-Flier Among E-Commerce Stocks

- Stocks Fall on Global Growth Risks as the Pandemic Worsens in China

- Meta Platforms Stock Run-Up Makes Its Put Options Look Attractive

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)