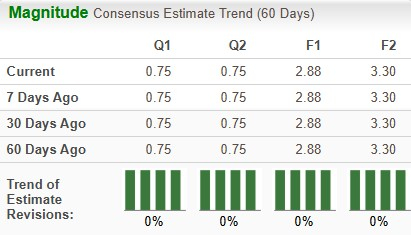

Arista Networks, Inc. ANET is scheduled to report fourth-quarter 2025 earnings on Feb. 12. The Zacks Consensus Estimate for revenues and earnings is pegged at $2.37 billion and 75 cents per share, respectively. Earnings estimates for Arista for 2025 and 2026 have remained steady at $2.88 per share and $3.3 per share, respectively, over the past 60 days.

Image Source: Zacks Investment Research

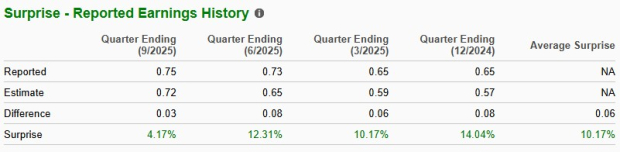

Earnings Surprise History

The communications components provider delivered a four-quarter earnings surprise of 10.17%, on average, beating estimates on each occasion. In the last reported quarter, the company pulled off an earnings surprise of 4.17%.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model does not predict an earnings beat for Arista for the fourth quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Arista currently has an ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Shaping the Upcoming Results

During the quarter, Arista introduced the next-generation family of R4 Series platforms for AI, data center (DC) and routed backbone deployment. With a broad portfolio of fixed and modular solutions for scalable and multiple use cases, the R4 family of routers helps customers reduce the total cost of ownership while ensuring high performance, low AI job completion time, low power consumption and integrated security.

It also introduced a new technology that will help enterprises build large, reliable, cloud-managed Wi-Fi networks in universities, hospitals, and corporate campuses. Arista’s new Virtual Ethernet Segment with Proxy ARP (VESPA) enables enterprise customers to create a large roaming domain, allowing users to move across campus without disconnections. Such innovative product launches are expected to have a favorable impact on the upcoming results.

In the to-be-reported quarter, Arista has collaborated with Fortinet to provide a Secure AI Data Center Solution, designed to help organizations deploy and scale high-performance, secure AI infrastructure efficiently. The solution combines Arista’s fast, low-latency networking with Fortinet’s hardware-accelerated security to deliver a safe, scalable, zero-trust architecture for AI data centers. Such customer wins are expected to be reflected in the upcoming results.

Arista continues to enhance its existing product line and develop new technologies and products that address emerging technological trends, evolving industry standards and changing end-customer needs. These raise operating costs and strains margin.

Price Performance

Over the past year, Arista shares have gained 14.3% against the industry’s decline of 18.9%, outperforming peers like Hewlett Packard Enterprise Company HPE but underperforming Cisco Systems, Inc. CSCO. Hewlett Packard has gained 10.1%, and Cisco soared 35% during this period.

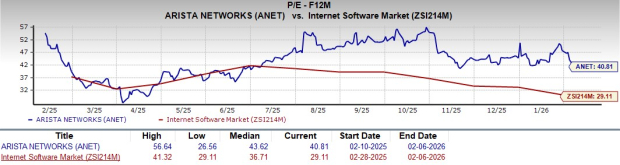

Image Source: Zacks Investment Research

Key Valuation Metric

From a valuation standpoint, Arista appears to be trading at a premium compared to the industry and above its mean. Going by the price/earnings ratio, the company shares currently trade at 40.81 forward earnings, higher than 29.11 for the industry but lower than the stock’s mean of 43.62.

Image Source: Zacks Investment Research

Investment Considerations

Arista is witnessing solid market traction across its comprehensive data-driven network platforms. The company’s innovation strategy is focused on improving compute capabilities and GPU utilization through improved Etherlink architecture. In this domain, Arista is actively collaborating with the worldwide market leader in GPU, NVIDIA.

By combining Arista’s network platforms with NVIDIA’s compute platforms, the collaboration aims to develop a streamlined AI data center ecosystem that delivers effective coordination between AI networking and AI compute infrastructure. However, Arista has emphasized creating a broad and open ecosystem which will include other major players in this domain, such as AMD, Anthropic, Arm, Broadcom, OpenAI, Pure Storage and Vast Data. The company is set to gain from rapid growth in the AI networking space. However, in this domain, the company faces competition from Cisco and HPE, who are also rapidly expanding their portfolio to capitalize on this emerging market trend.

The company places a strong focus on expanding operating cash flow. Efficient working capital management, inventory management and optimized cost structure will continue to drive cash flow. However, the company is exposed to customer concentration risks. It derives a substantial portion of its revenue from a limited number of large customers. Any change in demand patterns of these clients can significantly affect the top line and cash flow.

End Note

Arista continues to boast a leadership position in the Data Center and Cloud Networking vertical. The company introduced various solutions for cloud, Internet service providers and enterprise networks to meet the rising demands of AI/ML-driven network architectures. These innovations are allowing the company to deliver a superior customer experience and increase customer engagement. However, growing competition from other industry leaders and rising operating expenses are weighing on margins. Customer concentration risks remain a concern.

ANET appears to be treading in the middle of the road, and new investors could be better off if they trade with caution. However, a single quarter’s results are also not so important for long-term stakeholders and investors already owning the stock could stay put to reap long-term benefits.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).