MicroStrategy (MSTR) has had a bruising week as a leverage flush sent Bitcoin (BTCUSD) tumbling to a multi-year low of $60,000, dragging the stock down with it.

An alarming fourth-quarter net loss of $12.4 billion, driven by mark-to-market accounting on its massive digital hoard, spooked short-term traders in recent sessions.

At the time of writing, MicroStrategy stock is down more than 25% versus its year-to-date high.

MicroStrategy Stock Is Trading at a Discount

The ongoing weakness in MSTR stock has crashed its market valuation below its net asset value (NAV) this month.

This means that investors have a rare opportunity to load up on the world’s largest corporate BTC treasury at a significant discount.

With more than 700,000 Bitcoin on the books, MicroStrategy now owns about 3.4% of all BTC that will ever exist. Meanwhile, options data for the near term is skewed to the upside as well.

Contracts expiring Feb. 20, have the upper price set at about $151 currently, indicating the crypto stock could rally nearly 12% over the next two weeks.

Why Else Are MSTR Shares Worth Owning

MicroStrategy shares are worth buying on the dip also because it entered the new year with a $2.25 billion cash reserve, which provides a 30-month safety net for debt and dividend obligations.

Moreover, Bitcoin exchange-traded fund (ETF) outflows have slowed as well, signaling a rebound is brewing that may push MSTR back above its 20-day moving average (MA) currently at the $154 level.

It's also worth mentioning that historically (over the past 16 years), this cryptocurrency stock has closed both February and March in the green, a seasonal trend that makes it even more attractive to own in the near term.

These insights are particularly significant given MicroStrategy’s chief executive, Phong Le, also expressed strong confidence in BTC’s long-term potential in a recent CNBC interview.

What’s the Consensus Rating on MicroStrategy

While MicroStrategy has been a big disappointment for investors in recent months, Wall Street analysts remain bullish as ever on the Bitcoin proxy.

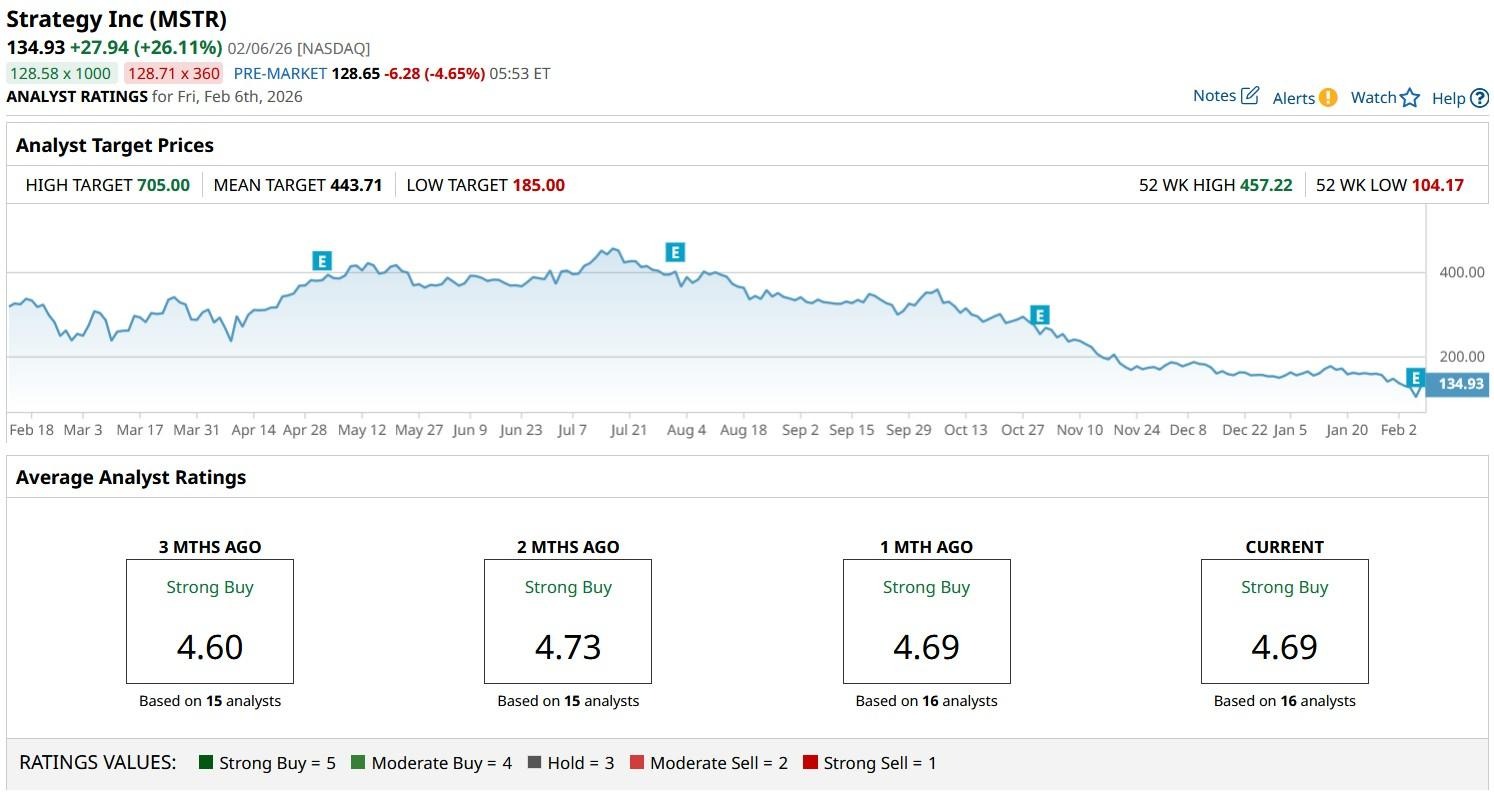

The consensus rating on MSTR shares sits at a “Strong Buy” currently, with the mean target of about $444 indicating potential upside of more than 200% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.