Heating oil has been trading at a significant premium to gasoline in 2022. While gasoline refining requires lighter, sweeter crude oil, heating oil and other distillate processing require slightly heavier petroleum with higher sulfur content. NYMEX WTI crude oil futures reflect the price of petroleum from the US and North America, a light sweet crude oil. WTI is the benchmark for approximately one-third of the world’s crude oil pricing. Brent North Sea crude oil trades on the Intercontinental Exchange (ICE). Brent is the pricing mechanism for approximately two-thirds of the world’s petroleum production and consumption. With a higher sulfur content, Brent reflects the price of European, Russian, African, and Middle Eastern crude oil. Brent is the preferable crude oil for processing into distillates.

Brent is trading at a significant premium to WTI crude oil

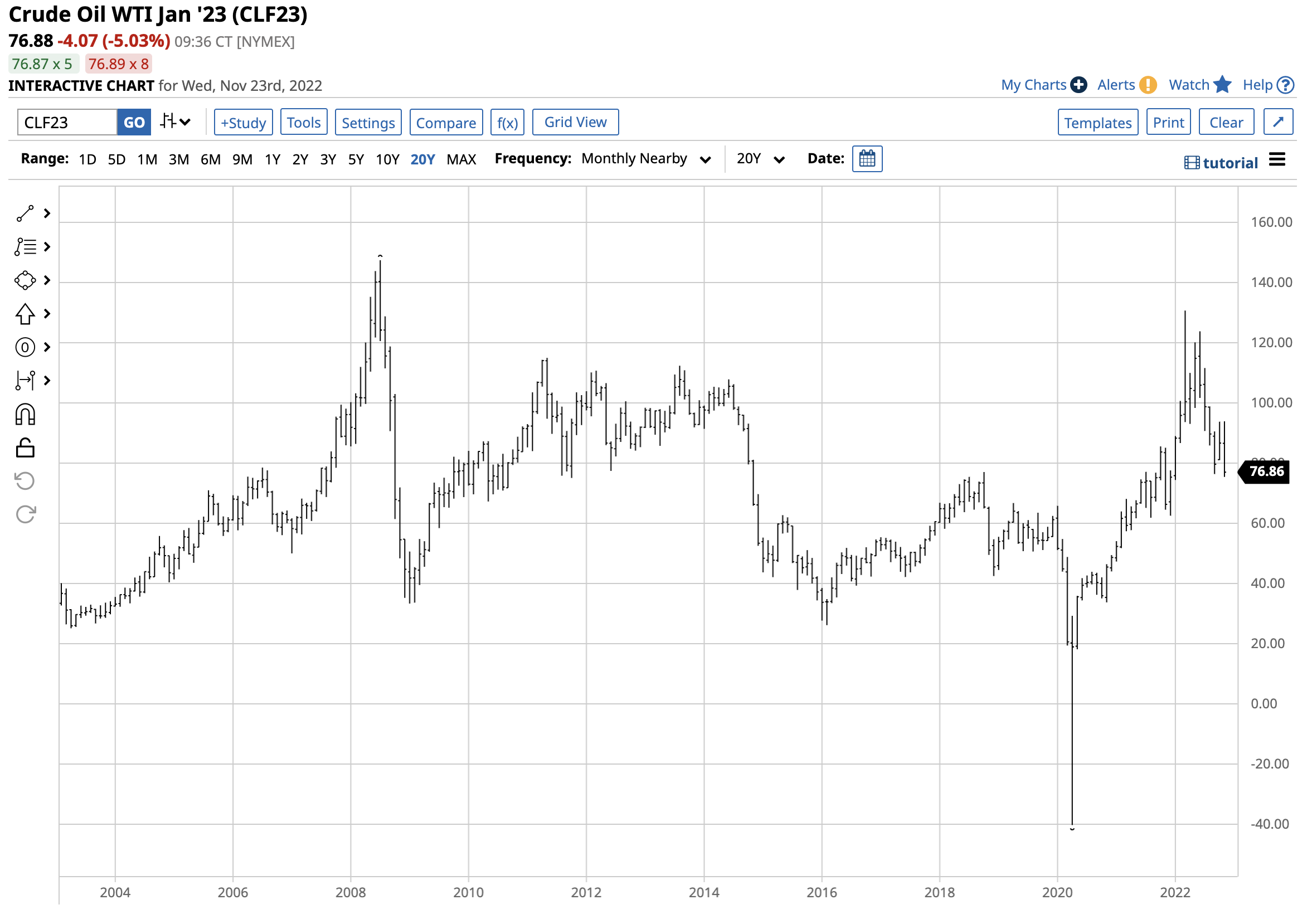

Crude oil futures have corrected since reaching highs earlier this year.

The chart shows the decline in NYMEX WTI futures from $130.50 in March 2022 to a low of $75.08. At the $76.88 per barrel level on November 23, WTI futures for January 2023 were close to the recent low.

The chart highlights the decline in Brent futures from $139.13 in March 2022 to an $82.31 per barrel low in November 2022. At the $84.38 per barrel level on November 23, Brent futures were trading at $7.50 per barrel above the NYMEX WTI futures. Two factors account for Brent’s premium. First, gasoline demand tends to decline during the off-season during the winter. Moreover, OPEC and Russia’s dominance in Brent crude oil production have caused it to command a higher price than the US crude oil output and inventories because of supply concerns.

The US has released approximately 180 million barrels from its Strategic Petroleum Reserves to keep a cap on oil prices over the past months. The SPR sales will end in December, and the US administration has stated that it will look to replace the SPR at around $70 per barrel. Meanwhile, economic weakness in China as COVID-19 lockdowns continue has weighed on the energy commodity’s price. When the lockdowns end, Chinese petroleum demand is likely to come roaring back.

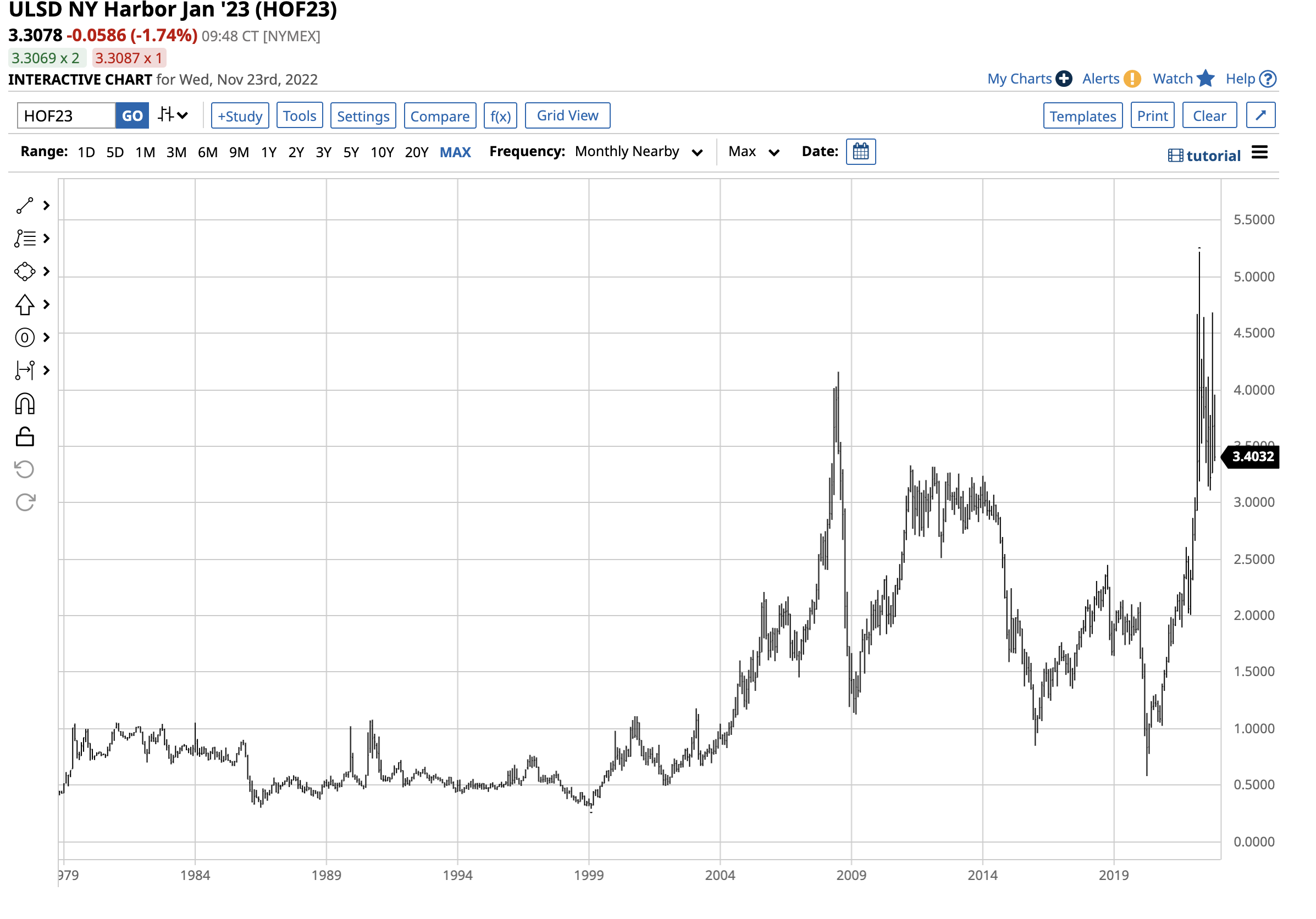

Heating oil futures remain at multi-year highs in November 2022

Heating oil and distillate prices remain at the highest level in years.

The chart shows at over $3.30 per gallon wholesale, NYMEX heating oil futures remain around a fourteen-year high. Before 2022, the last time heating oil futures were above $3.30 per gallon was in August 2008.

Heating oil rose to a record $5.2217 per gallon wholesale level in April 2022, surpassing the previous record from 2008 at the $4.1586 level.

The war in Ukraine and OPEC dominance support Brent and heating oil futures

Since Brent is the primary ingredient in distillate refining, the war in Ukraine has caused heating oil and other distillate fuels to move to higher levels than gasoline. While seasonality accounts for some of the premium in November 2022, the war and supply concerns have turbocharged the heating oil futures on the upside.

Meanwhile, the US’s greener path for energy production and consumption passed the petroleum pricing power to the OPEC oil ministers. In October, the oil cartel cut production, stating that weak Chinese demand and the potential for a US recession would weigh on consumption. Moreover, Russia has been the most influential cartel non-member over the past years. OPEC does not make a production decision without consultation with the Russian oil minister, making the quota a function of discussions and compromises between the Saudis and Russians. The war in Ukraine, sanctions on Russia, and Russian retaliation has made oil and natural gas weapons in Russia’s economic war against “unfriendly” countries supporting Ukraine.

When it comes to heating oil and distillates, the requirements for processing make OPEC and Russian oil production policies and the weaponization of petroleum a clear and present danger for supplies, boosting the Brent crude oil price.

The strongest oil product will likely rally the most when the current correction ends- SPR could put a floor under crude oil

In markets, the strongest assets tend to fall the least during corrections and rally the most when buying returns. One of the factors to watch over the coming days and weeks as crude oil prices make lower highs and lower lows are the US government’s stated intentions to replace the 180 million SPR release at prices around the $70 per barrel level. On November 21, January NYMEX crude oil futures fell to a $75.27 per barrel low as it moves closer to the US government’s buying level. Replacing the unprecedented SPR sales could put a floor under the oil price during the winter when crude oil prices tend to be seasonally weak.

Meanwhile, a November 21 report that OPEC was considering a production increase was quickly refuted by Saudi Arabia, stating that a production cut was more likely than an increase in the current environment. The bottom line is when crude oil finds a bottom later this year, or in early 2023, the ascent of heating oil futures could outpace gains in crude oil and gasoline.

Crack spreads are a real-time indicator of crude oil fundamentals as the refining margins measure the supply and demand dynamics. The heating oil crack spread, or the processing margin for refining a barrel of NYMEX crude oil into heating oil, rose to a record higher of $88.56 per barrel in October 2022. Before 2022, the record high was in 2012 at $45.12 per barrel. At over $62 per barrel on the January heating oil crack spread on November 23, the refining margin remains above the previous all-time high, signaling the supply concerns for distillate oil products.

Levels to watch in heating oil futures

Since late August 2022, January NYMEX heating oil futures have traded between $2.9301 and $3.8063 per gallon wholesale.

The chart shows at the $3.3113 level on November 23; the oil product futures were just below the $3.3687 midpoint over the past three months. A break below the late September $2.9301 low would be technically bearish for the oil product, while a rally that takes the price over the November 4 $3.7173 would be bullish.

Four factors ultimately favor the upside for the distillate futures despite the current correction and pattern of lower highs and lower lows over the past weeks:

- The US government buying at the $70 level to replace the SPR sales could put a floor under crude oil’s price.

- Chinese COVID-19 lockdowns will eventually end, and the demand from the world’s most populous country and the second-leading economy will come roaring back.

- Russia continues to weaponize oil and gas against “unfriendly” countries, potentially making oil and oil products a geopolitical hot potato that leads to rallies.

- Crude oil and oil product prices remain elevated during a seasonally weak time of the year for the energy commodity. The end of 2022 will shift the focus to the 2023 driving and travel season, putting upward pressure on oil and oil product prices.

At just over the $3.30 level, NYMEX heating oil prices are appreciably higher than the highs over the past years. The high in November 2021 was $2.5280 per gallon. Since the late 1970s, the highest November heating oil futures price was in 2011, at $3.2004 per gallon wholesale.

As of November 23, 2022, heating oil futures remain the strongest member of the petroleum complex, and that is likely to continue over the coming months. The strength of heating oil has nothing to do with seasonality and everything to do with the geopolitical and economic landscapes.

More Energy News from Barchart

- Crude Higher on Saudi Pushback on Increased OPEC+ Output Report

- Nat-Gas Gains on the Outlook for Colder U.S. Temps

- Long Call Options for Petrobras (PBR) Reflects Enthusiasm for Hydrocarbons

- Crude Gains on Dollar Weakness and Saudi Pushback on Increased OPEC+ Output

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)