- The distillates market is interesting in that it is showing a mixed of market factors while its long-term fundamentals remain bullish.

- Traders and hedgers alike are looking for an opportunity to get long the market, though technical and seasonal indicators are not showing a bullish turn yet.

- Behind the scenes is the possibility of a US rail strike in early December, a situation that if realized could change the fundamentals of the market again.

One of the markets I’ve had the most questions about of late is distillates (heating oil, diesel fuel, jet fuel, etc.). Folks in agriculture know the market is nearing its seasonal turn, with the question being is it time to lock in 2023 needs now. To answer let’s put the market together, like a puzzle one might do over the holiday, and see what we come up with.

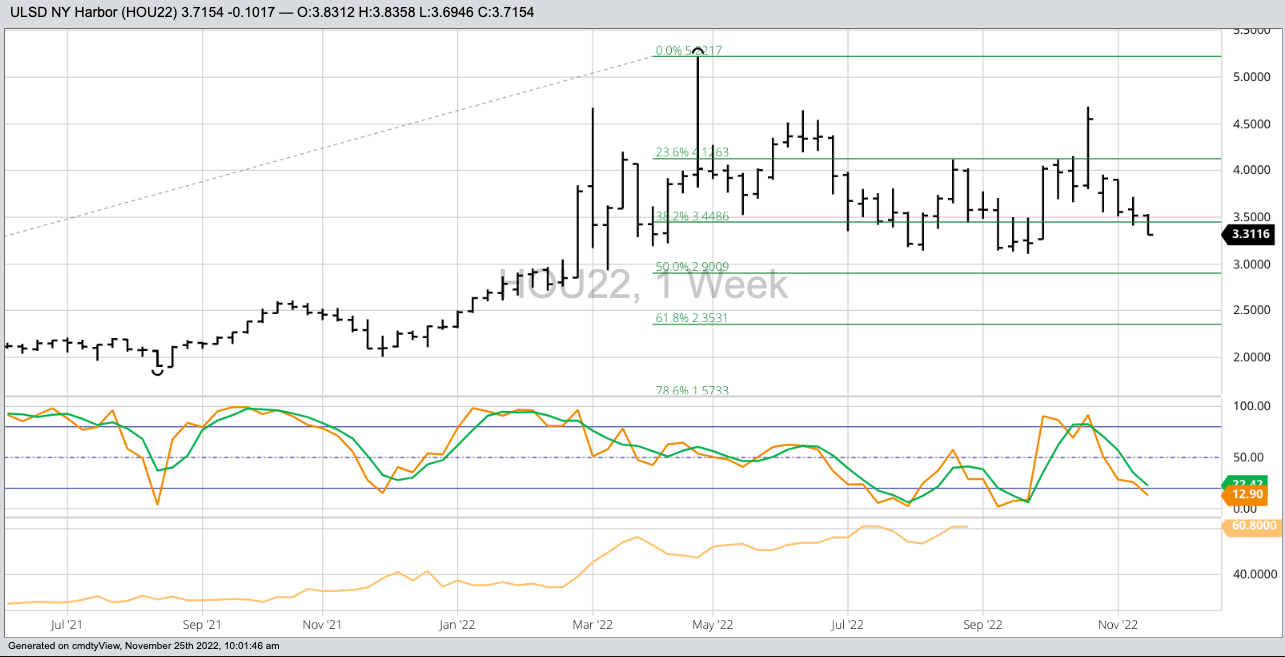

Trend (a reflection of the flow of noncommercial money into or out of a market): The continuous weekly chart for the market shows the spot-month contract has posted another new 4-week low this week. This isn’t bullish, as it indicates momentum remains to the downside. Additionally, weekly stochastics (another momentum study) have not moved below the oversold level of 20% meaning the market still has space and time to move to the downside. Long-term support on the market’s monthly chart is at the previous 4-month low of $3.1084.

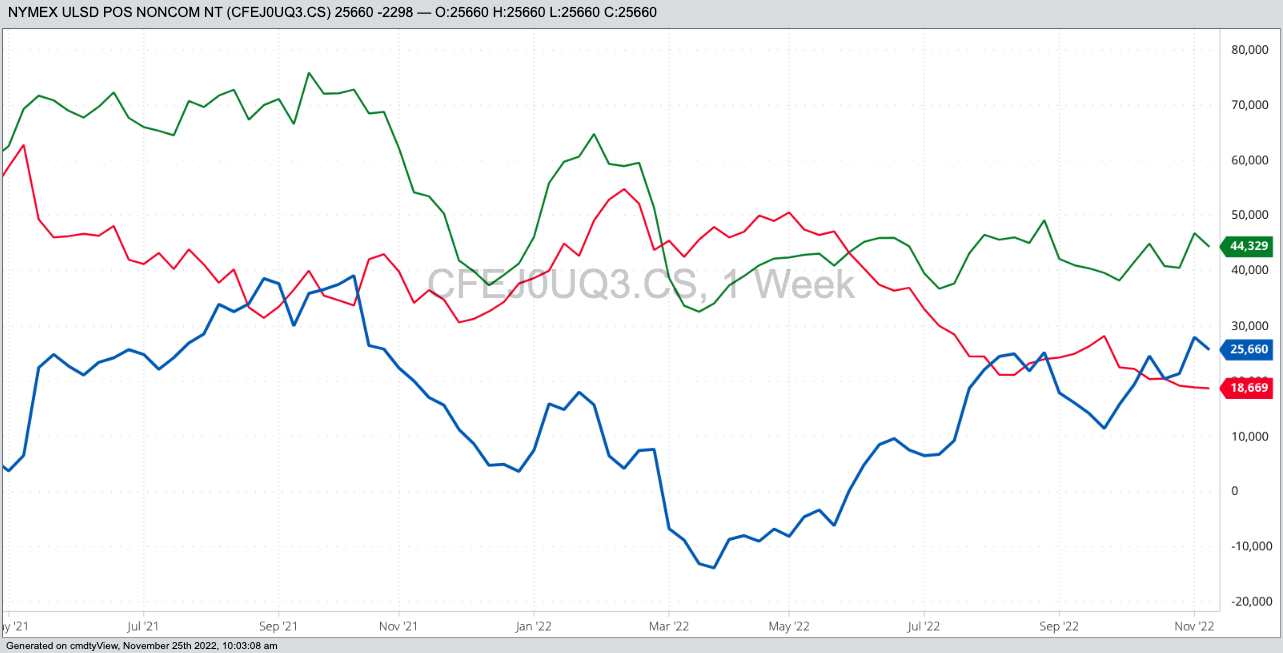

The downtrend on the weekly chart implies noncommercial money has been moving out of distillates. However, a look at the chart for the weekly CFTC Commitments of Traders report (legacy, futures only) shows this group has been adding to their net-long futures position (blue line). However, much of the addition has come from subtraction, meaning a decrease in short futures holdings (red line). This is not as bullish as if noncommercial interest had been aggressively adding long futures (green line).

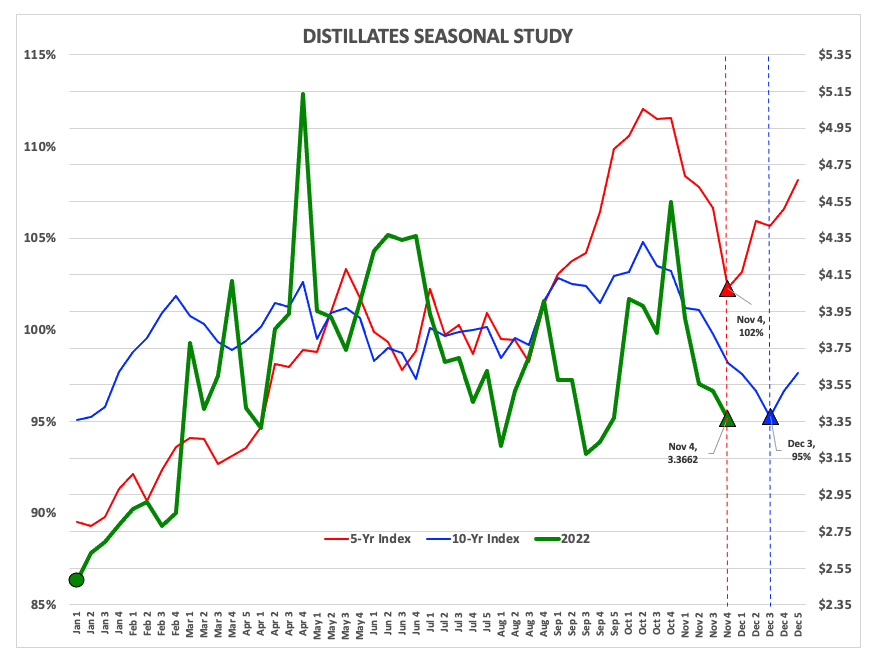

Seasonally things are about to get more interesting as the spot-month contract tends to post a low weekly close this week (5-year index, red line) or the third week of December (10-year index, blue line). Once the market makes its seasonal turn it tends to extend its rally through the following spring into early summer. Late in the year the market extends further to its seasonal peak in mid-October.

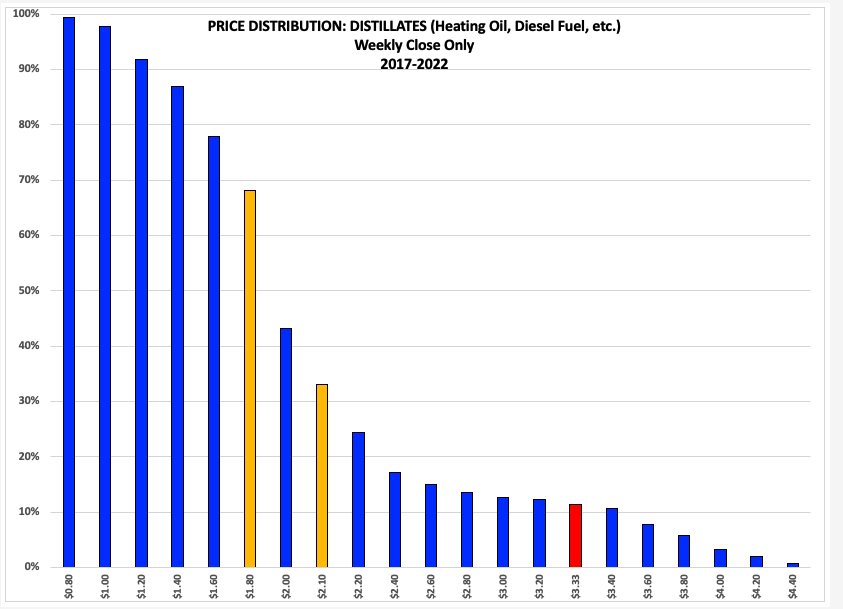

Looking at the market’s historic price distribution over the past 5-years (based on weekly closes only) we see the spot-month contract priced near $3.33 puts it in the upper 11% (red column on chart). For decades I’ve used these studies to show me the historic lower-third (left hand gold column) and upper-third (right hand gold column) to indicate potential buying and selling opportunities. However, recent years have skewed these ranges, decreasing the value of the studies in general. Historically a market in the upper 11% of its range would be considered a sell rather than a buy.

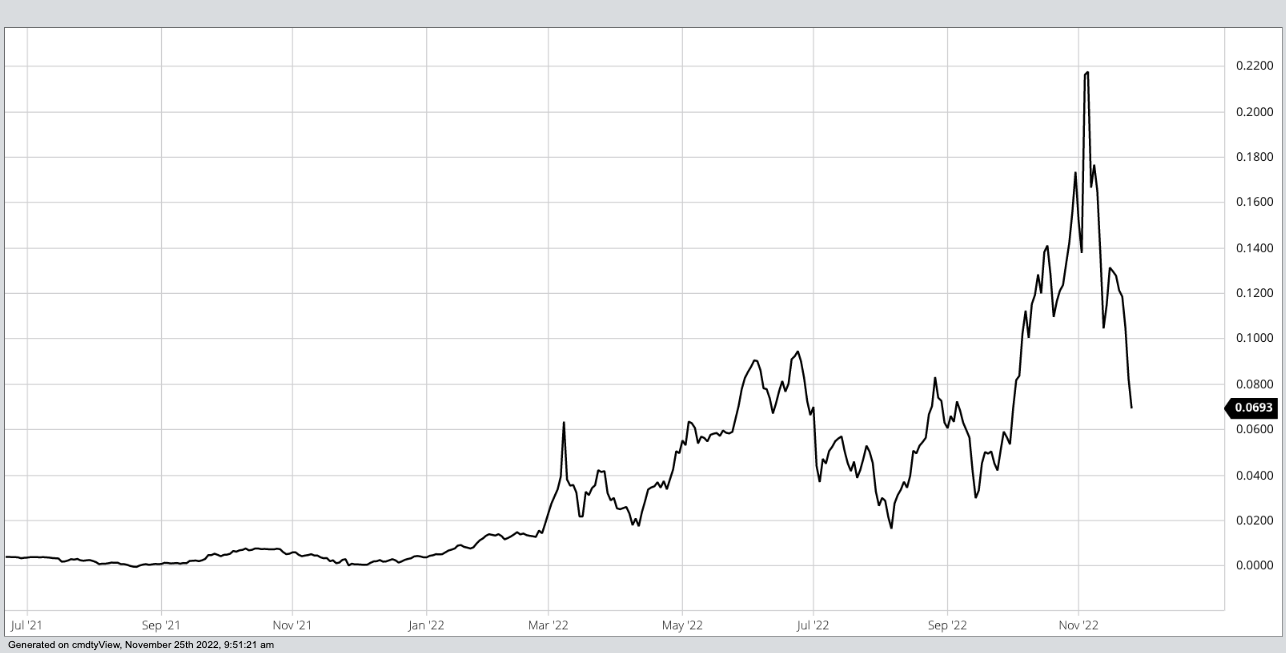

The result should come back to supply and demand (Newsom’s Rule #6: Fundamentals win in the end.). A recent piece from John Kemp of Reuters talked about how “US stocks of road diesel and heating oil show early signs of stabilizing and even increasing slightly as exceptionally high prices (price distribution) encourage production, discourage exports, and possible suppress consumption.” We’ll see how any or all that plays out, particularly with a potential US rail strike looming on December 8. The spot futures spread has lost a big part of its backwardation (inverse) since posting a high of $0.2177 on November 4. But to use the lesson from Horton the Elephant (of Dr. Seuss’ Horton Hears a Who fame): When it comes to storable commodities, an inverse is an inverse no matter how small.

Conclusion: Given the downside momentum in the futures market and spot futures spread, it looks like the market could target its 10-year seasonal index low the third weekly close of December. Given this, traders and hedgers might hold off on long-term buying until a clear reversal pattern is completed. All while fundamentals remain bullish, meaning money could come back into the market any time.

More Energy News from Barchart

- Nat-Gas Surges on Forecasts for Colder U.S. Temps

- Crude Sharply Lower on EU Plans to Curb Russian Crude Oil Sales

- Crude Tumbles as EU Discusses Cap Level on Russian Crude Prices

- Heating Oil Remains the Strongest Product, and it is Not Seasonal

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)