/A%20sign%20and%20office%20building%20for%20QuantumScape%20by%20JHVEPhoto%20via%20Shutterstock.jpg)

QuantumScape (QS) shares pushed meaningfully higher on Monday after the battery technology company officially launched its much-awaited production-scale platform, Eagle Line.

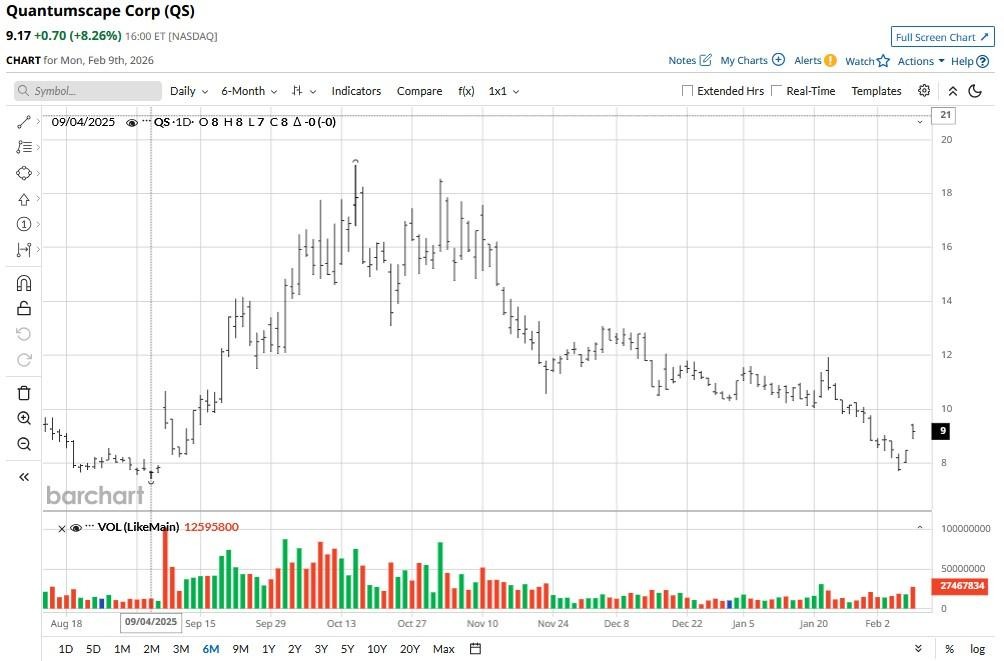

Following the rally on Feb. 9, QS looks headed to challenge its 200-day moving average (MA), a key resistance point. Breaking above this level often accelerates bullish momentum in the near term.

Despite the surge, however, QuantumScape stock remains down some 20% versus its year-to-date high.

Does Eagle Line Warrant Buying QuantumScape Stock?

For years, the bear case hinged on whether California-based QuantumScape can manufacture its solid-state chemistry at scale.

The Eagle Line proves industrial viability by validating the high-speed “Cobra” process, showing the tech is much more than just a lab experiment.

Additionally, it creates the blueprint for licensing deals, enabling partners like Volkswagen (VWAGY) to fund and build massive factories.

The Eagle Line produces B-samples needed for final automotive testing, bringing actual vehicle integration closer than ever.

In short, the production-scale platform warrants buying QS stock as it marks the firm’s transition from “lab” to “line,” positioning it to begin realizing commercial revenue in 2026.

Are QS Shares Worth Buying Heading into Q4 Earnings?

Risk-tolerant investors should consider investing in QuantumScape shares for shrinking losses as well.

The Nasdaq-listed firm is scheduled to report its fourth-quarter (Q4) results on Tuesday, Feb. 11. Consensus is for it to report $0.16 a share of loss, much narrower than the $0.22 loss per share a year ago.

QS’s recent announcement of a joint development agreement (JDA) with another top 10 automaker, expanding its customer base beyond VW, makes up for another great reason to own it for the long term.

How Wall Street Recommends Playing QuantumScape

Despite the Eagle Line announcement, however, Wall Street remains bearish on QuantumScape.

The consensus rating on QS shares sits at “Moderate Sell” with the mean target of $9.55 indicating shares are unlikely to push meaningfully higher from here, at least in the near term.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.