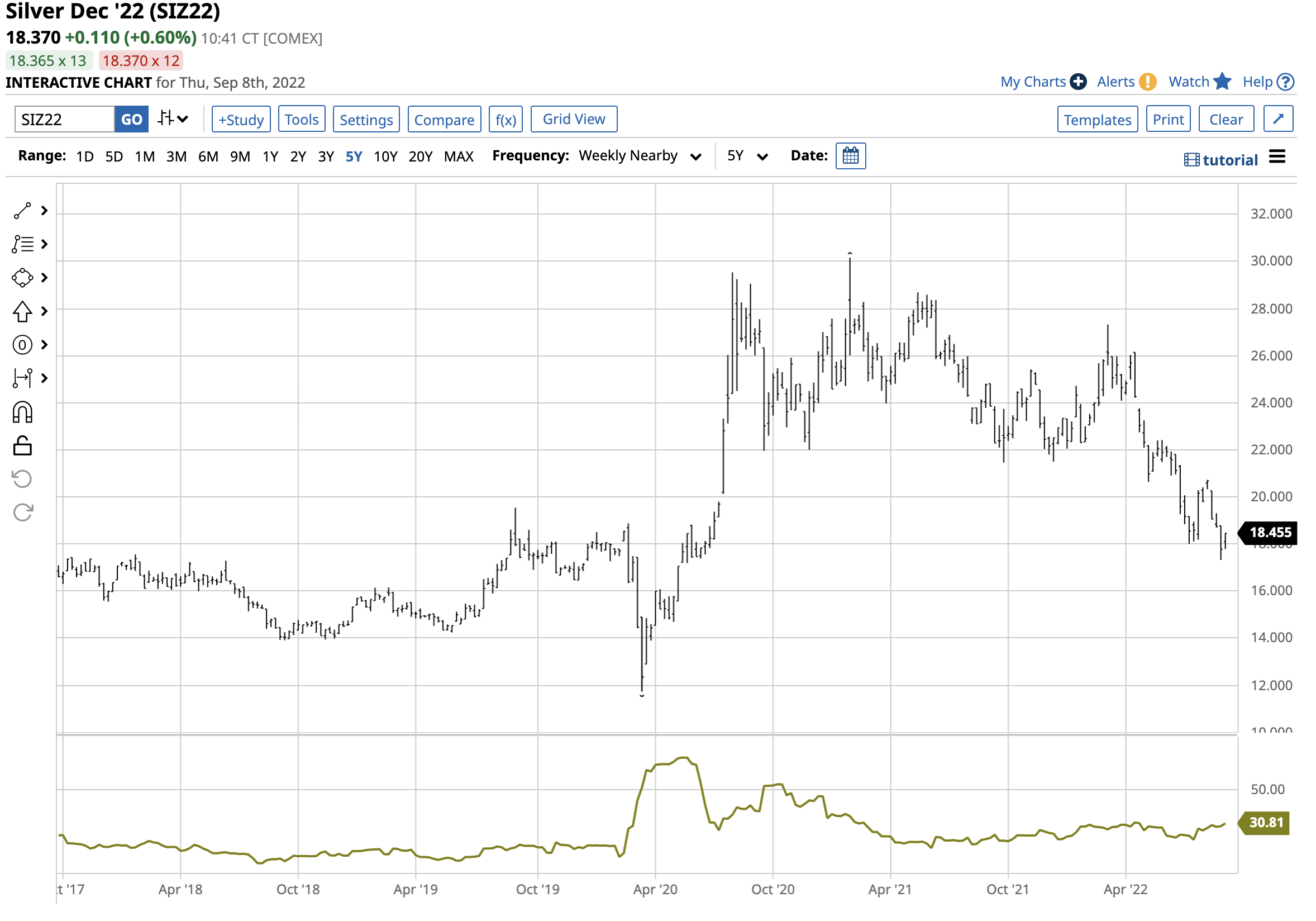

Nearby COMEX silver futures were trading below the $5.50 per ounce level at the turn of this century. At over three times that price on September 8, the short-term trend in the precious metal was bearish. Silver reached its most recent high at just over $30 per ounce in February 2021. Since then, the price has made lower highs and lower lows, reaching $17.32, the lowest price since May 2020 in September 2022. September COMEX silver futures were trading at the $18.38 on September 8, and its only successful friends these days are the trend-following bears.

A bear market since early 2021

The rise to over $30 per ounce in early 2021 ran out of bullish steam, and the price has been falling over the past nineteen months.

The chart shows the move to $30.16 per ounce and a pattern of lower highs and lower lows since the February 2021 peak. After reaching a lower high of $27.32 in March 2022, silver’s performance has been consistently bearish.

Silver volatility is higher than gold

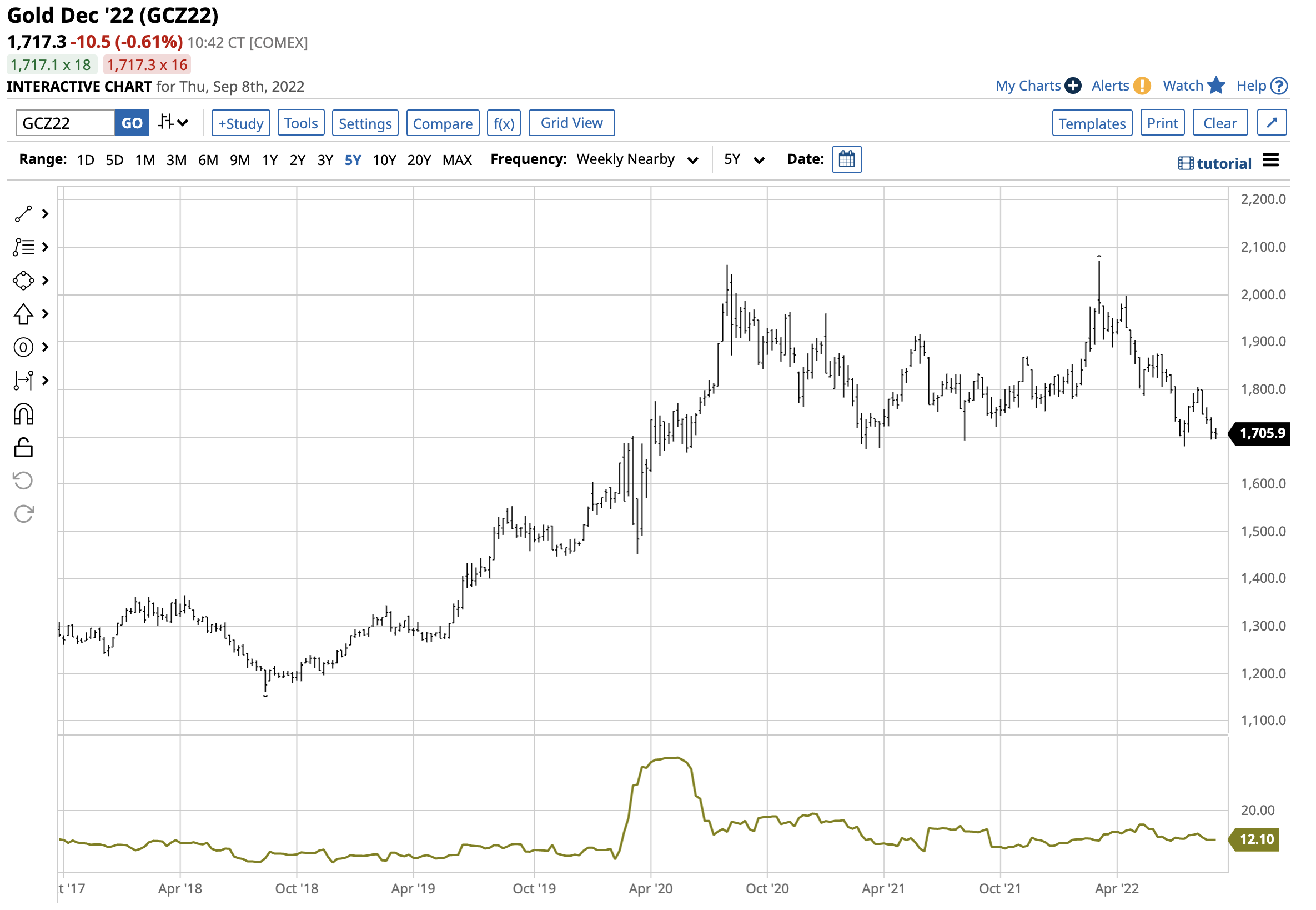

Silver attracts more speculative interest than the gold market because it tends to offer bulls and bears more significant percentage moves when trends develop. Nearby COMEX gold futures fell from a record $2072 high in March 2022 to a low of $1,679.80 in mid-July, an 18.9% correction. Since the March high, silver dropped from $27.32 to $17.32, or 36.6%. Silver offers market participants far more exciting rewards with higher risk than gold, making it the preferred precious metal for trend-following speculators.

The chart shows that historical volatility in silver stood at the 30.81% level on September 8.

The chart shows that the historical price variance in gold futures was less than half silver at the 12.10% level.

Silver is a volatile metal that tends to surprise- The 2020 volatility is a glaring example

Silver’s potential for shocking price moves is one of the reasons why speculators flock to the silver market when trends develop. In January 1980, silver futures reached a record, astonishing high of $50.36 per ounce as the Hunt Brothers attempted to corner the market. A few months later, the price explosion turned into an implosion when silver futures fell to $10.20 per ounce in March 1980.

It took silver over three decades to approach the 1980 high. In 2011, the price stopped short of the Hunt Brothers-inspired high when it reached $49.52 per ounce. After making lower highs and lower lows, silver found a bottom at $13.635 in late 2015. When the 2020 pandemic struck, silver spiked below the 2015, which had become a critical technical support level, reaching $11.735 in March 2020, but it did not stay there for long. The price turned higher, and a frenzy of buying lifted silver above the $13.635 the same month and set the metal on a path to its over $30 high in February 2021. At the $17.85 level on September 8, silver is below the midpoint of the March 2020 low and the February 2021 high.

Inflation has kept silver elevated, but rising interest rates and a strong dollar are bearish

Considering silver sat below the $10 per ounce level from 1983 through 2006, with only one attempt to breach the price in 1987, at nearly $18 per ounce in 2022, silver remains bullish from a long-term perspective. However, the inflation-adjusted price level remains low while nominal silver prices appear elevated.

However, inflation at the highest level since the early 1980s has done little to turbocharge rallies in the silver market. With the Fed battling inflation with monetary policy, rising interest rates have pushed the US dollar index to a two-decade high. Higher interest rates increase the cost of carrying silver inventories and weigh on the metal’s price. Moreover, since the US dollar is the world’s reserve currency, it is the pricing benchmark for most commodities, and silver is no exception. A rising dollar tends to be bearish for silver and other raw material prices.

Growing industrial demand has not been enough to push silver higher

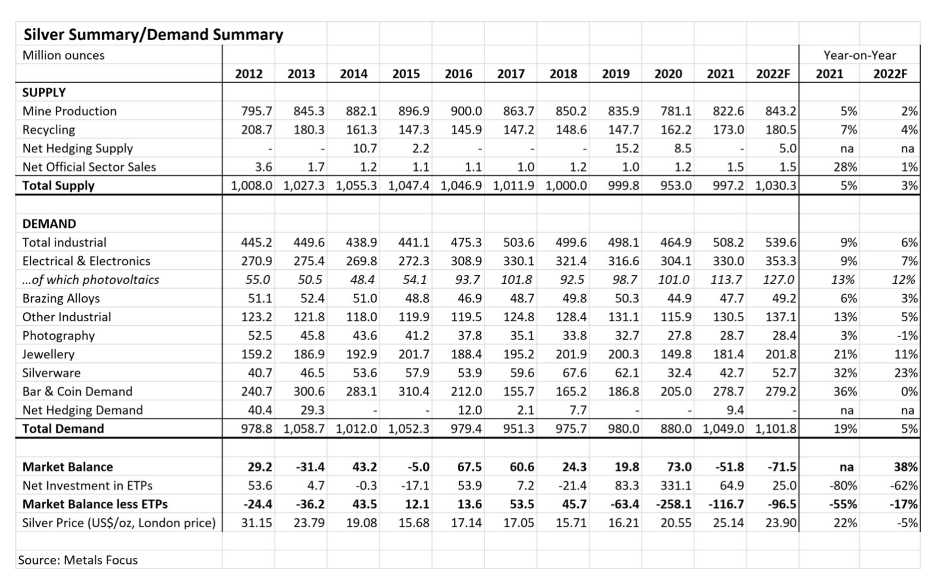

The Silver Institute forecasts that silver demand will rise to a record over 1.1 billion ounces in 2022, a 5% increase from 2021 after a 19% rise from 2020 to 2021.

Source: The Silver Institute

Double-digit percentage increases from the previous year in bar and coin demand, silverware, jewelry, industrial, electrical, electronics, and photovoltaics, or solar panels, account for the demand side of silver’s fundamental equation. While supplies have increased from 2020 and 2021, the demand has risen more on a percentage basis.

The growing industrial demand, which has outstripped increased supplies, has not been enough to lift silver’s price, which remains in a short and medium-term bearish trend. The bottom line is market sentiment holds the key to the path of least resistance of silver’s price. Until the market sentiment turns bullish, the price will likely continue its path of lower lows and lower highs because of the bullish trend in interest rates and the US dollar. However, when silver finds a bottom as it did in March 2020, watch out as the volatile metal could explode. A herd of buyers or sellers has the most impact on the volatile and speculative silver market. Follow those trends as in silver; they are your only friends.

More Metals News from Barchart

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)