McDonald's Corp (MCD) raised its quarterly dividend by 10.1% on Thursday, Aug. 13, from $1.38 per share to $1.52. That gives MCD stock a 2.50% dividend yield based on Friday's close ($6.08/$243.16). This portends good news for the fast-food company's upcoming Q3 earnings results scheduled for release on Oct. 27.

So far this year MCD stock is off about 9.5%, so the dividend hike is good news for investors. Moreover, the stock is off 8.7% from its recent peak in Aug of $266.19. But if it foreshadows significantly higher earnings and free cash flow (FCF) for Q3, the stock could make a rebound.

Historically Cheap

As it stands the dividend hike now gives McDonald's a historically high yield. For example, in the last four years, MCD stock has averaged 2.28%, according to Seeking Alpha. This implies the stock could rise to $264.35 or 8.7% higher.

Moreover, analysts project McDonald's will report earnings per share (EPS) of $9.82 for the year ending Dec. 2022 and $10.53 for 2023. That puts MCD stock on a forward price-to-earnings (P/E) multiple of 23x.

That is well below its historical average of 24.8x, plying the stock could rise 7.9%.

These numbers show that the stock is undervalued from its historical averages. But not that much. What will really move the stock is a huge gain in earnings or free cash flow.

Option Income Plays

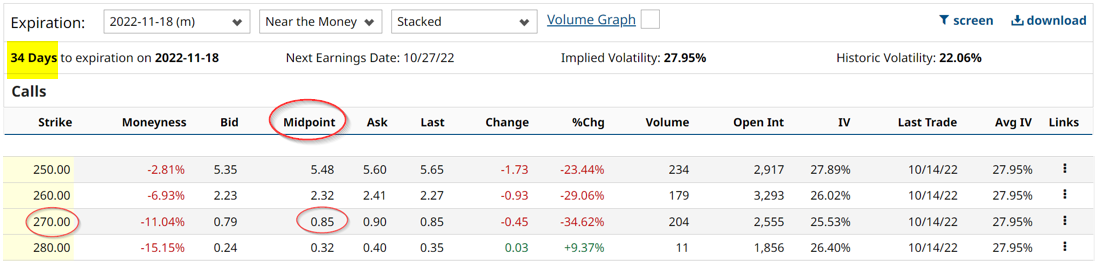

McDonald's offers reasonable covered call option income plays. For example, the Nov. 18 call option chain shows that the $270 strike price offers a premium of 85 cents.

That represents an immediate gain of 0.35% (i.e., $0.85/$243.16) for an option 34 days in the future. That works out to an annualized return of 4.2%, assuming this out-of-the-money (OTM) covered call play can be repeated every month. However, if MCD stock rises to $270 by Nov. 18, after the earnings are out, the investor will gain an additional 11% capital gain.

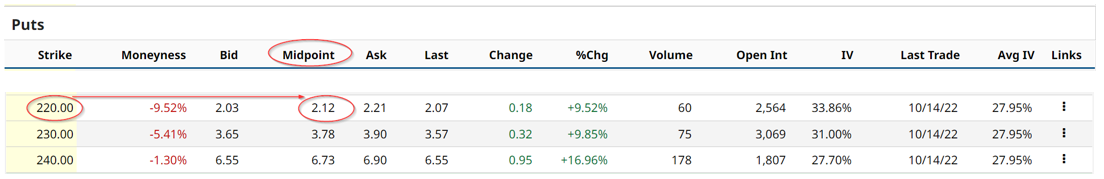

In addition, MCD put options for Nov. 18 show that the $220 strike price, which is over $23 below today's price, still offers a premium of $2.12 per contract for Nov. 18.

This means that the investor would make a 0.96% return on if they sell cash-secured puts at the $220 strike price. That assumes that McDonald's Corp stock will fall to this price by Nov. 18. However, even if that doesn't happen the investor in the OTM puts would make no capital gain. This is why some investors do both the OTM covered calls and OTM cash-secured puts for the same expiration period.

The bottom line here is that if McDonald's reports good earnings at the end of the month the stock is likely to move to its former heights.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)