Rising US interest rates and an appreciating US dollar are historically bearish for precious metals prices. Higher interest rates increase the cost of carrying precious metals positions and make fixed-income investments more attractive. In Q3, the US 30-Year Treasury bond futures fell 8.61% and were 21.17% lower over the first nine months of 2022. Rising US interest rates also cause the US dollar to appreciate against other world reserve currencies. Since the US dollar is the benchmark pricing mechanism for precious metals, a rising dollar tends to weigh on prices.

Moreover, the US dollar index has the most significant exposure to the euro currency at 57.6%. War on Western Europe’s doorstep put additional pressure on the euro versus the US dollar, which fell below parity against the US currency for the first time since 2002 in Q3. The dollar index rose 7.29% in Q3 and was 17.25% higher since the end of 2021 on September 30, reaching a two-decade high.

Gold, silver, platinum, and rhodium prices declined, while palladium posted a double-digit percentage gain, causing the sector to lead the commodity asset class over the three months.

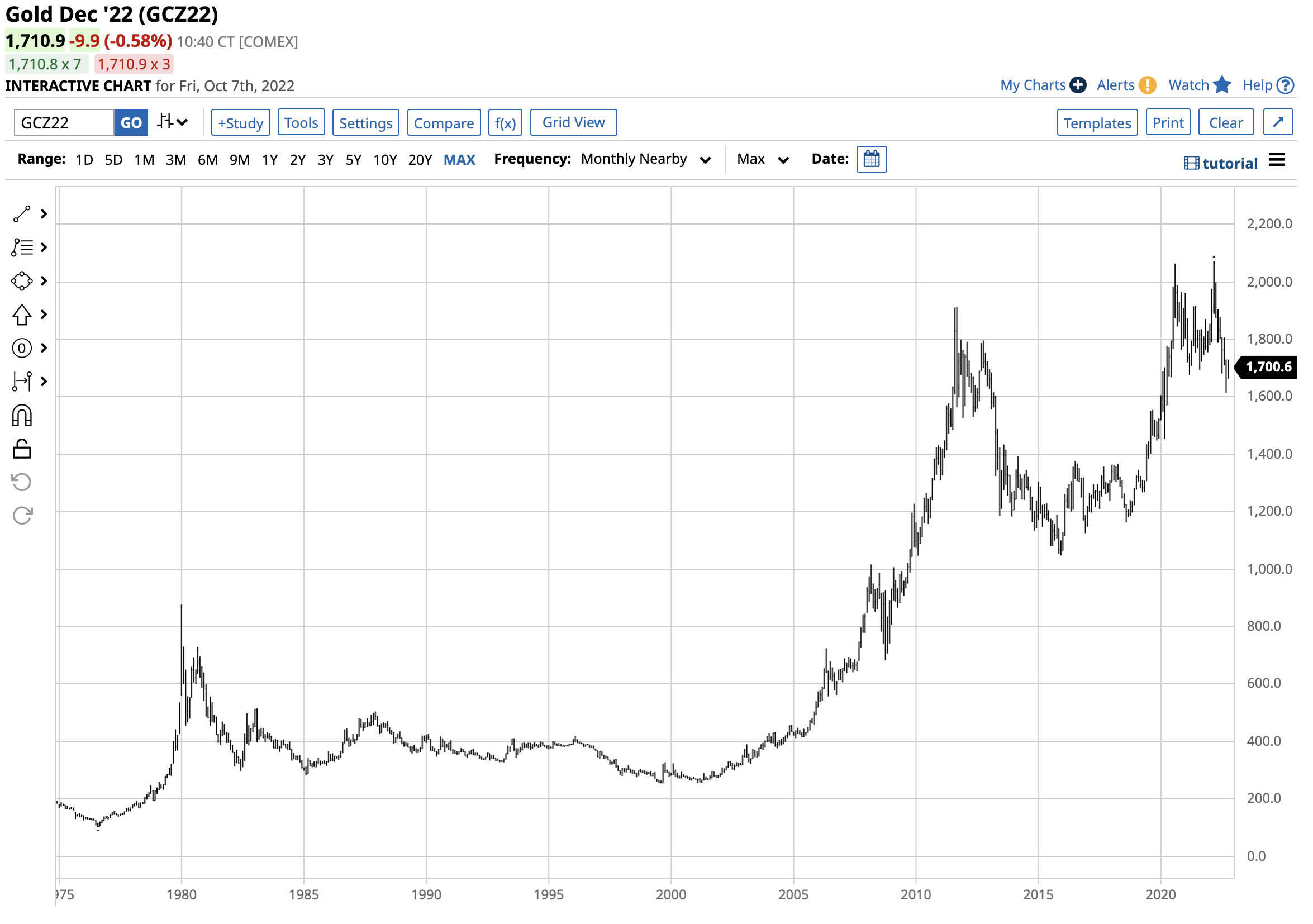

Gold moves lower after reaching a record high earlier this year

Nearby COMEX gold futures reached an all-time high of $2,072 per ounce in March 2022. Since then, the leading precious metal has made lower highs and lower lows.

The chart shows that gold futures corrected and display a short-term bearish pattern. However, the long-term trend since the 1970s remains bullish. In Q3, gold futures fell 7.83% and were 9.09% lower over the first nine months of 2022. While gold declined 3.51% in 2021, the precious metal gained 24.42% in 2020. Nearby gold futures settled at the $1,662.40 level on September 30, 2022, and the December futures contract was higher at around the $1,710 level on October 7.

Silver falls but outperforms gold

Silver tends to be far more volatile than gold, outperforming gold during bullish periods and underperforming during price corrections. However, silver slightly outperformed gold in Q3 2022 with a 6.13% decline.

The chart illustrates that while silver fell less than gold on a percentage basis in Q3, the 18.47% decline over the first three quarters of 2022 underperformed gold. Nearby silver futures settled at $19.039 per ounce on September 30 and were higher at around $20.35 per ounce on October 7.

Platinum and rhodium edge lower

Platinum group metals are precious and industrial commodities. Platinum group metals are critical for the catalysts that clean toxic emissions from the environment.

Platinum has a history as the most financial metal in the group, but it has underperformed gold for years. For many years platinum had traded at a slight premium to gold, but that ended in 2015 when it declined to an increasing discount. In Q3, NYMEX platinum futures posted a 3.16% decline.

The chart shows platinum futures have made lower highs and lower lows since reaching an all-time peak in 2008 at over $2,300 per ounce. Platinum futures slightly underperformed gold over the first nine months of 2022, with a 9.96% decline. Platinum lost 10.47% in 2021, and its 11.10% gain in 2020 was less than half of gold’s appreciation. Nearby NYMEX platinum futures closed Q3 at $870 per ounce and were higher at the $925 level on the active month January futures contract on October 7.

Rhodium is a platinum group metal with many industrial applications, but it only trades in the physical market and suffers from limited liquidity. In Q3, rhodium moved 0.71% lower and was down 2.80% over the first three quarters, closing at a midpoint of $13,900 per ounce on September 30, 2022. Gold, silver, platinum, and rhodium prices moved lower in Q3 and over the first nine months of 2022.

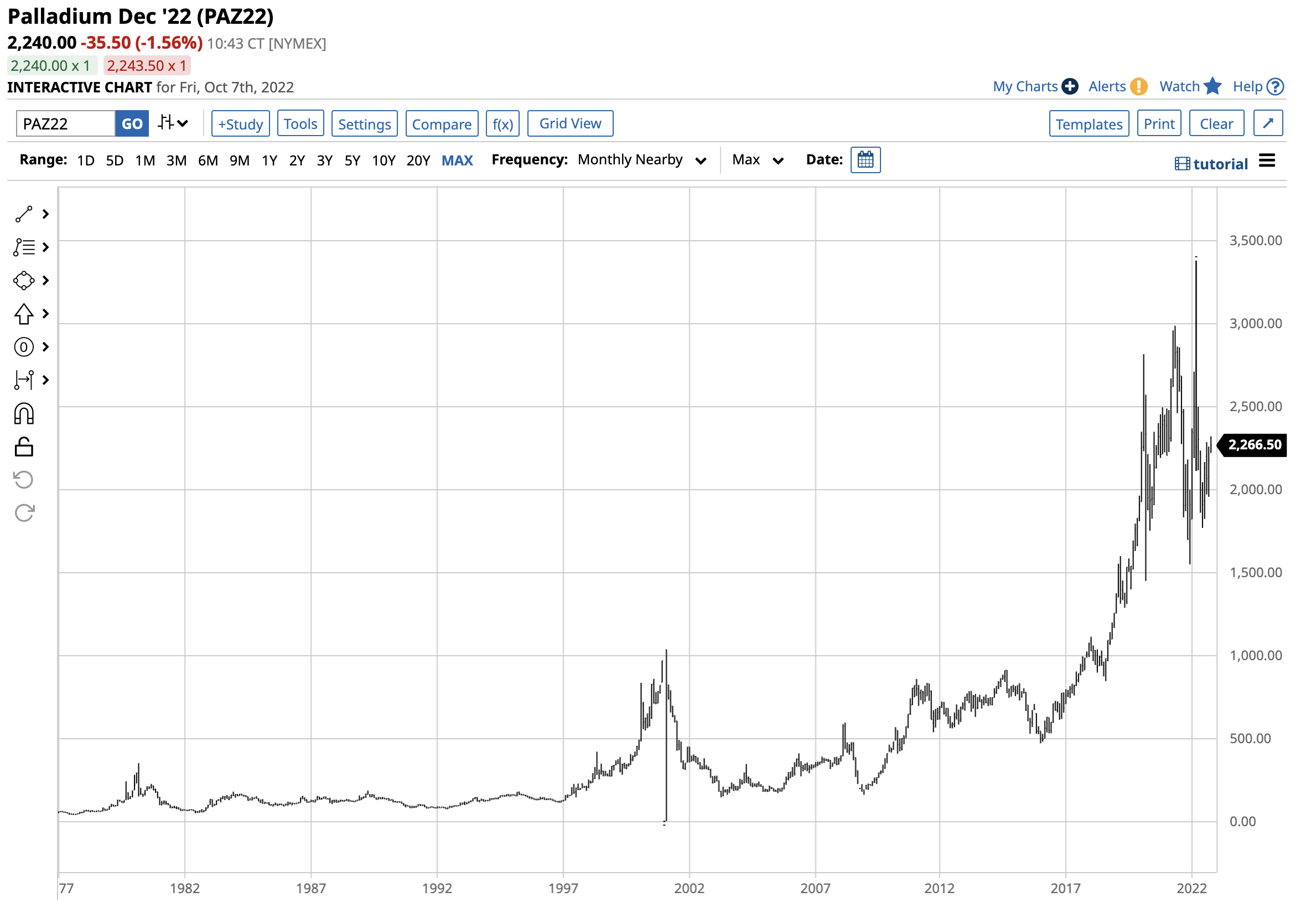

Palladium bucks the bearish trend

Palladium has been the star performer in the precious metals arena over the past years, reaching new all-time highs in March 2022 at the $3,380.50 per ounce level. Russia is the world’s leading palladium producer, and the war in Ukraine and supply fears pushed the metal’s price to record territory.

The chart highlights palladium’s ascent over the past years. After making higher lows and higher highs this century, the price took off on the upside in 2018 when it broke above the 2001 previous record peak. In Q3, NYMEX palladium was the only winner in the precious metals arena, posting a 14.33% gain for the quarter. Since the end of 2021, palladium futures have gained 14.13% after losing 22.08% in 2021. However, in 2020, palladium futures gained 28.52% and were 58.48% higher in 2019. Palladium was higher at the $2,240 level on October 7. The bull market in palladium continued as Russian supply concerns supported the precious metal that is a crucial ingredient in automobile catalytic converters.

Attractive levels for precious metals that take off on the upside in early Q4 for three compelling reasons

With three of the four exchange-traded precious metals futures posting losses in Q3 and over the first nine months of 2022, the prices are currently at attractive levels. When it comes to the gold, silver, and palladium markets, the long-term trends remain bullish despite the recent weakness.

The bottom line is price corrections in gold, silver, and palladium have been buying opportunities for more than two decades, and inflation and fiat currency weakness support a continuation of the trends. Regarding platinum, a thinly traded metal, production comes from South Africa and Russia. In Russia, platinum is a byproduct of nickel production. Thin markets tend to exhibit far more price variance than liquid markets. When platinum decides to move higher, the ascent could be furious. Platinum offers the best value proposition in the precious metals sector but has disappointed investors and traders over the past years.

I believe we will see higher highs in all the precious metals over the coming months and years. While rising interest rates and a strong US dollar have weighed on prices, inflation and geopolitical turmoil continue to support the metals that have financial and industrial applications in October 2022.

More Metals News from Barchart

- Stocks Sink as Hot U.S. Labor Market Keeps Fed Hawkish

- Dollar Rises on Hawkish Fed Talk

- Stocks Fall as Bond Yields Rise on Hawkish Fed Comments

- Dollar Rises as Treasury Yields Advance

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)