/Facebook%20-AGqzy-Uj3s4-unsplash.jpg)

Meta Platforms (META) is set to do large-scale job cuts this week, according to a story in The Wall Street Journal and widely reported yesterday. As a result, META stock is rallying on hopes that Facebook is finally addressing its overblown structure. That makes its call options quite interesting, as the stock is down one-third in the last month alone.

In fact, in the last 6 months, it is down almost 58% from its peak and is off 72% year-to-date (YTD). That has discouraged many investors in the stock.

Where Its Earnings and Cash Flow Stand

Interestingly, though, the company is still profitable, as it reported $1.26 in quarterly net earnings per share (EPS) on Oct. 26. In fact, it still squeezed out a small positive figure for free cash flow (FCF) for the quarter ending Sept. 30. It generated $173 million in FCF, but this was off dramatically from the $9.547 billion in FCF it made in last year's Q3.

Analysts, however, are not as pessimistic on the stock as the market seems to be. For example, the average of 12 analysts canvassed by Barchart shows an EPS forecast of $9.01 for 2022. So, at today's price of $95.47, this puts META stock on a very cheap 10.6x earnings. However, for next year, they predict $7.76 in EPS, a decline of 13.9% for 2023.

But that still makes META stock very cheap at just 12.3x earnings. Moreover, the average of 38 analysts surveyed by Seeking Alpha is $8.19 for 2023, a decline of just 10% or so from 2022. This puts its 2023 multiple at 11.7x.

Keep in mind that the stock's five-year average multiple is well over 23x, according to Seeking Alpha. This is simply too cheap too ignore. For example, even if the stock reaches a 15x multiple, META stock could rise 28% from here (i.e., 15x/11.7x -1 = 28.2%). That puts its target price at $122.85 (i.e., 15x $8.19). We can use this to look at how attractive its options are now.

Call Options Look Interesting Here

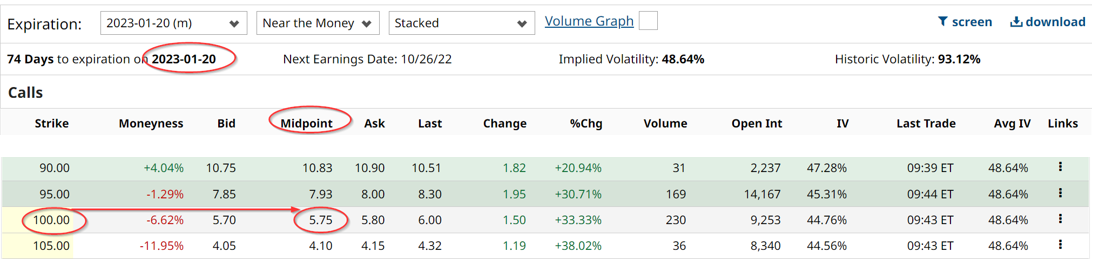

The upside in META stock makes call options attractive here. For example, the $100 strike for the Jan 20 expiration date, which occurs very close to the Q4 earnings results, is only $5.75 at the midpoint.

That implies that the stock has to rise to $105.75 for investors in the contract to break even. That is about a $10 stock price gain on today's price or about 10.4%. Based on our target that the stock could hit a 15x multiple, or $122.85 (see above), this still leaves $17.00 in price gains for the call option investor.

So, by paying $5.75 for the calls, the investor can potentially be worth $22.85 by Jan. 20 (i.e., $122.85-$100 strike price). The potential ROI is there 4x (i.e., $22.85/$5.75).

Keep in mind there are a lot of risks here. Investors could remain pessimistic on the stock. A recession could hit, forcing its earnings estimates even lower. But the astute investor will take stock of this before the call option has lost a good deal of its value and roll it over to the next three-month expiration period. That way they can extend their potential upside in the stock, albeit at a slightly lower ROI.

More Stock Market News from Barchart

- Markets Today: Stocks Climb on Lower T-note Yields and Meta Rally

- Option Volatility And Earnings Report For November 7 - 11

- Pre-Market Brief: Stocks Higher As Focus Shifts to China and Inflation Data

- Stock Market This Week: Five Themes To Watch

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)