Representing quite possibly the biggest news item in the global financial sector last year, Bitcoin (BTCUSD) and the rest of the cryptocurrency complex now suffers horrendously from a massive, paradigm-altering sentiment shift. With the infrastructure seemingly crumbling beneath them, formerly hardened crypto investors are now seeking the closest exit to them.

Of course, much of the cataclysm centers on the popular virtual currency exchange FTX, the world’s fifth-largest crypto exchange by year-to-date volumes. Earlier this week, the Bitcoin price popped higher on the announcement that Binance planned to bail FTX out, per the Motley Fool. Recently, though, Binance revealed that it’s bailing on the deal, sending BTC to the abyss.

What’s worse, the extreme volatility and fundamental shockwaves attracted the wrong kind of attention. According to the Associated Press, authorities are “now investigating the firm for potential securities violations,” leaving “analysts bracing for a further downturn in crypto prices.”

The AP continued, noting that a “person familiar with matter said that the Department of Justice and the Securities and Exchange Commission are examining FTX to determine whether any criminal activity or securities offenses were committed. The person could not discuss details of the investigations publicly and spoke to The Associated Press on condition of anonymity.”

It’s an ugly situation that may expose the dark underbelly of blockchain-based enterprises. “The investigation into [FTX CEO and founder Sam Bankman-Fried] and FTX by those in the crypto world as well as securities regulators is centering on the possibility that the firm may have used customers’ deposits to fund bets at Bankman-Fried’s hedge fund, Alameda Research.”

“In traditional markets, brokers are expected to separate client funds from other company assets. Violations can be punished by regulators.”

Of course, contrarians may view the above backdrop as a cynical catalyst to acquire Bitcoin and other compelling cryptos at discount prices. However, investors really ought to wait until BTC hits at least $10,000 (if not lower) before buying.

Bitcoin and the Money Stock Dynamic

On paper, Bitcoin appears as the disruptor, not the disrupted. Launched in early 2009, traditional market analysts largely treated BTC as a niche sector unlikely to gain mainstream traction. Certainly, earlier boom-bust cycles didn’t help the perception that cryptos represented nothing more than digital forms of casinos.

While the burgeoning blockchain arena helped shape narratives into a more favorable light, it became clear that regulators were mostly unprepared to handle the underlying revolution of decentralized assets. Currently, institutions are playing catch-up, with the issue of regulating and managing cryptos under a cohesive framework representing a top priority among governmental agencies.

This backdrop leads to a temptation to assume that Bitcoin and cryptos are disrupters, forging new paradigms that force the old guard to adapt or die. However, the broader evidence suggests that – just like any other tradable asset – mainstream fundamentals still represent the main arbiter of valuation trajectory.

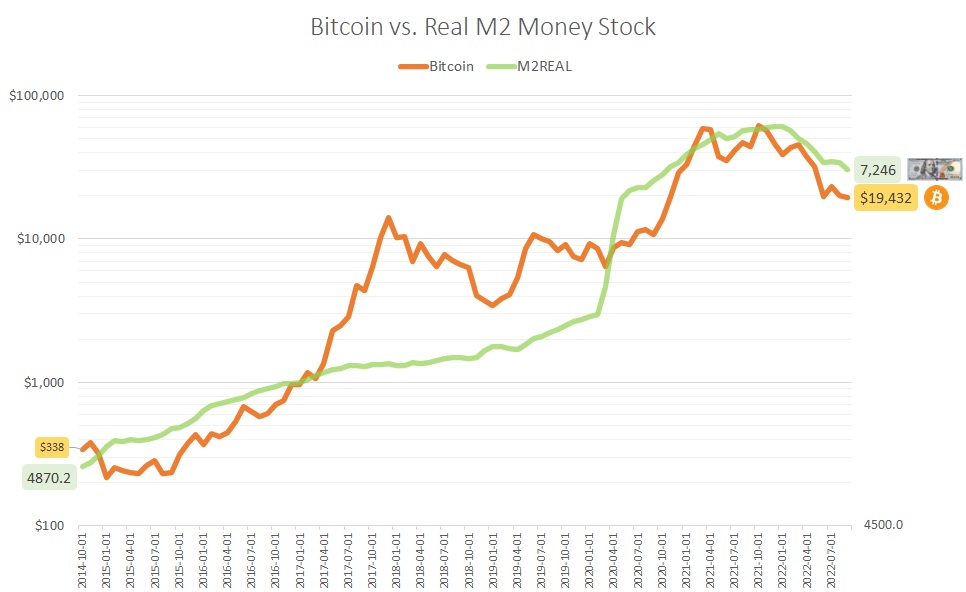

Specifically, Bitcoin shares an 87.81% correlation coefficient with the real M2 money stock between October 2014 through September 2022. To put it simply, as money stock (inflation) rises, Bitcoin tends to rise as well. However, as we’re seeing at the moment, when the money stock shrinks (deflation), BTC likewise suffers erosion in its market value.

Although the above relationship contrasts with popular narratives of the digitalized, decentralized Bitcoin forcing the anachronistic, cumbersome fiat dollar to adjust to new realities, so far, it seems that the Federal Reserve and its monetary policy is the gatekeeper for the crypto complex’s valuation cycles.

So long as the Fed is willing to pump liquidity into the system, BTC may be a sensible (albeit highly risky) investment. However, with the central bank taking away the monetary punch bowl, cryptos don’t make much sense.

Wait for $10,000

On a practical level, then, investors should stay away from adding major positions in Bitcoin and other cryptos. While it’s tempting to grab the red ink for long-haul acquisition purposes, the reality may very well be that Bitcoin drops to $10,000.

Technically speaking, the 10K mark represents both a historical resistance and support line. Psychologically, it’s the most logical place where the bears will attempt to push down the BTC price. In addition, several investors may have stop-losses at 10K. Therefore, triggering such mitigation points may spark even more volatility, benefitting the short traders.

Therefore, I don’t see 10K as the ultimate resting point for Bitcoin. It’s very much possible that BTC can slip below that point to say 8K, for the sake of throwing out a number. However, the main takeaway is that we’re probably not done with crypto volatility, so long as the Fed is determined to tackle inflation.

More Crypto News from Barchart

- With Blockchain Stocks, It’s Time to Rush for the Exits

- Will a Possible Fed Loosening Help the Cryptocurrency Sector?

- Some Signs of Bullish Life in Bitcoin and Ethereum

- Will a Possible Fed Pivot Boost Crypto Miner Marathon Digital (MARA)?

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)