/Facebook%20-Zb-iMVy8icc-unsplash.jpg)

Meta Platforms (META) stock has skyrocketed almost 27% since Nov. 3 to $111.41 as of Friday, Nov. 25. The run-up in META stock makes put options look attractive here.

Investors may be leery that the stock can continue this performance, especially since its Q3 financial results were disappointing. If Meta's Q4 financial results don't turn out as well as forecast, META stock could take a downturn again. That could present an opportunity for put option owners.

Analysts now project Q4 revenue of $31.58 billion, up 14% from the $27.7 billion in sales last quarter. But It is also off 6.2% from the $33.67 billion it posted last year in Q4 2021.

Nevertheless, earnings are projected to fall next year to $7.87 per share down from the $9.06 forecast for 2022. That puts META stock on a P/E multiple of 12.3x for 2022 and 14.2x for 2023. However, Barchart's survey of 12 analysts has EPS at $8.96 for 2022 and just $7.70 for 2023. That raises the 2023 P/E multiple to 14.5x.

Earlier this month the stock moved up based on news that Meta Platforms was planning on large-scale job cuts. On Nov. 9 Meta announced layoffs of 11,000 employees or over 13% of its workforce. That could help right the company's free cash flow eventually, although in the short run it will hurt the company.

Nevertheless, the stock may already reflect a lot of this good news. As a result, put options could be attractive here.

Shorting META Stock With Puts

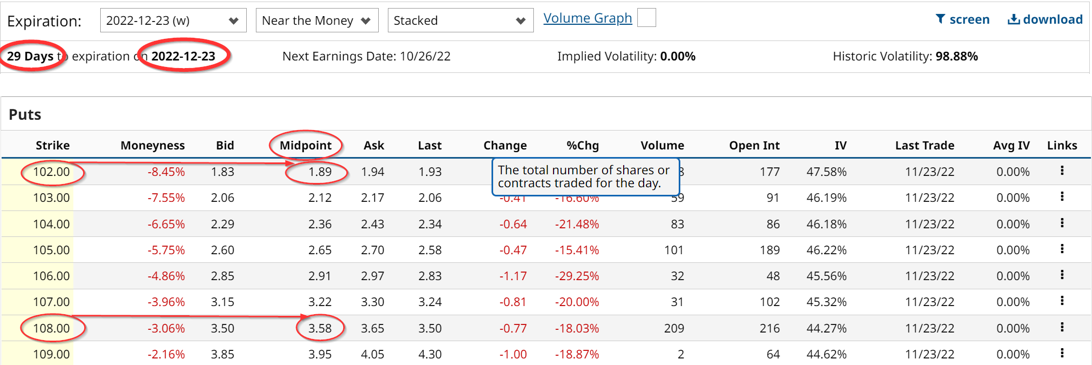

The option chain below from Barchart for the period ending Dec. 23 shows that the out-of-the-money (OTM) puts for the $108 strike price cost $3.58 per put contract. That is a high premium, worth about 3.2% of the stock price at $111.41 today (Nov. 25).

On top of that, there is a good deal of open interest at this strike price, with 216 contracts in total. That implies that there is going to be a lot of selling pressure on META stock at this price by Dec. 23. So, even though the puts cost a lot, in terms of yield, there might be a good likelihood that the stock could fall below $104.42, the breakeven point (i.e., $108-$3.58).

That means META stock will have to fall just 6.3% from $111.41, today's price, which could very well happen. For example, it's not uncommon for stocks that have risen quickly to get hit with tax-loss selling near the end of the year.

Moreover, for conservative investors, it might be worth selling puts at the $102.00 strike price and collecting $1.89 in premiums per put contract. That involves putting up $10,200 per shorted put contract. But the investor gets to keep $189 against the $358 cost of the long puts, thereby raising the break-even to $106.31, or just 4.6% below today's price.

Even if the stock falls to the $102 strike price by Dec. 23, the investor might want to keep the shares that he would have to buy. The reason is that would be a good entry price. Moreover, long put would have a profit at some point, and that would lower the overall buy-in cost.

And if the stock keeps rising the investor could cut his losses in the long put before expiration, lowering his overall loss in the long put. He might even be open to selling covered calls. That could also help make the overall trade scenario break even or even profitable. Given that there seems to be a high possibility of META stock falling from here, this long-put scenario probably makes good sense here.

More Stock Market News from Barchart

- Strong Seasonality And Other Key Themes To Watch This Week

- Chinese Stocks and the FXI

- Nvidia Out-of-the-Money Puts and Calls Are Attracting Income Buyers

- Here’s One Hot Stock That Could Fundamentally Rise Even Higher

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)