/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

Shares in Microsoft (MSFT) fell after a downgrade by Stifel, who reduced its rating to a "Hold" and reduced its price target to $392 from a previous target of $540. This comes at a time when there is a growing sense of caution among investors regarding investments in artificial intelligence (AI) technology, particularly about its ability to drive top-line and bottom-line growth in a sustained manner.

It is not a question of whether AI is real and whether investments in this space make sense from a strategic perspective. The answer to that is a resounding yes. The question is whether these investments can drive sustained top-line and bottom-line growth in a timely manner, particularly regarding supply chain constraints and increasing investments in AI technology internally, particularly regarding its Azure segment.

About Microsoft Stock

Microsoft Corporation is a global technology leader in cloud computing, enterprise software, productivity software, gaming, and AI. The company is based in Redmond, Washington, and its market capitalization is approximately $2.9 trillion, making it one of the largest publicly traded companies in the world.

Over the past 52 weeks, MSFT stock has traded in a range from a low of $344.79 to a high of $555.45. The stock is currently trading at around $412 per share, a result of a moderate decline in its stock price over the past five trading sessions of about 3%. However, a six-month decline of 20% and a drop of 14% year-to-date (YTD) indicate a sharp underperformance compared to its peers. This is a result of growing concerns with AI-related capex spending rather than any fundamental deterioration in its business model.

From a valuation perspective, MSFT stock is trading at a trailing price-earnings ratio of 26.9x and a forward price-earnings ratio of 25.3x. The stock’s current valuation is a bit lower than its recent highs but is still high compared to its historical averages, particularly regarding its margins, which have been impacted by growing capex. The stock’s price-sales ratio is 10.9x.

Microsoft Beats on Earnings, but AI Spending Dominates the Narrative

Microsoft has beaten expectations with its fiscal Q2 2026 earnings announcement, which shows the strength of the company’s operating business despite the debate on the cost of its spending on AI. Its revenues grew by 17% as they reached $81.3 billion, while operating income grew by 21% to reach $38.3 billion. In terms of GAAP, Microsoft saw its EPS grow by 60% to reach $5.16.

Microsoft saw continued momentum in its cloud and AI businesses, with its cloud revenues crossing the $50 billion mark. In this context, Microsoft CEO Satya Nadella said that AI is not a future optionality story; rather, it is already becoming a material business at scale.

However, Stifel downgraded MSFT stock due to its future prospects rather than its current performance. Analyst Brad Reback said that the company is looking at spending as much as $200 billion in capital expenditures in fiscal 2027, which is close to Google’s (GOOG) (GOOGL) projected range for 2026. In this context, he said that gross margins will decline to 63%, as opposed to the earlier expectation of 67%, as the company enters a new phase of investment.

The key concern here is the company’s Azure segment. Supply chain pressures, increased allocation to first-party AI workloads, and increasing pressure due to Google Gemini and Anthropic’s enterprise success are all affecting the company’s ability to accelerate its Azure segment growth.

What Do Analysts Expect for MSFT Stock?

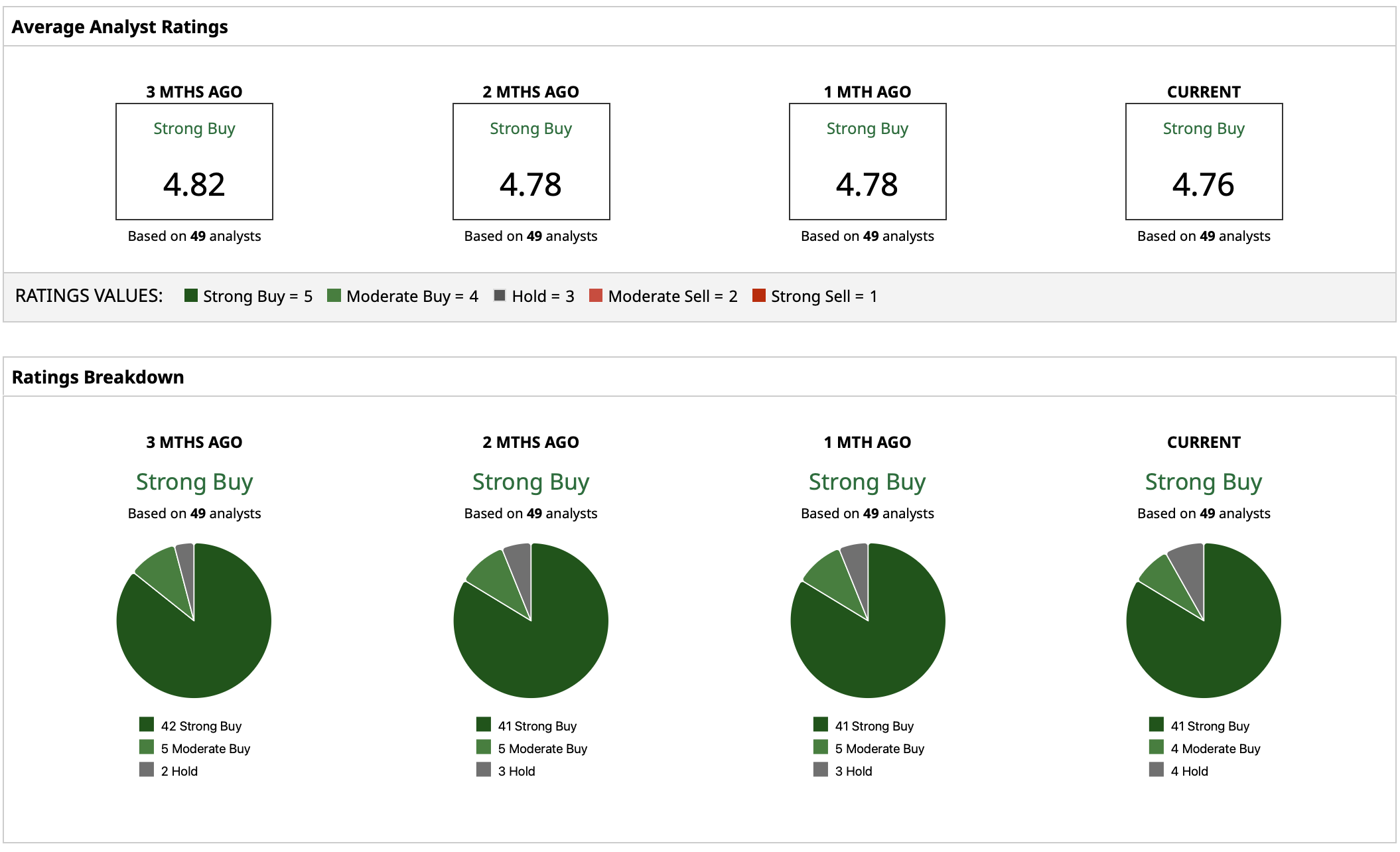

While Stifel has downgraded MSFT stock, Wall Street is still quite positive on Microsoft with a “Strong Buy” rating consensus based on a broad base of analysts covering the stock. According to estimates, the mean target on the stock is $599.28 based on a range of estimates. This suggests that there is a good amount of room to run if growth estimates are ultimately realized.

However, it is interesting to note that the range of estimates on the stock is growing, with a target ranging from a low of $392 to a high of $678. Investors may not be able to re-rate MSFT until they see a slowing down of capex growth rates relative to Azure growth rates.

On the date of publication, Yiannis Zourmpanos had a position in: MSFT . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)