/computer%20board%20micro%20chip%20green.jpg)

Nvidia Corp (NVDA) reported its Q3 financial results on Nov. 16, showing that revenue was down 17% YoY and even 12% below the prior quarter. But NVDA stock now looks attractive now, given its outlook and analysts' projections. As a result, a popular income play shorting out-of-the-money puts and calls is attracting value buyers.

On the one hand, the company produced negative free cash flow (FCF) of $156 million, which is not ideal. But, on the other hand, this was on depressed negative revenue growth, and, in addition, the FCF margin was only -2.6% on revenue of $5.93 billion. The point is that once revenue growth rebounds, the FCF margin will quickly turn very profitable.

In addition, analysts now project that next year's revenue will rebound by 11.4% from the $26.9 billion forecast for 2022 to over $30 billion in 2023. Moreover, earnings per share (EPS) will rise by over one-third from $3.27 per share this year to $4.38 in 2023.

That puts NVDA stock, at $162.70 as of Friday, Nov. 25, at just 37x earnings. This multiple is well below its 5-year historical average of 39.4x, according to Morningstar.com. Moreover, given the huge amount of share buybacks the company is doing ($3.485 billion in the last quarter alone), earnings per share will consistently rise.

As a result, the stock has been rising, although lately, it is off its highs. In the past month, NVDA is up almost 25%. In fact, in the last week, it's up 7.0% as well. As a result, option premiums are now high and this allows the value investor to take advantage of this through option income plays.

Shorting Puts and Calls To Create Income with NVDA Stock

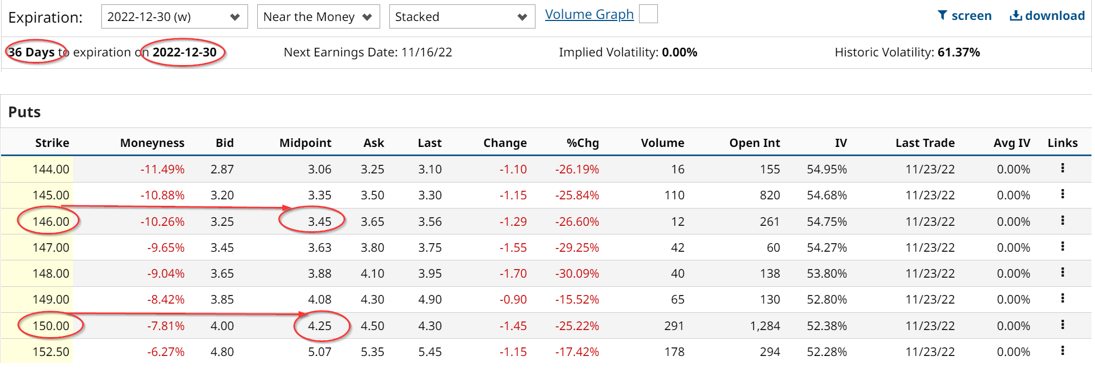

For example, look at the Dec. 30 expiration option chain (below) from Barchart, which is just 36 days forward or a little over one month. The out-of-the-money (OTM) put premium for the $150 strike price, which is almost 8.0% (7.81%) below the closing price on Friday, Nov. 25 of $162.70, has a very high premium of $4.25 per put contract.

That represents a 2.61% immediate yield to an investor who puts up $15,000 with the brokerage firm to short the $150 put contract for Dec. 30. That is a very high annualized return of about 31%. However, if the stock starts to rise over $162.70 and never falls, the investor has no opportunity to make a capital gain.

Therefore some investors also short OTM calls for the same expiration period (to control their risk). If this is done on a covered call basis (by owning the 100 shares of NVDA prior to shorting the OTM calls), the income return is also high.

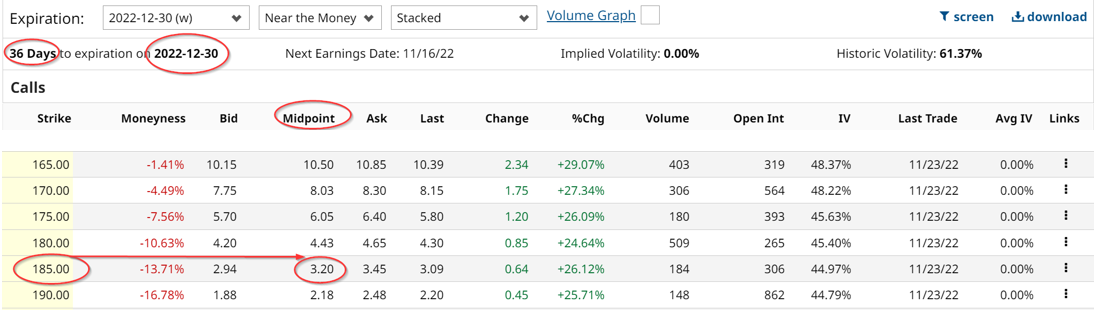

For example, the Barchart call option chain below shows that the $180 strike price has a $4.43 premium. This strike price is 10.6% over today's price. To be even more conservative (in case NVDA keeps rising by Dec. 30) the $185.00 strike price offers a premium of $3.20. This strike price is 13.7% over today's price.

This means that the covered call investor can make an immediate 2.0% yield (i.e., $3.20/$162.70=1.967%) by shorting 1 call contract at a strike price that is 13.7% over today's price. So, even if the stock rises to $185 by Dec. 30, the investor will have made 13.7% plus another 2.0% from the covered call.

If the investor puts on both the call and the put OTM short plays, they will have collected $4.43 from the OTM short put play and $3.20 from the short call play, or $7.63 in total or $763 total. However, to do that they had to put up $15,000 to secure the put margin and paid $16,270 for the covered call play, or $31,270. Therefore the total yield gained of $763 works out to 2.44% of the total $31,270 investment or used-up margin.

That means that if the stock falls $763 from $162.70 to $155.07, the investor will still break even on their long 100 shares held for the covered call. The investor may want to protect their downside, in case NVDA falls well below $150, where they would be required to buy NVDA stock. That could potentially involve extra unrealized losses, since the $150 short put would be exercised, forcing the investor to own 200 shares of NVDA.

Three-Way Collar Hedge

So to protect against this downside possibility, the investor could use some of the $773 in income to buy long puts at a much lower put strike price, say at $146.00 (see above). That means that if the stock fell below $146.00 by Dec. 30, the investor's unrealized losses below that would be covered. This long put would cost $3.45, or $346 per put contract representing 100 shares, about 45% of the $773 already received.

This long-put contract covering just 100 of the 200 shares held if the stock falls below $150 could be managed. For example, if NVDA stock starts to rise, the investor could later sell the long put and recover some of the lost income they had previously received (obviously not the full $3.45 paid, but potentially half of that). That would still result in a total income gain of $590.00, or 1.89% of the total $31,270 investment. This is seen by taking the original $763 received, subtracting $346 for the long put purchase, and then selling the long put later (after seeing NVDA stock rise) at a 50% loss for $173, or half of the long put price.

The bottom line is that by managing both OTM puts and calls, the investor can make about a 1.89% yield (assuming the investor hedges a portion of the unrealized loss potential by buying long puts), and assuming this long put is later closed out. This strategy is known as a three-way collar and can be profitable if properly managed.

More Stock Market News from Barchart

- Here’s One Hot Stock That Could Fundamentally Rise Even Higher

- Stocks Settle Mixed in Holiday-Shortened Session

- Bear Markets Rarely Move In Straight Lines

- High Inflation May Reduce Holiday Retail Sales

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)