- December 2022 corn options expire on Friday, November 25 meaning there is exactly four weeks remaining for traders to play in this market.

- A tendency of most option markets is to expire causing the most pain, or in other words with the majority of outstanding contracts having no value.

- As of today, for the December 2022 corn futures contract that would be roughly $6.50.

A look across the market landscape midday Friday tells us there is a great deal of uncertainty heading into this weekend, and rightfully so. The presidential run-off election in Brazil is scheduled for this Sunday so we know the world’s largest soybean buyer[i] will be keeping a close eye on the outcome, if not playing a direct role. The same can be said about Russia and US mid-term elections next week, needing a regime change so desperately the Madman Across the Water (Putin) might just resort to using nuclear weapons[ii]. Meanwhile, the debate over global inflation and record profits for both global grain and oil industries is only going to get hotter. Yes, I could’ve spent thousands and thousands of words trying to cover all this, so instead, I’m going to take a lighter approach and wait to see what happens this weekend.

Let’s talk about December corn (ZCZ22) options. I know, that’s like someone knocking on your door and asking if you have three hours to talk insurance. If you haven’t already clicked away from this piece, thank you because there is an interesting situation brewing as October comes to an end.

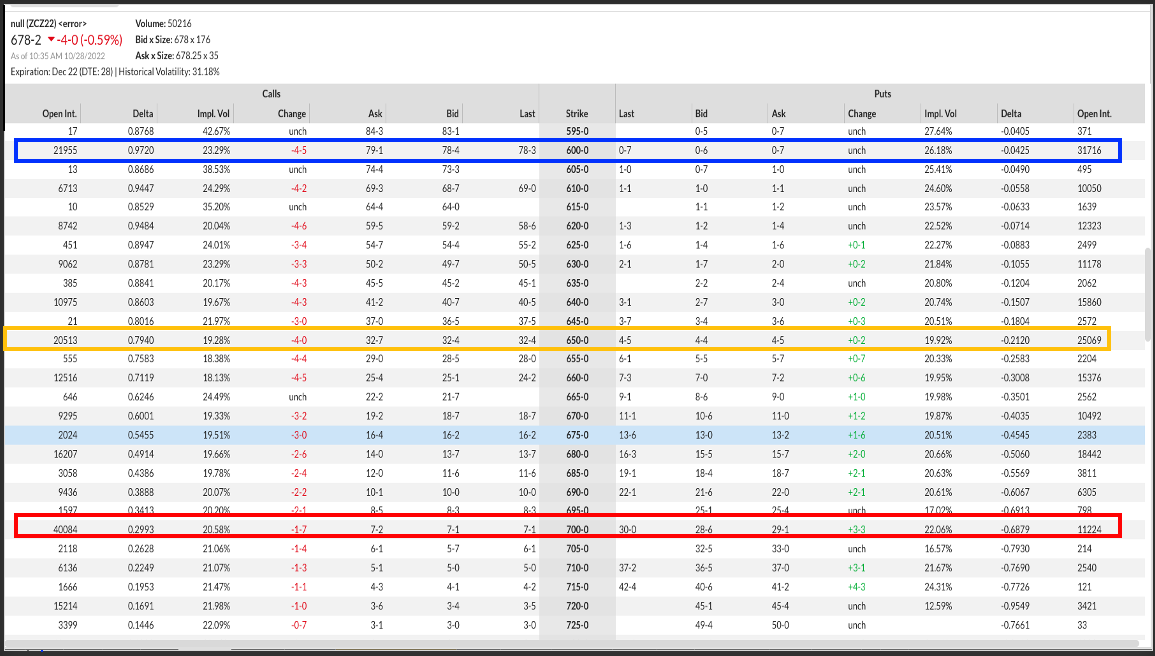

An initial look at the Barchart Options Chain table might give you flashbacks to the last time someone put an actuary table in front of you but bear with me for a moment. The last trading day for December corn options is Friday, November 25, meaning there are 28 days remaining for traders to play. To the equation we can add the tendency for any option market to cause the most pain, meaning expiring at the price level that takes the majority of open contracts down to $0. Another look at the attached table shows us Dec corn $6 options (combined puts and calls) are showing open interest of roughly 54,000 contracts, the $6.50 options 45,500 contracts, and the $7 options 51,300 contracts.

If we look even closer we see the two options with the largest open interest being $6 puts at about 32,000 contracts and $7 calls at approximately 40,100 contracts. Before we continue down this merry path, recall corn’s characteristic Round Number Reliance[iii] as we are now dealing with three big numbers of $6.00, $6.50, and $7.00.

Assuming options like to cause the most pain possible, a $6.50 target for the Dec22 futures contract at option expiration stands out like a beacon. Theoretically, based on today’s open interest numbers, if Dec22 posted a close of $6.50 on November 25 it would mean the long $6 puts, $7 calls, and all the $6.50 options would go off at $0. That would be roughly 120,000 contracts or roughly 600-million-bushel worth of options, not to mention the other strike prices that would also finish with no value.

From a technical point of view, is $6.50 a reasonable target? If we use the Dec22 weekly close-only chart as a guide, and assume the contract put in its seasonal high weekly close the second week of October and market fundamentals remain bullish, the downside target looks to be near $6.40. So yes, I’d say $6.50 could be considered a reasonable target for the last weekly close of November (dashed gold line).

[i] No, not Spain. Though it was good to see it book some 2022-2023 soybean supplies Friday morning.

[ii] Putin was recently quoted as saying there is “no need” to deploy such weapons (nuclear) in Ukraine. This can be taking a number of ways, including they have already been deployed. As for use, if he says he won’t it means he will.

[iii] The various aspects of the corn market tend to search out support and resistance at round numbers. And like moths to a flame, the bigger and brighter the round number (in this case $6, $6.50, and $7) the more it attracts the market.

More Grain News from Barchart

- Weaker Wheat Markets into Friday

- Corn Red at Midday

- Redness in Soy Market

- Wheats End Red on Thursday

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)