Merck (MRK) has been one of the strongest stocks in the past few months.

MRK is rated a Strong Buy and The Barchart Technical Opinion rating is a 56% Buy with strengthening short term outlook on maintaining the current direction.

Rather than just buying the stock, savvy traders can use the options market to find smart ways to trade Merck stock without risking too much capital.

Today, we’re going to look at a couple of bull call spread trades on Merck stock.

Here are the parameters for finding some bull call spread trade ideas on MRK.

- Symbol equals MRK

- Break Even Probability above 40%

- Moneyness Leg 1 -10% to 0%

- Days to expiration 30 to 150

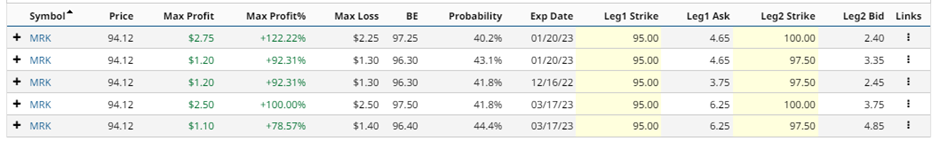

Here are the results of that particular screener:

Let’s analyze some of these ideas.

Bull Call Spread 1: January 95-100 Bull Call Spread

As a reminder, A bull call spread is a bullish defined risk option strategy. To execute a bull call spread an investor would buy a call option and then sell a further out-of-the-money call.

Let’s use the first line item as an example. This bull call spread trade involves buying the January expiry 95 strike call and selling the 100 strike call.

Buying this spread costs around $2.25 or $225 per contract. That is also the maximum possible loss on the trade. The maximum potential gain can be calculated by taking the spread width, less the premium paid and multiplying by 100. That give us:

5 – 2.25 x 100 = $275.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 122.228%.

The probability of the trade being successful is 40.2%, although this is just an estimate and does not indicate the probability of achieving the maximum profit.

The spread will achieve the maximum profit if MRK closes above 100 on January 20th. The maximum loss will occur if MRK closes below 950 on January 20, which would see the trader lose the $225 premium on the trade.

The breakeven point for the Bull Call Spread is 97.25 which is calculated as 95 plus the $2.25 option premium per contract.

Bull Call Spread 2: March 95 – 97.50 Bull call Spread

The last example involves buying the 95 March call and selling the 97.50 call.

Buying this spread costs around $1.40 or $140 per contract. That is also the maximum possible loss on the trade. The maximum potential gain can be calculated by taking the spread width, less the premium received and multiplying by 100. That give us:

2.50 – 1.40 x 100 = $110.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 78.57%. The probability of the trade being successful is 44.4%. The spread will achieve the maximum profit if MRK closes above 97.50 on March 17.

The maximum loss will occur if MRK closes below 95 on March 17, which would see the trader lose the $140 premium.

The breakeven point for the Bull call Spread is 96.40 which is calculated as 95 plus the $1.40 option premium per contract.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

For a bull call spread, setting a stop loss of 50% of the premium paid is a good idea. In the first MRK example above, that would be a loss of around $110. For the second example, the stop loss would be around $70.

Traders may also consider a stop loss if MRK 7-8% from the entry point.

Merck is due to report earnings in late October, so some traders my prefer to close the trades before then.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Surge on Strength in Bank and Tech Stocks

- Roku Might Not Benefit from Netflix Optimism

- Stocks Jump on Lower Bond Yields and Strength in Bank and Tech Stocks

- McDonald's 10% Dividend Hike Foreshadows Good News For Q3

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)