Marathon Petroleum (MPC) produced huge EBITDA and cash flow results in Q3. Moreover, its recent dividend hike, buyback activity, and cheap valuation metrics make its stock look attractive. This signals a potential upside in MPC stock and opportunities with options income plays.

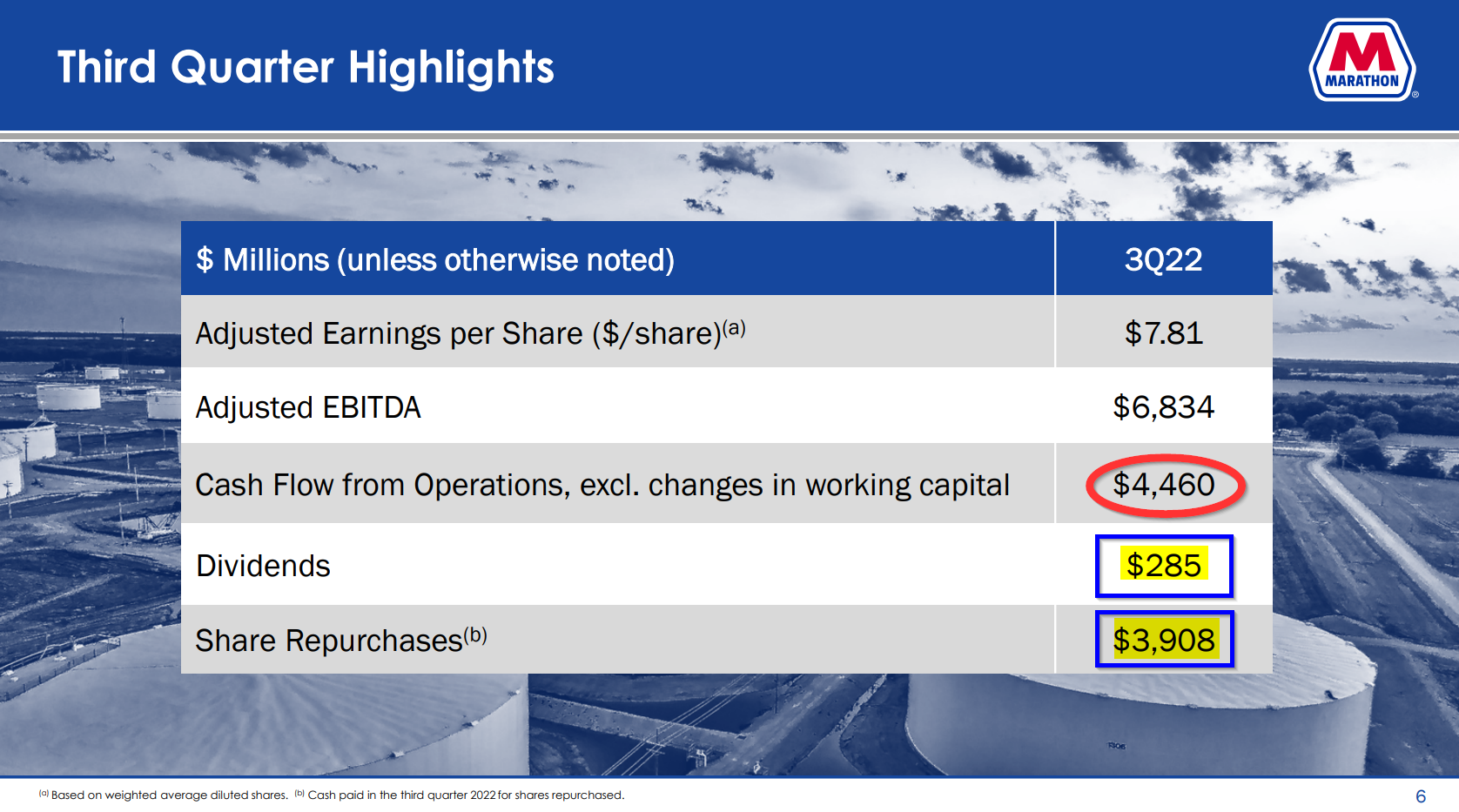

On Nov. 1, Marathon Petroleum, an oil and gas refiner not to be confused with Marathon Oil and Gas (MRO), an oil and gas producer, reported excellent Q3 results. Its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) came in at $6.8 billion, reflecting improving operational and commercial execution.

Strong Cash Flow Leads to Higher Dividends and Good Buyback Activity

In addition, the company still produced a very strong adjusted cash flow from operations (CFFO) of $4.46 billion during Q3. It used this adjusted CFFO to raise the dividend by 30% to 75 cents per share. In addition, the adjusted CFFO was used to buy back almost $4.0 billion of its common stock shares ($3.9 billion).

Moreover, the company said it completed $15 billion in capital return to shareholders. Marathon Petroleum indicated it is going to start further buybacks on its remaining $5 billion in share buyback authorization starting in November.

Where This Leaves Investors in MPC Stock

MPC stock closed on Nov. 2 at $118.20 per share, up 3.0% for the day after the results were announced the day before. So far in the last month, the stock is up over 17% and YTD it's up over 80%.

But with the 30% dividend hike MPC stock now has a dividend yield of 2.54% (i.e., $3.00 annualized dividend per share / $118.20. Moreover, analysts project it will make $25.81 per share year in earnings, putting MPC stock on a cheap forward multiple of just 4.6x earnings. That is a very low multiple, especially compared to its historical average of over 13.7x, according to Seeking Alpha.

The bottom line is investors can expect to see further gains in the stock as its cash flow stays strong from high oil and gas prices.

Option Income Plays

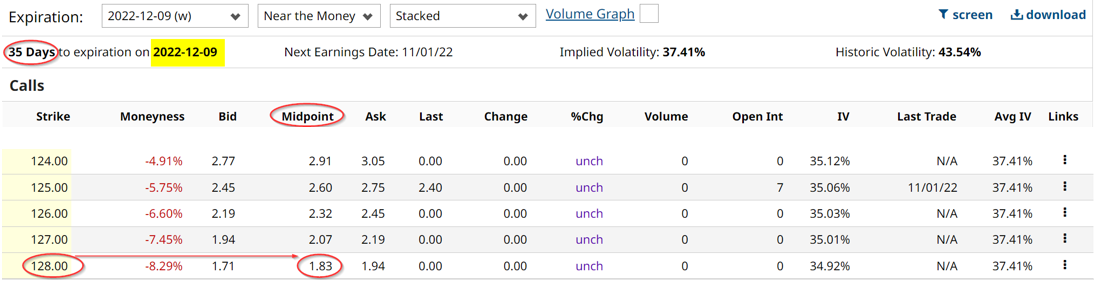

MPC stock offers good option income plays. The out-of-the-money (OTM) call options one month out have very high premiums, indicating that investors expect the stock to keep rising. For example, the Dec. 9 expiration contracts show that the call options at the OTM strike level of $128, or almost $10 over today's price have a midprice of $1.83 per contract.

That implies that the covered call investor can make 1.55% by selling call options at that level, for expiration 35 days from now (i.e., $1.83/$118.20 stock price). This means that if the stock rises by 8.29% from $118.20 to $128.00, the covered call investor will be able to keep that gain when his shares are exercised at $128. So the total gain will be 8.29% + 1.55% or 9.84%, almost 10% in one month. Even if the stock does not rise as high as $128 by Dec. 9, the investor keeps the gain in his underlying shares, plus the $1.83 received from the sale of the covered calls contract. That is a decent deal for most investors.

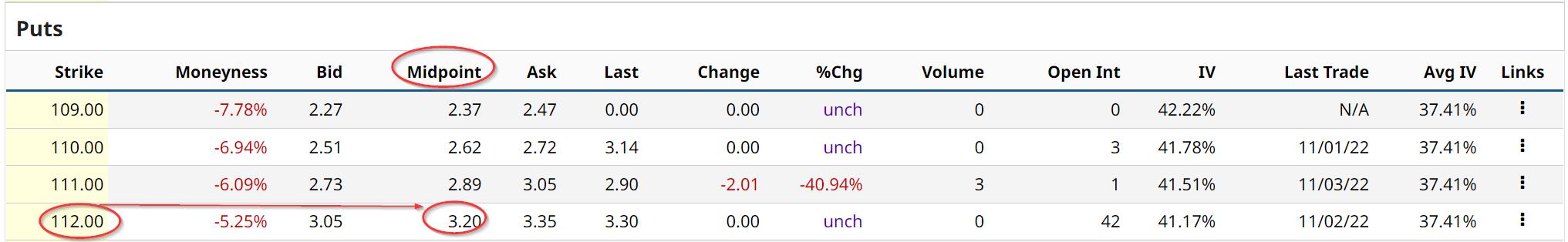

Moreover, some investors like to sell OTM puts that are covered by cash put up with the brokerage firm in order to make more income. For example, the $112.00 strike price puts for the same expiration offer an even higher premium of $3.20.

This represents a further 2.86% in potential income to the investor (i.e., $3.20/ $112.00 strike price). However, the OTM short put investor must put up the full cost of the $112.00 strike price, i.e., $11,200 per contract with the brokerage firm, until the contract expires or is exercised (assuming the stock falls 5.25% to $112.00. In addition, the cash-secured put investor will not be able to make any capital gains as can the covered call investor. This is why sometimes investors do both covered calls and cash-secured puts for the same expiration period - in order to maximize income plays.

By the way, there is a silver lining in the latter case. If the cash-secured put investor is forced to buy the stock at $112.00, he can then turn around and sell covered calls for the next expiration period. So there is a way to make additional income out of this unfavorable turn of events. (This is known as a “wheel” strategy).

The bottom line here is that MPC stock looks very attractive and is showing very good options income plays to bargain investors.

More Stock Market News from Barchart

- Stocks Fall on the Outlook for Tighter Fed Policy

- Markets Boost Rate-Hike Expectations after FOMC Meeting Outcome

- Stocks Fall on Hawkish Fed Policy Outlook

- Markets Today: Stocks Slump on Hawkish Fed and Weakness in Tech Stocks

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)