When Bitcoin began quietly trading in 2010, the price was only five cents per token. One year ago, in November 2021, the price reached $68,906.48. A $100 investment in 2010 bought 2,000 Bitcoin worth an astronomical $137.8 million at the peak. While those 2,000 tokens were still worth $33.2 million on November 11, with Bitcoin at the $16,600 level, most investors and traders did not buy at the 2010 lows. Over the past years, the exponential rise caused market participants to chase the cryptocurrency and many others over 21,700 tokens higher. Last week, cryptos received a gut punch when one of the leading crypto exchanges and its founder went bust.

SBF goes from Bitcoin guru to the Madoff of 2022

Sam Bankman-Fried is the founder and was, until last week, the CEO of FTX, a cryptocurrency exchange. In 2017, SBF managed assets through Alameda Research, the quantitative cryptocurrency trading firm he founded in October 2017. His net worth grew to $16 billion but fell to zero as FTX collapsed during a liquidity crisis.

On Friday, November 11, FTX filed for bankruptcy, and SBF resigned. On Thursday, November 10, before the filing, he tweeted, “I’m sorry. That’s the biggest thing. I f---up and should have done better.”

A lack of funds and capital caused FTX to halt customer withdrawals. On November 8, FTX reached a deal to sell itself to Binance, the crypto exchange that helped trigger the liquidity crisis. Binance pulled out of the deal on November 9, leaving FTX no way to raise cash as any potential suitors ran for the hills.

The problems began when SBF stepped in to save other struggling crypto firms with cash injections in Voyager Digital and others. He transferred billions in FTX funds to Alameda Research to cover losses, a portion of which were customer funds, a regulatory no-no. As fears surrounding FTX began to grow with cryptocurrency values falling, customers withdrew funds, causing a run on the bank and triggering the liquidity crisis that cost SBF his entire fortune. The bottom line is that the scandal could be the most significant financial caper since Bernie Madoff’s Ponzi scheme came tumbling down.

Prices plunge- The asset class suffers the most significant blow since Mount Gox

Bitcoin and Ethereum, the two leading cryptos that hold around 56% of the asset class’s shrinking market cap, plunged in the wake of the FTX scandal.

The chart shows after a recovery to $21,466.76 on November 7, Bitcoin plunged to below $16,000 and was sitting at just under the $16,600 level on November 14.

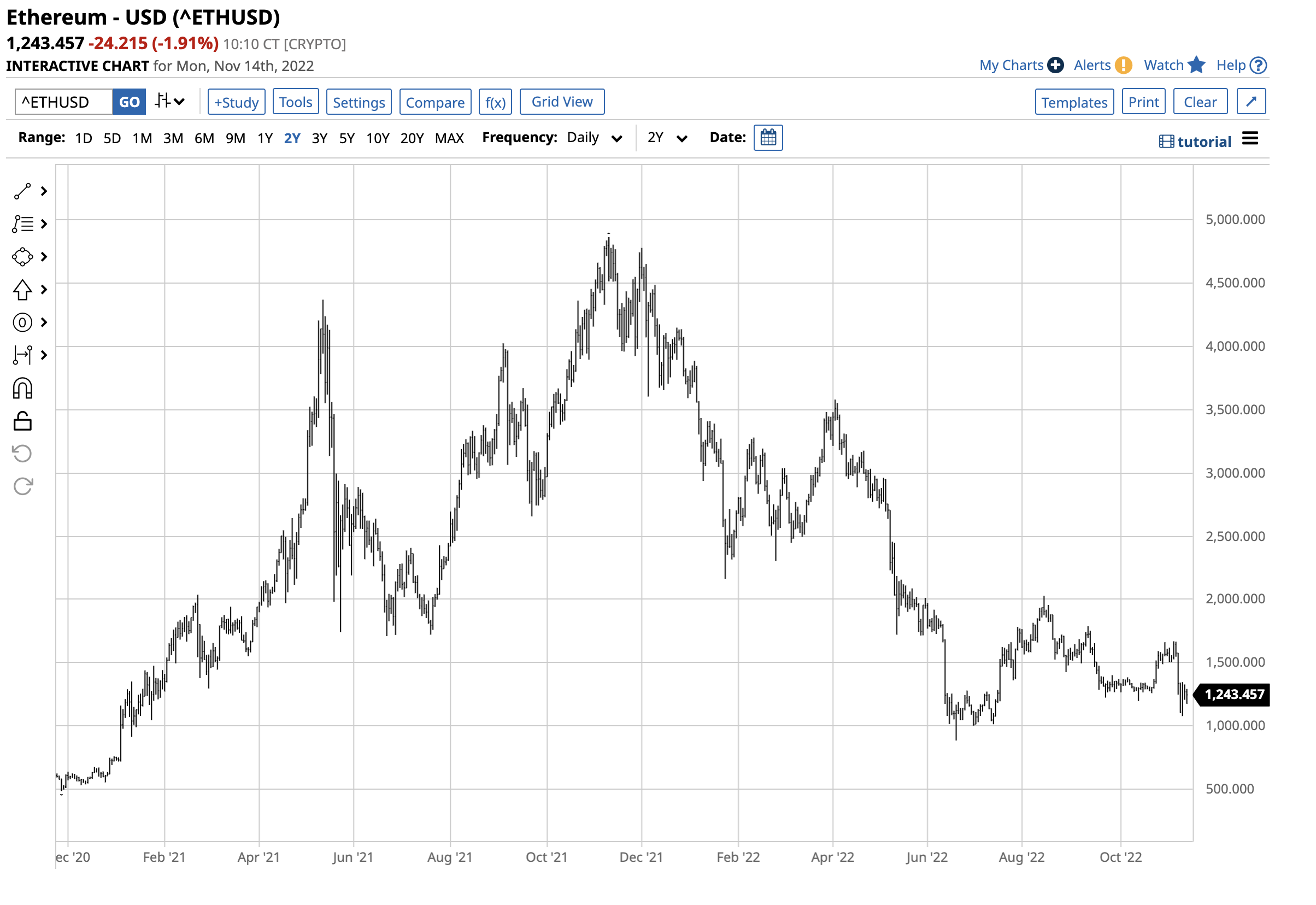

Ethereum, the second-leading crypto, fell from $1,664.707 on November 7 to below $1,100 and was at the $1,245 level on November 14.

Time will tell if the FTX bankruptcy will continue pushing prices lower. However, confidence in the asset class received the most significant PR hit since the Mount Gox scandal in 2014, when a hack at the Japanese crypto exchange caused the loss of thousands of Bitcoins, causing the price to plunge. However, Bitcoin was below $1,500 per token when Mount Gox failed. At over ten times higher, the FTX scandal has a far more series impact on the cryptocurrency asset class and could have systemic ramifications.

Regulators have been asleep at the wheel

Despite warnings from financial sector leaders like Warren Buffet and Jamie Dimon, many traditional investors and traders fearing they would miss the most significant bull market in history flocked to cryptocurrencies. While Buffett called Bitcoin “rat poison squared” and Dimon said the asset class was a collection of “decentralized Ponzi schemes,” other high-profile icons, including Elon Musk, Mark Cuban, and others, embraced cryptos. The world’s leading financial institutions, including Dimon’s JP Morgan Chase, began allowing their customers to include cryptos in investment portfolios.

Bitcoin and Ethereum futures have been under the Commodity Futures Trading Commission’s (CFTC) regulatory umbrella. Shares of crypto-related companies and ETF products like BITQ, RIOT, COIN, and others are SEC-regulated companies. As the debate within the regulatory agencies, the US House of Representatives and the Senate, the EU, and other government bodies continued, FTX went belly up, causing wide-ranging losses in the billions. While some crypto companies and investors have been calling for a regulatory framework, the bottom line is the regulators were asleep at the wheel as FTX failed last week.

Blockchain is the innovation- Cryptos could become tulip bulbs

Blockchain is an advanced database mechanism that allows transparent information sharing within a business network. Blockchain is a financial, technological innovation that creates databases that store data in blocks linked together in a chain. Blockchain improves the efficiency and speed of settling transactions. The relationship between cryptocurrencies and blockchain is a chicken-and-egg phenomenon. In a 2008 white paper, the illusive Satoshi Nakamoto created blockchain as the publicly distributed ledger for Bitcoin and cryptocurrency transactions. While there is a debate about the original inventor, Nakamoto launched the crypto market, which became a speculative frenzy over the past decade.

Detractors say that cryptos have no intrinsic value because they have no backing, comparing cryptos to tulip mania that gripped the Netherlands from 1634-1637. Supporters argue that fiat currencies that depend on the full faith and credit of the governments issuing legal tender also have no intrinsic value, and confidence in governments is declining. We will likely hear many more references to tulip bulbs in the wake of the FTX collapse.

Opportunity or the beginning of an epic crash- Risk and reward lessons

In any market, the risk is always a function of potential rewards. The rise of a $100 investment in Bitcoin in 2010 to an over $137 million fortune in November 2021 was a glaring warning of a massive bubble risk. The question becomes if the bubble burst that sent Bitcoin from over $68,900 to $16,600 is enough or if those holding the token will suffer the same fate as SBF, with their holdings going up in smoke. The current environment could make Bitcoin, Ethereum, and over 21,700 cryptos dust collectors in computer wallets.

On the other hand, the Mount Gox scandal caused a substantial correction that led to new highs in the asset class. On November 14, the cryptocurrency asset class’s market cap stood at the $835 billion level, down from over $3 trillion in November 2021. The risk was a function of the spectacular rewards last year, and the same holds during the artic crypto winter of November 2022. The lesson is market participants should only invest assets they are willing to lose as the trend is lower, and the epic crash could be far from over. Cryptos have become lotto tickets in the current environment, as we do not yet know the systemic impact of FTX’s collapse.

More Crypto News from Barchart

- Cryptocurrencies Remain Under Pressure as FTX.com Goes Bankrupt

- Here’s Why Investors Should Wait Until Bitcoin Drops to $10,000 Before Buying

- With Blockchain Stocks, It’s Time to Rush for the Exits

- Will a Possible Fed Loosening Help the Cryptocurrency Sector?

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)