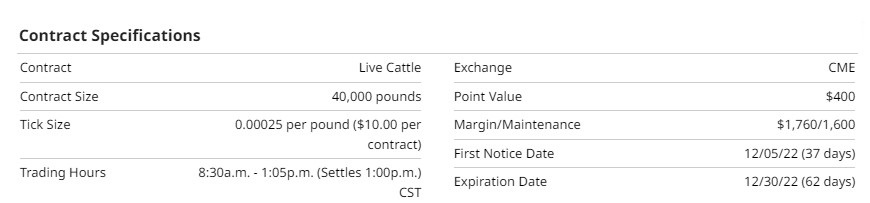

Specifications and Statistics

Live cattle futures began trading on the Chicago Mercantile Exchange (CME), now part of the Chicago Mercantile Group Exchange (CMEGroup), in 1964. Live cattle futures were the first non-storable commodity, such as grains, traded on US exchanges. Hedgers welcomed the futures contract as they face several factors impacting the supply and demand of the live cattle market. Long feeding periods, weather, feed prices, fuel prices, and consumer sentiment can affect profit margins.

Hedgers and speculators both use live cattle futures contracts. Cattle producers, feedlot operators, and merchant exporters can hedge selling physical livestock through live cattle futures and allow a producer's price risk to be managed. Conversely, meat packers and merchant importers can hedge future buying prices of physical live cattle. Trend-following speculators will drive prices up to the producers to sell contracts and down to the processors to buy contracts.

Understanding the physical commodity life cycle will help traders understand the seasonality and breeding/feeding seasons. Alternative trading opportunities, such as products used to feed livestock, can be found. Barchart publishes this information provided by CRB Yearbook on its website:

The beef cycle begins with the cow-calf operation, which breeds the new calves. Most ranchers breed their herds of cows in summer, thus producing a new crop of calves in spring (the gestation period is about nine months). This allows the calves to be born during the milder spring weather and provides the calves with ample forage through the summer and early autumn. The calves are weaned from the mother after 6-8 months, and most are moved into the "stocker" operation. The calves usually spend 6-10 months in the stocker operation, growing to near full-sized by foraging for summer grass or winter wheat. When the cattle reach 600-800 pounds, they are typically sent to a feedlot and become "feeder cattle." The feedlot feeds the cattle with a particular food mix to encourage rapid weight gain. The mix includes grain (corn, milo, or wheat), a protein supplement (soybean, cottonseed, or linseed meal), and roughage (alfalfa, silage, prairie hay, or an agricultural by-product such as sugar beet pulp). The animal is considered "finished" when it reaches full weight and is ready for slaughter, typically at around 1,200 pounds, which produces a dressed carcass of about 745 pounds. After getting to full weight, the cattle are sold for slaughter at a meatpacking plant.

Live cattle futures are very liquid, with an average daily volume of 65K contracts and cumulative open interest of approximately 300K.

The CMEGroup trades live cattle futures from 08:30 to 13:05 CT, Monday morning to Friday afternoon. Traders should take note of the short trading hours of the futures contract. When markets have short trading sessions, there is always the risk of a gap opening, causing slippage when exiting a trade. Many traders don't like holding equity trades overnight because the market is only open for 6.5 hours daily, increasing the risk of a gap opening. The livestock market is only available for 4 hours and 35 minutes daily. Futures are a leveraged asset, and the extra losses on slippage increase tremendously.

As of this writing, the front month December live cattle contract is trading at $153.00 per hundredweight (cwt). CWT equals 100 lbs. Otherwise, live cattle would be trading at $1.53 per pound wholesale. Data providers quote the livestock markets in cwt. Conversely, the CMEGroup contract specification shows a minimum tick of .00025 cents per pound; multiplying this by 100 results in a minimum tick of .025 cents per tick. Each .025 tick is worth $10.00 per contract.

The current notional value of the contract is $61,200. Margin requirements to trade live cattle futures are $1,600 per contract creating leverage of 38:1. Prices are currently trading at contract highs and nearing an all-time high price of $172.750 per cwt made in November 2014. The volatility and risk will increase as prices increase, leading to higher margin requirements from the exchange.

The contract has been in a broad trading range since February 2022 and is now breaking out to the upside. During the past 3-months live cattle futures have increased by 3.5%. Year-to-date, the market has returned 5.75%.

Fundamentals Affecting the Market

There is already some speculation that demand from consumers at these high prices is beginning to wane. Consumers may switch their choice of meat flavors until beef prices decline. With corn prices rallying, the price per pound to raise live cattle is steadily increasing. Additionally, the price of diesel fuel will start to add more cost to cattle production. Lower demand due to higher prices and a seasonal drop in demand due to the holidays, and we could see lower cattle prices: nothing extreme, but certainly enough to attempt to bring the consumer back in 2023.

Technicals

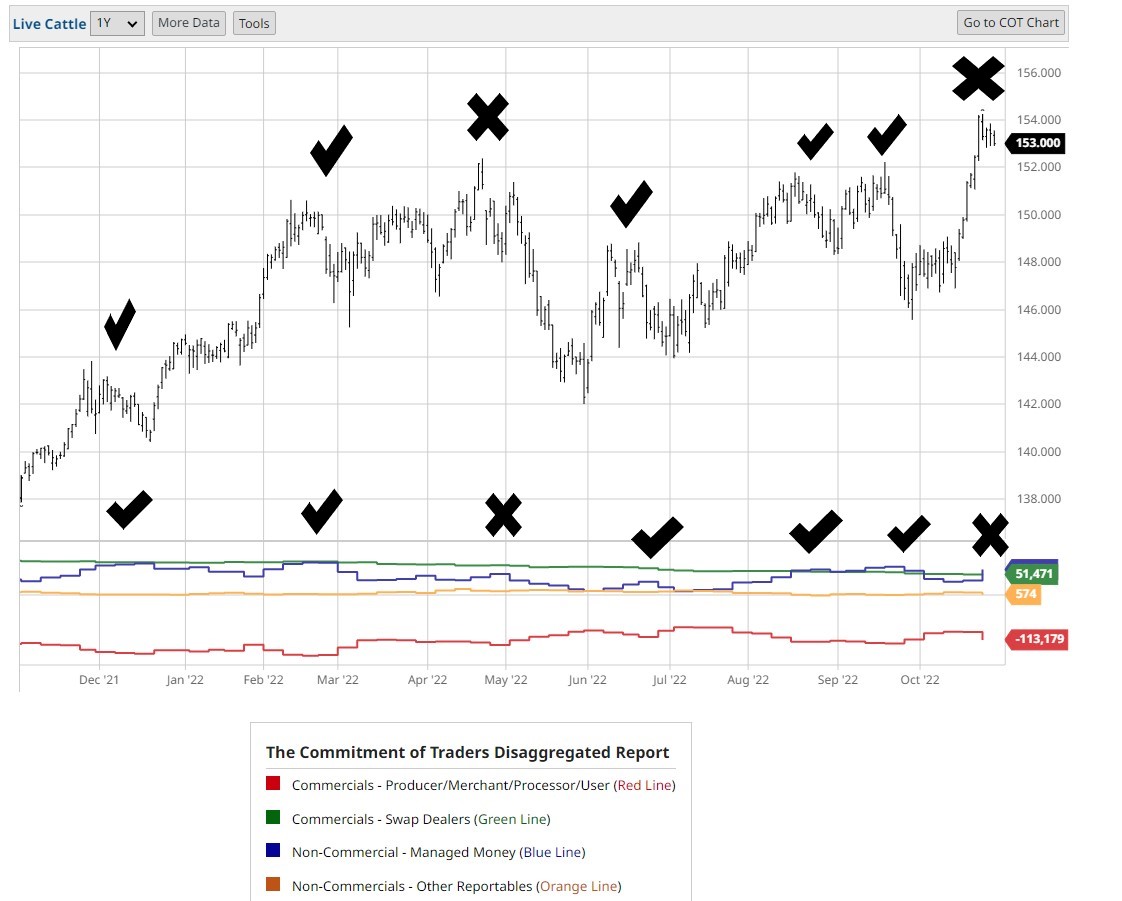

Live cattle futures have been trading in a broad range since February 2022 and appear to be breaking out. A contract high in futures is viewed similarly as a 52-week high in the equity markets. When the price makes contract highs, the momentum traders come in to buy. The question becomes, are the traders buying this market the strong hands?

Seasonal Patterns

Moore Research Center, Inc (MRCI) has researched the cash steer market and found that over the past 15 years, live cattle prices have declined into Thanksgiving and Christmas holidays, with a brief rally between the two holidays. While there are some opportunities for selling live cattle futures due to the holidays, the more significant trading opportunity appears to be a seasonal buy towards the end of December, and the trend possibly continues into March & April.

The Commitment of Traders (COT) Report

The COT report shows an interesting divergence between new highs in price and managed money not making new highs.

December 2021 showed prices making new highs, and each time managed money (blue line) added to their long positions. In April, a divergence between new price highs and managed money new longs resulted in a decent price correction in May. The rally to new highs recently has the same divergence. Managed money follows trends and has failed to make a new position high. Managed money did put on a prominent position last week, as seen by the blue line turning up. But, even with such a significant new long position, there is still a divergence. Next week's COT report will help determine if managed money has control of this trend. In the meantime, we could see a failed trading range breakout.

ETNs and Futures Contracts to Participate in Live Cattle

The standard live cattle futures contract (LE) is the only futures contract available. At this time, there are no micro or mini contracts. Options on the standard futures contracts are available.

For equity traders, there is an exchange-traded note (ETN) symbol, COW. Trading COW is not directly related to the live cattle futures as a portion of the COW index is the lean hog futures contract. COW has a meager volume averaging 7K shares daily. The expense ratio is .45%.

Summary

Live cattle are trading at high prices, slowing consumer demand for beef products. As we begin to trade in November, the live cattle market has shown seasonal tendencies for lower prices. Except for the price rally between Thanksgiving and Christmas. The COT report showed a divergence between managed money (trend followers) long positions and the live cattle price.

Aggressive traders could wait for a downtrend to start and look for shorting opportunities as the data identifies possible price weakness soon in live cattle.

In late December, be prepared for uptrends to begin, confirmed by the COT report and price action lasting into the March-April timeframe.

More Livestock News from Barchart

- Hogs Rebound into Weekend

- Cattle Market Fades on Friday

- Cattle Down on Stronger Feeders

- Hogs Firming up on Friday

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)